TL;DR

- This guide ranks the top consolidated reporting tools for family offices in 2025: Asora, Masttro, Landytech, and MS Excel.

- It breaks down strengths across automation, usability, data integration, and output flexibility.

- Asora shines for fast onboarding, real-time aggregation, intuitive UI, and flexible reporting — ideal for $50M–$750M AUM offices.

- Each financial consolidation software serves different needs based on complexity, ownership structure, and budget.

Family offices today need more than spreadsheets to keep up with the growing complexity of managing wealth. They’re turning to top consolidated reporting software that provide a clear, timely view across all asset classes. These platforms go beyond simple aggregation, offering powerful analytics, customisable dashboards, and seamless data integrations to support informed decision-making.

As reporting requirements increase and structures become more intricate, the need for accurate, timely insights across entities, currencies, and asset types becomes critical. Consolidated reporting software streamlines the financial consolidation process, reduces manual work, and helps eliminate human error.

Whether you’re overseeing a single-family office or managing multiple client relationships, our roundup of the best consolidated reporting software aims to guide you to solutions that deliver operational efficiency, robust reporting, and long-term value. With the right tools, finance teams can shift their focus from data collection to strategic planning and wealth preservation.

Top 4 consolidated reporting software

As family offices manage increasingly complex, multi-asset portfolios across entities and generations, the need for consolidated reporting software has never been greater. From aggregating data across custodians and asset classes to delivering clear reports, the right platform can streamline operations and support better decision-making.

Consolidated reporting tools not only reduce the reliance on manual spreadsheets but also provide a centralised, timely view of the family’s total wealth. These platforms enable family office teams to track performance, manage risk, and generate tailored insights for principals and stakeholders. With features like automated data aggregation, performance monitoring, and financial reporting, they also help support long-term financial stewardship and intergenerational planning.

Below are four of the best consolidated reporting solutions today, with their regional focus, core client segments, regulatory compliance, and key features and capabilities.

| Software | Best for | Key feature |

|---|---|---|

| Asora | Family offices of all sizes, $50M–$750M AUM | Timely wealth reporting with intuitive ownership mapping, strong security, and an easy-to-use modern interface with no learning curve. |

| Landytech | Asset owners, managers, and advisers, $100M–$500M AUM | Combines investment reporting with in-built bookkeeping tools. |

| Masttro | Family offices and wealth managers, $250M–$1B+ AUM | AI-powered document automation and visual interface for wealth consolidation. |

| Microsoft Excel | Startup SFOs or UHNWIs , <$100M AUM | Best-known for its familiarity and flexibility, though it lacks automation, scalability, and security. |

Asora

Year founded: 2021 | $$

Asora is a purpose-built platform for family offices of all sizes, UHNWIs, and wealth managers. It offers automated data aggregation from banks and custodians, on-demand reporting, and a Wealth Map to visualise ownership structures. Asora replaces spreadsheets with a timely, structured, and secure reporting system, compliant with GDPR and ISO27001.

Asora’s user-friendly interface ensures there’s no steep learning curve, and teams can hit the ground running. It’s ideal for teams moving off spreadsheets and looking for a modern, intuitive way to manage and report on wealth.

Best for: Asora serves family offices of all sizes, with $50M–$750M AUM looking to move beyond spreadsheets with automation and structured reporting.

Core Client Segment

Regulatory Compliance

Regions Served

Features & Capabilities

Core Client Segment

Regulatory Compliance

Regions Served

Features & Capabilities

Landytech

Year founded: 2018 | $$$

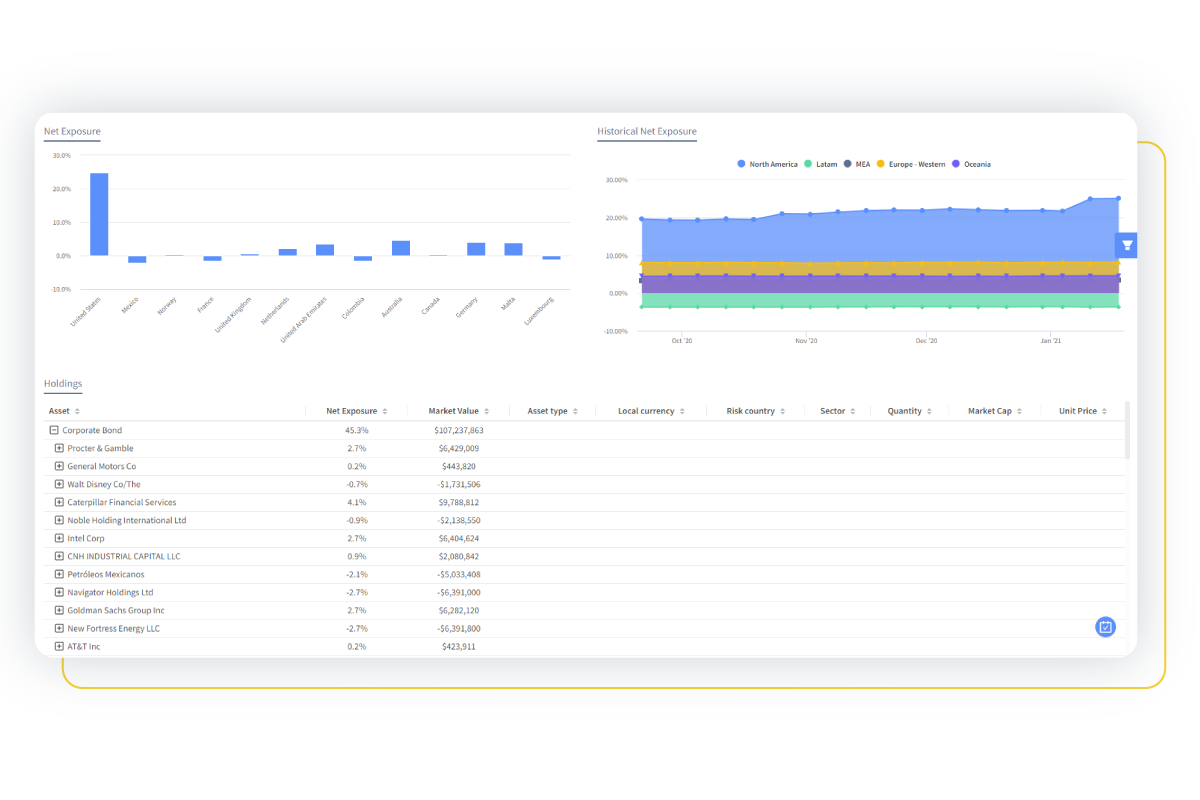

Headquartered in the UK, Landytech is designed for asset owners, managers, and advisers who require timely performance analytics and bookkeeping support.

Its Sesame platform combines investment reporting with operational tools, making it well-suited for teams managing structured financial records alongside portfolio data.

Best for: Asset owners, managers, and advisers with $100M–$500M AUM seeking performance analytics and bookkeeping support.

Core Client Segment

Regulatory Compliance

Regions Served

Features & Capabilities

Masttro

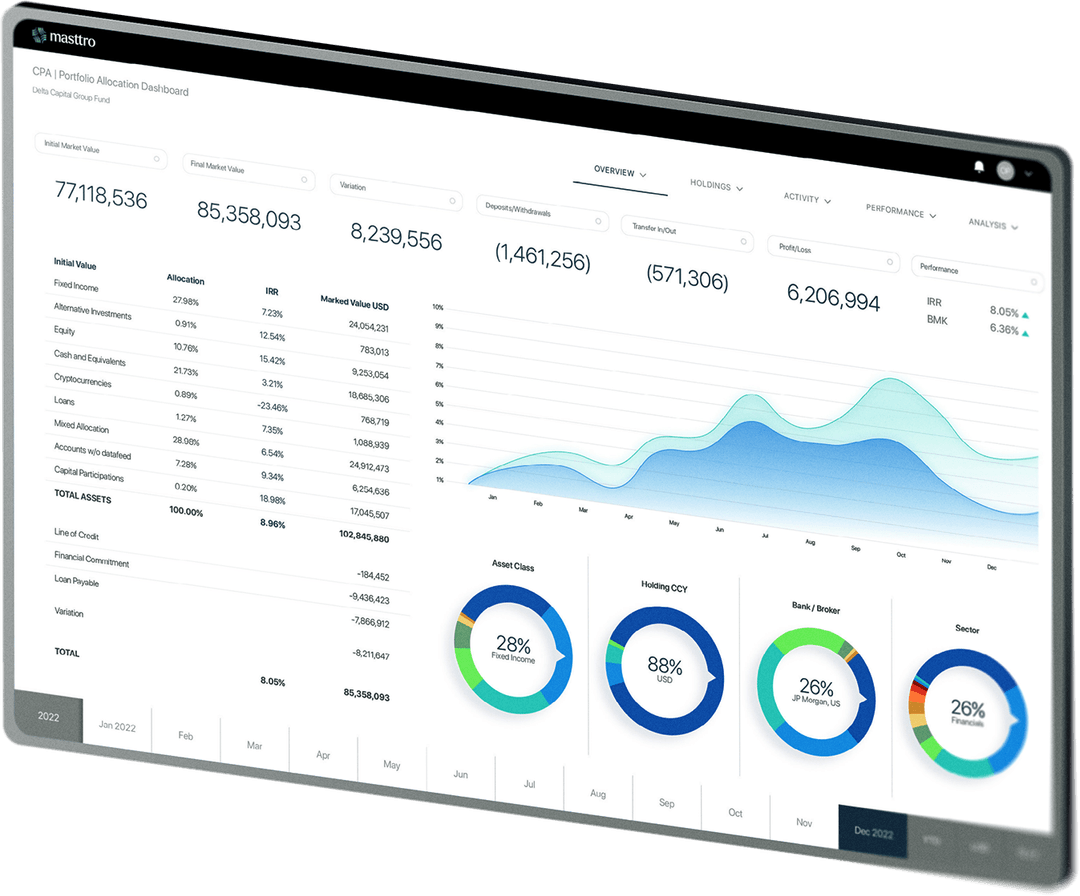

Year founded: 2010 | $$$$

Masttro is well-suited for family offices and wealth managers managing layered ownership structures and large volumes of financial documents. Its AI-powered document automation and secure data aggregation make it easy to consolidate complex financial and ownership information.

With visualisation tools designed for clarity and communication, Masttro enables a clear, dynamic view of wealth across generations and entities.

Best for: Wealth managers and family offices managing $250M–$1B+ AUM with layered ownership structures and document-heavy workflows.

Core Client Segment

Regions Served

Features & Capabilities

Microsoft Excel

Year founded: 1985 | $

Microsoft Excel is a common starting point for family offices and UHNWIs due to its low cost, flexibility, and familiarity. It allows teams to manually consolidate data and build custom reports across accounts and entities.

However, as portfolios grow in complexity, Excel’s manual workflows often become time-consuming and error-prone, limiting its effectiveness as a long-term reporting solution.

Best for: Startup SFOs or UHNWIs with less than $100M AUM managing reporting manually.

Core Client Segment

Regions Served

Features & Capabilities

How to pick the best consolidated reporting software

Every family office is unique. Some operate as lean teams managing a handful of entities and assets, while others oversee complex portfolios spanning multiple jurisdictions, currencies, and ownership structures. Variations in investment complexity, reporting cadence, and internal capabilities mean there is no one-size-fits-all solution. The best consolidated reporting software is the one that aligns with your specific operational model and reporting needs, offering the right balance of automation, flexibility, and ease of use.

Choosing the right platform requires more than comparing feature lists. It begins with a clear understanding of your office’s structure, data sources, and reporting requirements. Here are key factors to consider when evaluating financial consolidation and reporting tools:

- Map out your data landscape: Start by identifying the volume and type of data you need to consolidate. This includes transactional data from banks, brokers, alternative investment managers, real estate holdings, and private equity structures, and operational data. The software should support easy data integration across multiple entities and custodians.

- Assess your team’s internal capabilities: Evaluate whether your team needs a low-maintenance, highly automated solution or whether you have in-house expertise to manage more complex configurations. Some platforms offer extensive configurability but come with a steep learning curve. Others prioritise usability and speed of implementation.

- Understand your reporting cadence and output needs: Consider how frequently you report to stakeholders (monthly, quarterly, ad hoc) and the level of detail required. Look for tools that streamline reporting processes and offer customisable outputs for internal and external stakeholders, including income statements, balance sheets, cash flow statements, and performance dashboards.

- Prioritise automation and data accuracy: Manual processes introduce risk and slow down reporting. Look for a platform that automates data collection, handles currency conversions, performs intercompany eliminations, and ensures consistency across all reports. Reducing manual touchpoints helps minimise human error and accelerates the financial close.

- Review support for multi-entity, multi-currency operations: If your office spans multiple jurisdictions or involves complex global consolidations, make sure the solution can handle multi-currency environments, local tax treatments, and different entity structures without requiring constant workarounds.

- Consider scalability and long-term fit: The reporting needs of a family office will evolve as investments change, entities grow, or new generations take leadership. The solution should be able to scale with your structure and support emerging requirements and business processes.

- Evaluate the implementation process and vendor support: A powerful solution is only effective if it can be implemented successfully. Look for providers who offer dedicated onboarding support, clear documentation, and responsive customer service. Understand the time and resources required to go live and factor in potential constraints around data migration or internal bandwidth.

- Look beyond reporting to overall financial intelligence: The right consolidated reporting platform doesn’t just generate reports. It helps you interpret and act on the data. Look for solutions that enable better financial analysis, real-time insights, and support for planning processes that align with your business strategy.

By thoroughly evaluating each platform’s capabilities against your specific needs, you can select a consolidation solution that simplifies reporting, improves transparency, and empowers the family office to make timely, informed decisions. Ultimately, the right tool should serve as a foundation for smarter financial management and intergenerational wealth preservation.

*All images from company websites, social media, or created for illustration. Excel image is a stylised depiction.

What is consolidated reporting software for family offices?

A consolidated reporting platform for family offices is a specialised solution designed to centralise and harmonise all financial data across various entities, asset classes, geographies, and custodians into one cohesive view. It enables a single source of truth by streamlining oversight for finance teams, empowering better financial planning, and reducing the time spent on manual financial consolidation.

Family offices are structurally and operationally diverse. One office may oversee trusts, holding companies, foundations, and operating businesses across several jurisdictions. Investments often include a mix of traditional securities, private equity, real estate, and alternatives, held through complex legal structures and across multiple currencies.

In this context, traditional tools like Excel or general-purpose accounting software fall short. They can’t keep up with the demand for:

- Timely, accurate reporting

- Aggregation of transactional data across multiple entities

- Fully compliant consolidated financial statements

- Consistent treatment of intercompany eliminations, currency conversions, and ownership adjustments

A modern financial consolidation solution built for family offices enables you to:

- Combine operational and investment data from disparate systems

- Automate the financial consolidation process across entities and asset types

- Generate compliant cash flow statements, income statements, and balance sheets

- Deliver insights tailored to both internal and external stakeholders

Ultimately, this software supports the office’s business strategy by improving transparency, saving time, and enhancing the overall effectiveness of financial management. It’s not just a reporting tool—it’s a strategic enabler for family offices that want to move beyond spreadsheets and towards scalable, insightful operations.

Why consolidation is especially complex for family offices

Unlike corporations with standardised operations, family offices often face unique and evolving structures—multiple trusts, foundations, holding companies, and operating entities, each with their own financial systems, tax treatments, and reporting timelines.

This makes the financial consolidation process particularly complex due to:

- Multiple currencies across banking relationships and private investments

- Fragmented data sources (e.g., PDFs, portals, spreadsheets)

- Diverse accounting principles depending on the jurisdiction of each entity

- The need for manual financial consolidation, increasing the chance of human error

- Limited internal resources that carry the burden of the monthly or quarterly financial close

Many family offices rely on spreadsheets to piece together reports and inform planning processes, which is a time-consuming and error-prone method of financial consolidation, especially as the family’s footprint grows. For offices managing global operations, producing accurate reporting across entities and asset types becomes a heavy lift.

This complexity also slows down the ability to produce timely consolidated financial reports, especially when preparing for board meetings, tax filings, or strategic reviews. This results in increased operational risk and a financial reporting process that can’t scale with the family’s evolving needs.

A modern consolidation solution built for family offices can alleviate these challenges by automating core tasks and ensuring that financial performance data is consolidated with integrity and transparency.

Benefits of consolidated reporting software for family offices

Implementing financial consolidation software tailored to family offices delivers measurable benefits across both operational and strategic dimensions. Instead of spending time assembling reports from custodians, accountants, and advisors, finance teams can shift their focus to value-added analysis and informed decision-making.

With the right consolidation and reporting platform, family offices gain visibility, reduce risk, and increase efficiency.

Key Benefits for Family Offices

Time savings for finance teams

It eliminates repetitive and manual tasks such as account reconciliation and spreadsheet-based consolidation and frees up time for higher-value financial planning and analysis.

Accurate and consolidated reporting

Generates consolidated financial reports that unify data from multiple entities, accounts, and asset classes, providing a clear picture of the family’s total financial position.

Support for complex family structures

Consolidated reporting software supports layered ownership, entity hierarchies, and diverse asset mixes. It can manage trusts, foundations, operating businesses, and investment vehicles across jurisdictions with ease.

Multi-currency and multi-asset consolidation

Automated currency conversions and roll up performance data across private equity, hedge funds, real estate, and traditional investments, regardless of currency or geography.

Real-time insights for family leadership

The best financial consolidation software lets you create dashboards and reporting views that provide timely visibility into liquidity, cash flow, investment performance, and other key indicators relevant to family decision-makers.

Scenario planning and strategic oversight

Supports strategic planning with tools for scenario planning, financial modeling, and forward-looking analysis. Helps the family office evaluate potential outcomes before decisions are made.

Reduced risk of human error

Financial consolidation software streamlines fragmented manual processes with automated consolidation. Reduces the chance of errors caused by spreadsheet versioning, manual entry, and inconsistent data collection.

Improved communication with stakeholders

Produces clear and intuitive management reports tailored for principals, family council members, and external stakeholders such as auditors or advisors. Consolidation software delivers transparency and consistency in financial reporting.

Consolidated reporting software empowers finance teams within the family office to operate with more control, speed, and accuracy. It transforms reporting from a time-consuming chore into a strategic asset that supports decision-making, governance, and long-term wealth preservation.

FAQs: Consolidated Reporting Software

What is consolidated reporting software?

Consolidated reporting software helps family offices centralise data from multiple custodians, banks, and private assets into one platform for performance tracking, analysis, and reporting.

How do I choose the right reporting platform?

Consider your reporting frequency, the types of assets you manage, integration needs, and team capacity.

What features should I look for in consolidated reporting software?

Key features include private asset tracking, automated data aggregation, performance analytics, and customisable reporting.

Which family office platforms support illiquid and alternative assets?

Platforms like Asora, Landytech, and Masttro support private equity, real estate, and other alternative investments.

How does Asora compare to Excel?

Unlike Excel, Asora automates data aggregation, enables real-time portfolio views, and supports secure, multi-entity reporting. It’s built for scalability and auditability, without manual upkeep.