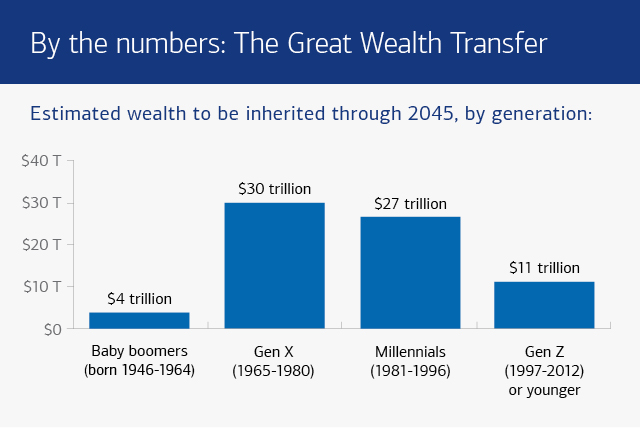

The Great Wealth Transfer is the largest generational shift of wealth in history, with over $84 trillion expected to change hands by 2045. This massive shift will reshape family offices, wealth management, and financial markets, as younger generations inherit and manage wealth in new and innovative ways.

Why this is the biggest wealth transfer

Three key factors drive the Great Wealth Transfer:

- The ageing baby boomer generation: as one of the wealthiest generations in history, baby boomers are passing down assets accumulated through decades of economic growth, home ownership, and business ventures. With many reaching retirement or passing on, the wealth shift is accelerating.

- The rising value of assets: property, equities, and alternative investments have appreciated significantly over the past few decades, contributing to a larger transfer of wealth. Real estate, in particular, has seen substantial gains, making it a key component of inheritance strategies.

- The growing role of wealthy families: These families hold a significant share of global wealth, and their estate planning decisions play a major role in shaping how and where wealth is distributed. As inheritance becomes an increasingly dominant factor in financial success, these families are not just passing down assets, they are defining economic mobility for future generations.

These factors set the stage for a transformative shift in how wealth is managed and invested across generations.

Each generation invests wealth differently:

- Generation X: More structured and diversified in their investment approach.

- Millennials: Digital-first investors with a preference for alternative investments and ESG-focused opportunities.

- Generation Z: Likely to demand greater transparency, engagement, and technological integration in financial management.

The trend of ‘Giving While Living’

An increasing number of families are transferring wealth before death, motivated by tax advantages and wealth preservation. This shift allows wealth holders to shape the financial future of their heirs actively.

Benefits of ‘Giving While Living’:

- Tax efficiency: Certain gifting strategies reduce estate tax liabilities.

- Heir preparation: Providing financial education and oversight ensures responsible wealth stewardship.

However, early wealth transfers must be structured carefully to prevent mismanagement, ensure long-term sustainability, and preserve family financial legacies.

Impact on markets

As younger generations take control, investment strategies will evolve:

- Increased focus on impact investing: ESG, private equity, and venture capital will gain momentum over traditional investments.

- Shifts in risk appetite: Wealth moving from risk-averse Boomers to younger investors could lead to short-term market volatility but drive long-term innovation.

- Growth in alternative assets: Millennials and Gen Z have shown a strong preference for non-traditional assets, including private markets, digital assets, and cryptocurrencies.

Challenges and considerations

While this wealth transfer presents opportunities, it also comes with significant risks:

- Wealth dissipation: Without proper financial education and planning, large fortunes can erode within a generation.

- Succession planning: Ensuring smooth asset transition requires robust estate planning and governance structures.

- Demand for digital financial tools: Tech-savvy heirs will expect seamless, intuitive platforms for wealth management. Family offices and financial firms must prioritise modern UI/UX to remain relevant.

The Great Wealth Transfer

The Great Wealth Transfer is more than a financial event—it is a fundamental transformation in how wealth is managed. Family offices that embrace modern tools, adapt to shifting investment trends, and prioritise financial education will be best positioned for the future. By preparing for this transition, wealth holders and financial institutions can ensure a lasting legacy for generations to come.

Asora is a SAAS solution for single and multi-family offices to track and oversee assets, automating data capture and providing digital on-demand reporting on the web and mobile.