Automate your family office

Schedule DemoHeading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

TL;DR

Family office operations face critical challenges in 2026 including key person risk, manual processes, and security vulnerabilities that hinder effective wealth management. Modern family offices need streamlined operations that eliminate inefficiencies through centralized platforms, automated workflows, and secure collaboration tools.

Most family office operations are held together by spreadsheets, emails, and the institutional knowledge of a few key people. When the Chief Investment Officer who's been with the family for 20 years decides to retire, or when the family office CEO gets sick, everything falls apart.

Family offices with significant wealth can't afford to operate like small operating businesses anymore. The complexity of modern wealth management (private equity, multi-generational planning, regulatory compliance, fiduciary duties, and global asset allocation) demands operational sophistication that matches the stakes involved.

Yet many family offices and family businesses still rely on outdated processes that create unnecessary risks and inefficiencies. The families that recognize this reality and modernize their operations will thrive. Those that don't will struggle with mounting complexity and missed opportunities.

The Operational Challenges Holding Family Offices Back

Key Person Risk: When Everything Depends on One Person

Many family offices operate with fewer than five employees, creating dangerous dependency on key individuals. Whether it's a single family office with one operations manager wearing multiple hats or a multi family office where the chief financial officer handles everything from investment management to administrative support, this concentration of responsibility creates massive vulnerabilities.

These key people often possess decades of institutional knowledge and deep understanding about the family's strategies, generational wealth planning preferences, tax planning, strategic planning, and operational quirks. When they leave, retire, or become unavailable, family office operations can grind to a halt. Critical information about private investments, estate planning decisions, and family governance exists only in someone's head or personal files.

The problem extends beyond just losing employees. Many family offices lack proper documentation and standardized processes, making it nearly impossible for new team members to step in effectively. This isn't just an operational risk-it's an existential threat to family wealth management continuity.

Manual Processes That Kill Efficiency

Walk into most family office operations, and you'll find teams drowning in manual work. Investment advisors spend hours downloading PDFs from different portals, copying data into spreadsheets, and manually creating reports that are outdated before they're finished.

The typical reporting cycle for many family offices can take up to 21 days from data collection to final presentation. By the time family members see performance reports, market conditions have changed, investment opportunities have passed, and critical decisions have been delayed.

This manual approach doesn't just waste time-it multiplies errors. When data passes through multiple hands and systems, mistakes compound. A simple typo in one spreadsheet can cascade through multiple reports, affecting investment strategies and decision making for months.

Security Vulnerabilities That Keep Compliance Officers Awake

Family offices handle incredibly sensitive information about wealthy families, their investments, and their personal affairs. Yet many still share this information through unsecured email, personal devices, and cloud storage accounts that would horrify any information security professional.

The consequences extend beyond data breaches. Poor security practices can expose multiple families to fraud, identity theft, and even physical security risks when travel plans or personal information falls into the wrong hands. For families with public profiles or political exposure, these vulnerabilities become even more dangerous.

Traditional tools like spreadsheets offer virtually no access control. Either everyone has access to everything, or people can't find the information they need to do their jobs effectively. This all-or-nothing approach creates both security risks and operational inefficiencies.

How Modern Family Offices Are Solving These Problems in 2026

Centralized Operations That Actually Work

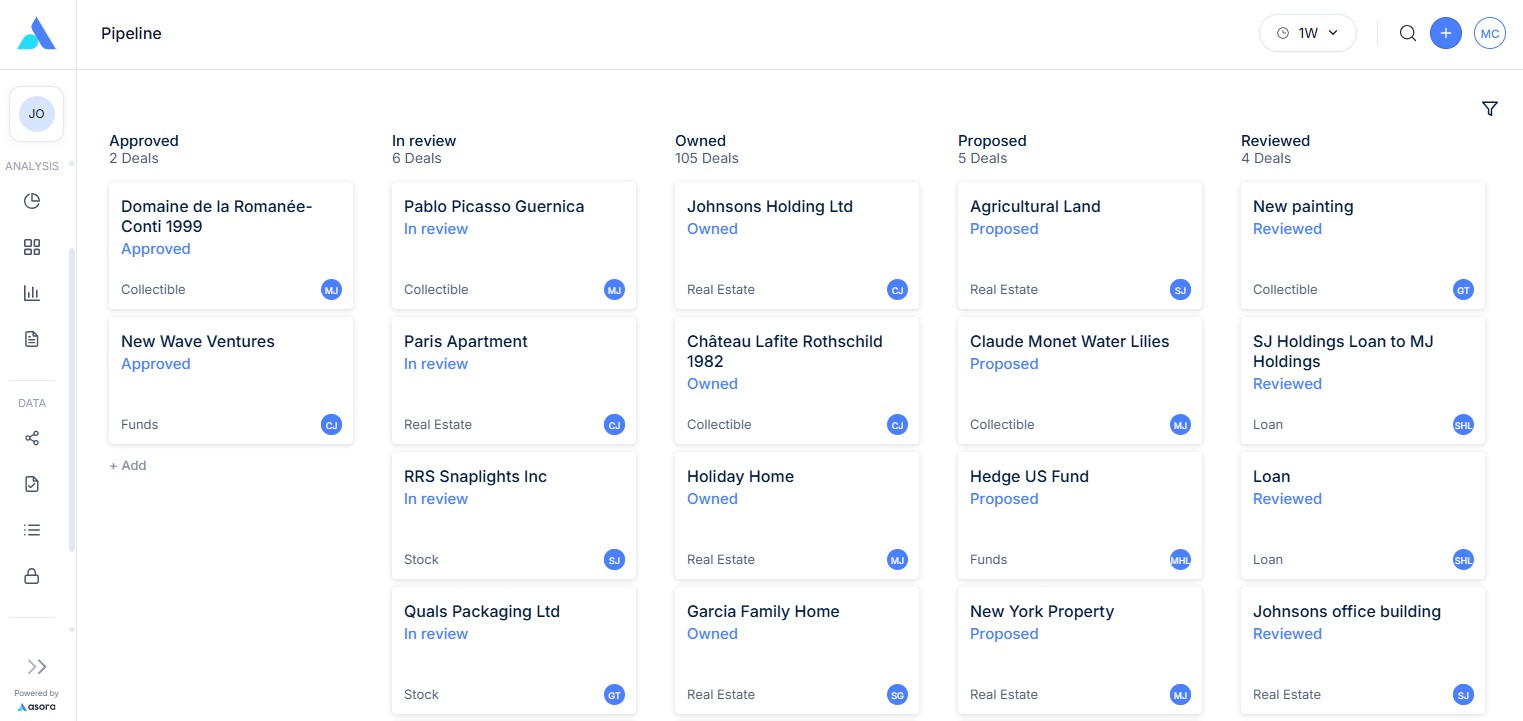

The best family office operations start with a single source of truth-a centralized platform where all critical information lives, gets updated automatically, and remains accessible to the right people at the right times.

Modern wealth management platforms provide the infrastructure for this centralization, automatically aggregating data from banks, investment managers, and service providers while maintaining the security and access controls that family offices require.

Automation That Eliminates Busywork

The most successful family office operations automate routine tasks that used to consume huge amounts of staff time. Instead of manually downloading investment data, sophisticated platforms pull information directly from custodians and fund administrators.

Report generation transforms from a weeks-long manual process to an on-demand capability. Family members can access current performance information whenever they need it, not just during quarterly reporting cycles.

Secure Collaboration That Provides Enhanced Privacy

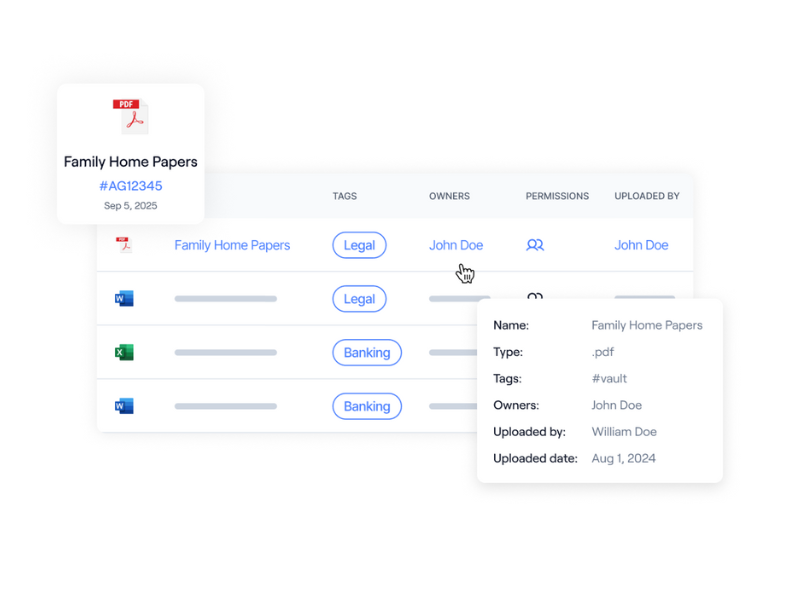

Modern family office operations require greater controls that balance security with operational efficiency. The best solutions provide role-based access that can be customized down to individual assets or documents.

Document management systems designed for family offices provide secure sharing capabilities that eliminate the need for email attachments while maintaining audit trails of who accessed what information when.

Building Operational Excellence for Wealthy Families

Designing for Multi-Generational Success

Effective family operations must serve both current needs and future generations. This means building systems that can accommodate changing family dynamics, evolving direct investing strategies, and new regulatory requirements.

Family governance structures need to be embedded in operational processes, ensuring that family values guide day-to-day operations while preserving family legacy.

Balancing Personalized Services with Efficiency

Single family offices exist to provide personalized services that wealthy families can't get elsewhere. The challenge lies in delivering this customization without sacrificing operational efficiency.

The most successful office operations standardize processes and systems while maintaining flexibility in service delivery. Technology plays a crucial role, automating routine tasks while providing the customization capabilities that enable truly personalized wealth management services.

Managing External Relationships Effectively

Modern single family office structures involve complex networks of external providers-investment advisors, legal counsel, tax professionals, and specialized consultants. The best family office operations create systems that enable seamless collaboration with external providers while maintaining appropriate oversight.

Workflow management tools help coordinate activities across internal teams and external providers, ensuring that increasingly important deadlines are met and responsibilities are clearly defined.

Technology Solutions for Modern Family Operations

Comprehensive Wealth Management Platforms

The foundation of efficient family office structure is a comprehensive platform that handles all aspects of wealth preservation-from investment tracking and performance monitoring to estate planning documentation and family governance.

These platforms must be designed specifically for family office needs, not adapted from institutional tools. The unique requirements (complex legal structures, diverse asset classes, multi-generational succession planning) require specialized capabilities.

Mobile Access and Integration

Family members need access to critical information regardless of location. The best mobile solutions provide secure access to timely information while maintaining security standards. Most family office structures have existing relationships with banks and investment managers. Effective platforms must integrate seamlessly with these existing systems rather than requiring wholesale replacement of working relationships.

Workflow management tools help coordinate activities across internal teams and external providers, ensuring that increasingly important deadlines are met and responsibilities are clearly defined.

Improve Your Family Office

Successful virtual family offices don't happen overnight, but the investment in modernizing systems and processes pays dividends in improved efficiency, better decision making, and enhanced family satisfaction.

Asora specializes in helping family offices transform their operations through comprehensive wealth management platforms designed specifically for affluent families.

Schedule a demo to see how modern technology can transform your family office.

Frequently Asked Questions

What are the biggest operational challenges facing family offices?

The primary challenges include key person risk management where critical knowledge is concentrated in few individuals, manual processes that waste time and create errors, security vulnerabilities from using unsecured communication methods, and lack of centralized systems that force staff to work with scattered information across multiple platforms.

How can family offices reduce key person risk while maintaining support services?

Existing family offices can reduce key person risk by implementing centralized documentation systems, standardizing processes across all operations, cross-training team members on critical functions, and using technology platforms that capture institutional knowledge in accessible formats.

What technology features are most important for family offices?

Essential features include automated data aggregation from multiple sources, secure document management with granular access controls, timely reporting capabilities, mobile access for family members and staff, and comprehensive workflow management tools that coordinate activities across teams.

How do successful family offices balance security with operational efficiency?

The best family offices use role-based access controls, include shared resources, implement secure and clear communication platforms that eliminate email for sensitive information, maintain comprehensive audit trails, and use encrypted systems that protect data while enabling efficient collaboration.

What's the typical timeline for modernizing family offices?

Most single family office operational transformations take 3-6 months for full implementation, though basic improvements can be realized within 4-6 weeks. Successful implementations typically use phased approaches that minimize disruption to ongoing operations.

.jpg)