Automate your family office

Schedule DemoThe primary goal of most family offices is to preserve and grow assets across generations. The biggest threat to preserving wealth is not market volatility but poor decisions resulting from poor access to information. For many family offices data is scattered across multiple places leading to inefficiencies, higher risk of error and potential cyber security threats. All of which can put a family’s wealth at risk.

To address this family offices must prioritize developing a comprehensive data strategy that ensures data is handled in a way that:

- enhances operational efficiency

- informs decision making

- mitigates cyber risks

Why you should have a data strategy

The 3 main benefits of a proper data strategy:

- Informed decision-making: A robust data strategy ensures that information is accurate, timely, and centralized, enabling well-informed decisions that are critical for preserving family wealth.

- Risk management: Consolidating data mitigates security risks and reduces the likelihood of errors from manually aggregating data across disparate sources.

- Performance tracking: Data is the foundation for evaluating the success of investment strategies. Without a coherent data strategy, assessing whether your investment strategy is effective becomes nearly impossible.

While most family offices understand the importance of having good data, practically ensuring they have good data is difficult. Family offices, regardless of size and type, own a lot of different assets. All these assets have data that needs to be tracked, analyzed, and used to make informed decisions.What sort of data are we talking about? When we talk about data being used and analyzed in family offices, we are typically referring to:

- Bank statements, Excel and PDF

- Investment valuations and transaction reports, Excel and PDF

- Alternative fund reports, capital call and distributions notices, typically PDF

- Legal documentation, Word or PDF

- Public market data such as security prices and FX rates taken from the internet or market data software

Usually this data is stored in different places including being left in place in third-party external platforms. As a result family offices typically have data residing on:

- Bank portals

- Emails inboxes

- Fund administration portals

- Shared folders such as One Drive, Google Drive or Dropbox

- Hard copy documents

All these places store data in different formats, with different data naming conventions and for different time periods. So when a family office professional wants to analyze their total portfolio, they have a hard time doing so.

The fundamental importance of good data to good decision making and the challenges in handling data underline why having a proper data strategy is key for running a successful family office. It also emphasises why the status quo for most family offices of having data dispersed across multiple file types – spreadsheets, PDFs, word docs, powerpoints – and across various internal and third-party platforms can put the family’s wealth at risk.

The 5 components of a good data strategy

This guide aims to help family offices improve their data strategy and introduces a new way of working with data, using a purpose-made tool like Asora.When we talk about data strategy, there are 5 key components:

1. Centralized data management

All data is stored in a secure centralised system that is accessible by all of the team. The Family has a single source of truth for data on all assets whether liquid or private, and in all formats whether structured, unstructured or document — and the data is under their control.

2. Data quality control

Data is reconciled and analyzed to ensure data accuracy and integrity. There are tools for assessing data quality and identifying and correcting anomalies quickly and easily.

3. Security measures

The centralized data source is protected with robust encryption, access controls, and regular security assessments to protect sensitive information. There is comprehensive permissioning allowing specific access with all access via 2-factor authentication and detailed security logs maintained.

4. Data aggregation

Automated datafeed connections are put in place with service providers to minimize manual data collation and ensure fast, efficient data handling. Open banking connections, direct custodian connections and automated PDF reading software are leveraged to minimize manual effort and the risk of manual error.

5. Analytics and reporting

Information and analytics can be easily accessed on dashboards on the web and on mobile in order to minimize the extraction and unsecure sharing of information through email and offline.

Setting up a data strategy

Based on the 5 key components of an effective data strategy for family offices outlined above, let’s take a step-by-step approach on how to set up such a data strategy:

- Assess current state: Evaluate existing data management practices, tools, and systems. Check out our Data Strategy Scorecard below.

- Define objectives: Establish clear goals for what your desired data strategy should achieve, aligned with the family office's overall objectives.

- Select tools and platforms: Choose appropriate data management and analytics tools that fit the family office's needs.

- Develop policies and procedures: Create comprehensive policies for data entry, management, and security.

- Implement and train: Deploy the chosen systems and ensure all staff are trained in their use.

- Monitor and review: Continuously monitor and review your data management practices to make sure they are up to date with best practice.

What is the risk to your family office of having data dispersed across spreadsheets, PDFs, and various platforms? Check out our data strategy scorecard to assess where you are today.

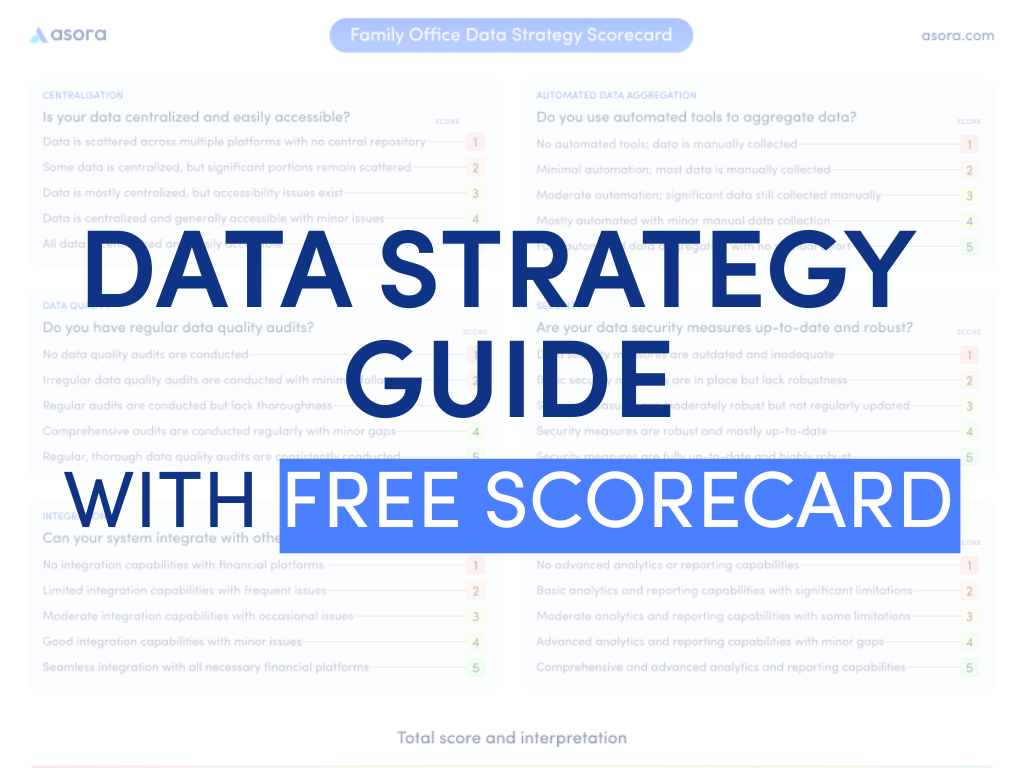

Family Office Data Strategy Scorecard

Ensure your family office is on track to preserve wealth across generations with our Data Strategy Scorecard. Use it to evaluate the effectiveness of your current data management practices and identify areas for improvement.The scorecard comes with 6 questions. Based on your answers, you will get your personalized data strategy score.

Enter your email below to access your free Data Strategy Scorecard.Why you need this scorecard:

- Identify gaps: Highlight areas in your data strategy that need improvement.

- Enhance security: Evaluate the robustness of your data security measures.

- Automate Data Aggregation: Identify areas to improve automated data aggregation from banks and service providers.

- Optimize decision-making: Ensure you have the necessary tools for advanced analytics and reporting.

- Prepare for AI: Assess your data strategy's readiness for AI integration and utilization.

By downloading and using this scorecard, you can make informed decisions that protect and grow your family’s wealth. Don’t leave your legacy to chance—start optimizing your data strategy today!

Asora: Software for the modern family office

Asora helps you automate the aggregation of bankable and private asset data, generate robust performance monitoring, and customised reporting — all on a single platform.

.png)

.png)