Automate your family office

Schedule DemoHeading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

TL;DR

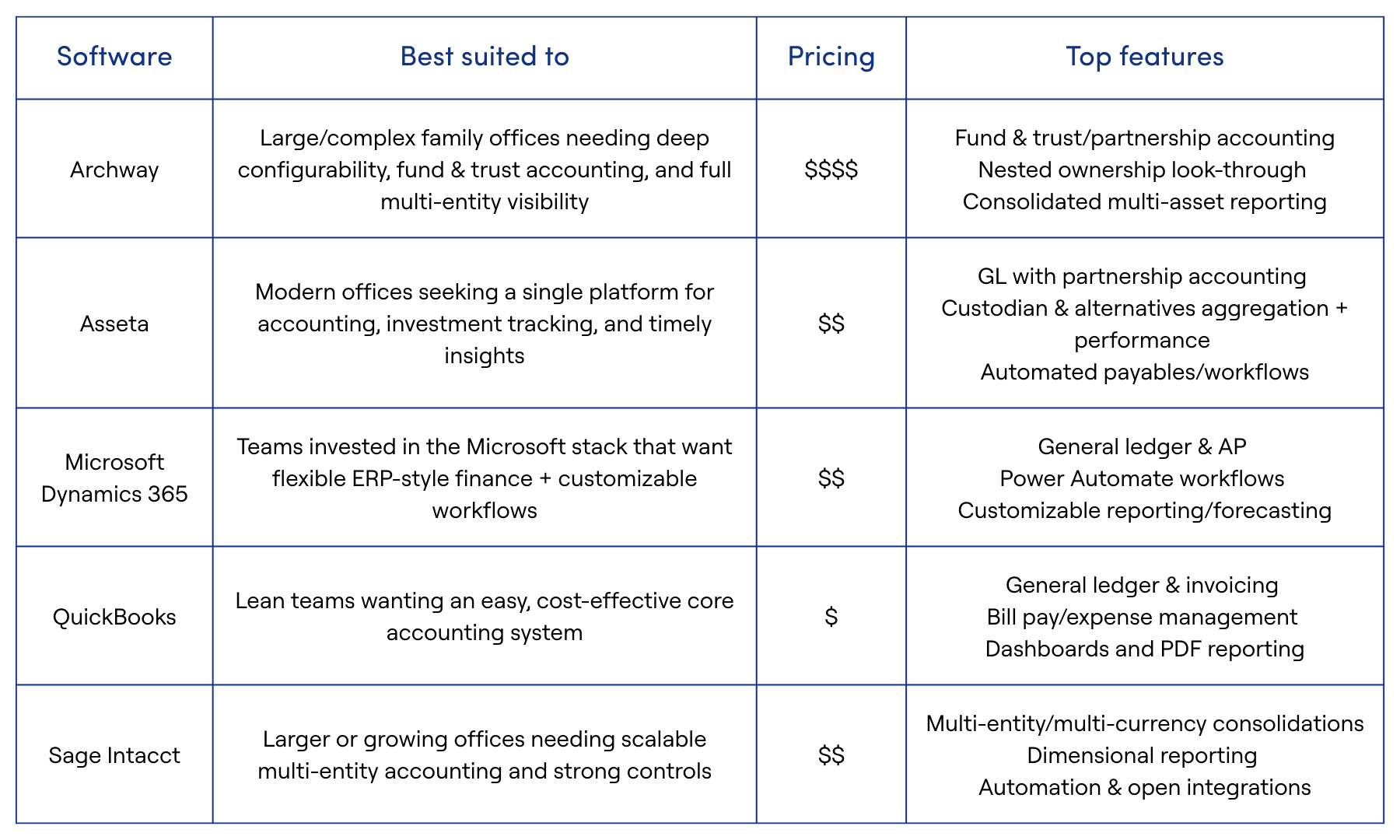

Family offices need accounting software that supports multi-entity structures, complex ownership structures, and diverse asset classes. This family office accounting software comparison covers the leading platforms, from enterprise-grade solutions like Archway to streamlined options like QuickBooks. We'll help you understand what accounting software family offices use and how to pick the right fit.

What Family Office Accounting Must Handle

Managing the books for a family office isn't like running accounting for a regular business. You're dealing with multiple entities, trusts, investment partnerships, private equity holdings, and assets spread across custodians and asset managers. Standard accounting software simply wasn't built for this.

The best family office accounting software needs to handle:

- Multi-entity consolidation across holding companies, trusts, and LPs

- Investment accounting for both liquid and illiquid assets

- Multi-currency operations for global portfolios

- Complex ownership structures and look-through reporting

- Integration with custodians, banks, and wealth management platforms

Below, we compare the top family office accounting software solutions, breaking down their strengths, typical client profiles, and key features.

How to Pick the Best Accounting Software for Family Office Use

Before diving into specific platforms, let's cover what matters when evaluating family office accounting systems.

- Scale and complexity: A family office managing $50M in liquid assets has different needs than one with $500M across private equity, venture capital, real estate, and public markets. The best accounting software for family office operations should match your current complexity without forcing you to pay for features you'll never use.

- Entity structure: How many legal entities do you manage? Do you need consolidated reporting across trusts, partnerships, and operating companies?

- Asset mix: If you're heavily invested in alternative assets (private equity holdings, venture capital firms, direct real estate), you need investment accounting capabilities that go beyond basic bookkeeping. Look for platforms with portfolio management features and automated data feeds from investment managers.

- Integration requirements: Your accounting software family office uses should connect seamlessly with your existing systems, whether that's custodian feeds, wealth management services, or a family office platform for consolidated reporting.

- Team resources: Some platforms require dedicated finance professionals who understand complex financial structures. Others prioritize ease of use for smaller teams.

Now let's look at five family office accounting software solutions worth considering.

Top Family Office Accounting Software Compared

Use this section to scan the leading options for family office accounting without vendor hype.

1. Archway: Enterprise-Grade Multi-Entity Accounting

Year founded: Early 2000s | Pricing: $$$$

Archway is purpose-built for family offices with complex portfolios requiring institutional-grade capabilities. It combines general ledger accounting with investment data aggregation, fund accounting, and n-tier ownership structures.

Best for: Large or complex family offices requiring deep configurability, fund and trust accounting, and complete multi-entity visibility.

Core Client Segment: Single-family offices, multi-family offices, UHNWIs

Key Features:

- Fund and trust accounting with partnership accounting support

- Investment data aggregation from custodians and asset managers

- Nested ownership look-through capabilities

- Consolidated reporting across all asset classes

- Performance reporting and investment analytics

- Document storage and workflow automation

- Cash flow forecasting

- Open architecture for custom integrations

Regulatory Compliance: SOC2

Headquarters: North America

2. Asseta: Modern Platform for Streamlined Operations

Year founded: 2023 | Pricing: $$

Asseta is an AI-native accounting and investments platform bringing modern technology to family office accounting. The intelligent family office suite combines accounting, investment tracking, and performance reporting in a single integrated platform to automate financial workflows.

Best for: Modern family offices seeking a streamlined platform for accounting, investment tracking, and timely financial insights.

Core Client Segment: Single-family offices, multi-family offices, UHNWIs

Key Features:

- General ledger with partnership accounting

- Consolidated reporting across multiple entities

- Automate and control payables

- Custodian and alternative investment data aggregation

- Investment analytics with portfolio performance tracking

- Multi-entity ownership structures

- Document management

- Cash flow forecasting

- Multi-currency support

- Open architecture

Regulatory Compliance: SOC2 Type II

Headquarters: North America, Europe, the Middle East & Africa

3. Microsoft Dynamics 365

Year founded: 2016 | Pricing: $$

Microsoft Dynamics 365 is a comprehensive ERP platform that includes financial management, accounting, and operational tools. While not built specifically for family offices, its flexibility and integration with Microsoft tools make it viable for offices with technical resources.

Best for: Family offices already invested in the Microsoft ecosystem that need flexible ERP capabilities and customizable workflows.

Core Client Segment: Single-family offices, multi-family offices, UHNWIs, wealth managers

Key Features:

- Accounts payable

- Financial reporting

- General ledger

- Budgeting

- Workflow automation (using Power Automate)

- Position & cash flow forecasting

Regulatory Compliance: GDPR, ISO27001, SOC1, SOC2, CCPA, LGPD, PIPEDA

Regions Served: North America, Latin America, Europe, Middle East & Africa, Asia Pacific

4. QuickBooks: Streamlined Accounting for Growing Teams

Year founded: 1992 | Pricing: $

QuickBooks is the most widely used accounting software for small businesses, offering essential bookkeeping, invoicing, and financial tracking. It was designed for small businesses but is commonly used by smaller family offices.

Best for: Growing teams looking for an easy-to-use, cost-effective accounting solution.

Core Client Segment: Single-family offices, multi-family offices, wealth managers

Key Features:

- General ledger accounting

- Bill pay and expense management

- Financial reporting with dashboards

- Document attachement

- PDF reporting

- Data management

- Third-party integrations

Regulatory Compliance: GDPR, ISO27001, SOC2, CCPA

Regions Served: North America, Latin America, Europe, Middle East & Africa, Asia Pacific

5. Sage Intacct: Scalable Cloud Accounting

Year founded: 1999 | Pricing: $$

Sage Intacct provides enterprise-grade multi-entity consolidation, dimensional reporting, and automation in a modern cloud architecture. Its breadth of features and controls make it a strong fit for multi-family offices and sophisticated finance operations.

Best for: Large family offices needing scalable multi-entity accounting, advanced reporting, and strong financial controls.

Core Client Segment: Single-family offices, multi-family offices, wealth managers

Key Features:

- General ledger

- Multiple entity and multiple currency consolidations

- Financial dashboards and reporting

- Reporting in HTML, PDF, CSV, or Excel formats

- Advanced ownership consolidation

- Document attachment

- Data management

- Bill pay and expense management

- Open architecture for integrations

Regulatory Compliance: Not specified in available documentation. Read more here.

Regions Served: North America, Europe

Family Office Accounting Software Comparison Table

What Accounting Software Do Family Offices Use?

There's no universal answer to what the best family office accounting software is. The right choice depends on your specific situation:

- For complex, multi-billion-dollar family offices with private equity holdings, fund structures, and dozens of entities: Archway provides the depth you need.

- For modern family offices prioritizing streamlined operations and current technology, Asseta offers a strong balance of features and usability.

- For offices embedded in Microsoft infrastructure with technical resources, Microsoft Dynamics can be customized to fit.

- Lean single-family offices with straightforward accounting can run efficiently on QuickBooks, an affordable, easy-to-use core.

- Teams anticipating multi-entity scale and deeper controls will find Sage Intacct a feature-rich foundation with room to grow.

Remember, single-family office accounting software needs differ from those of multi-family offices. Multi-family offices often need client service features, CRM integration, and granular reporting by client, but those capabilities matter less for single-family setups.

Why Accounting Software Isn't Enough on Its Own

The family office accounting software solutions above are excellent at what they do: managing books, tracking transactions, and maintaining accurate financial records across multiple entities.

But they only solve part of the problem.

To run efficiently, family offices also need a wealth management platform that pulls together portfolio data from custodians, banks, investment managers, and alternative assets, then turns that information into clear, actionable insights.

That's where Asora comes in. While your accounting system handles the books, Asora handles:

- Data aggregation: Consolidates financial information across all asset classes and custodians

- Performance monitoring: Tracks portfolio performance with IRR, MOIC, and time-weighted returns

- Private asset tracking: Manages illiquid assets, capital calls, and distributions

- Customizable reporting: Tailors reports for family members, investment committees, or advisors

- Real-time visibility: Provides up-to-date financial information through the Wealth Map for faster decision-making

Asora is typically used alongside systems like Archway, Sage Intacct, or QuickBooks, with data exchanged via secure feeds, files, or APIs to create a more complete picture of your wealth.

Learn more about how Asora simplifies consolidated reporting or schedule a demo to see how it fits into your tech stack.

FAQ

What is the best accounting software for family offices?

It depends on your complexity. Archway and Asseta support complex portfolios with investment accounting. Sage Intacct suits growing offices that need multi-entity consolidation. QuickBooks fits smaller single family offices with straightforward finances. Asora supports lean teams that want a unified wealth view with Accounting, Performance Monitoring, Private Assets, Documents, and workflow support, all with timely data updates.

Can QuickBooks be used for family office accounting?

As a solid accounting core, QuickBooks handles day-to-day books and payables; combined with Asora, offices gain multi-entity visibility, performance analytics (TWR/IRR), and secure, automated reporting across banks and private assets. Many offices pair QuickBooks with Asora to aggregate bank and custodial data, track private assets, and link documents, reducing spreadsheet work while keeping books intact.

How is family office accounting software different from regular accounting software?

Family office systems support complex ownership structures, trust and partnership entities, investment accounting across liquid and illiquid assets, multi-currency operations, and consolidated reporting. Standard business tools are not built for look-through reporting or diverse alternative assets. Asora supports these needs with entity-level registers, links between performance and accounting fields, timely updates, and workflow support for tasks.

How do I choose the right accounting software for a family office?

Match the system to your entity count, ownership structures, mix of liquid and private assets, reporting cadence, and the need to connect with custodians and service providers. Your accounting platform should excel at the general ledger, payables, and consolidations; Asora complements that stack by aggregating bank and investment data, tracking private assets, and delivering consolidated, investment-grade reporting, so finance and investment views stay in sync without turning your accounting tool into a portfolio system.