Automate your family office

Schedule DemoHeading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

TL;DR

Spreadsheets and generic wealth tools no longer cut it for modern single family offices (SFOs) managing complex, multi-entity wealth. Today’s best wealth management software – like Asora – automates data aggregation, streamlines reporting, and offers real-time access, security, and support for public and private assets. This guide compares the top platforms for SFOs, what features matter most, and how to choose software built for your family’s needs (not just for advisors or institutions).

Running a single family office today isn't what it used to be. You're managing alternative investments, steering always-changing regulations, guiding multiple entities across different jurisdictions, and trying to keep up with family members who expect real-time access to their financial information from their phones.

The old spreadsheet-and-PDF approach just doesn't cut it anymore. Modern family offices need technology that can handle the complexity without creating more work. We're talking about wealth management software platforms that automate the tedious work, provide meaningful insights instead of just data dumps, and deliver the security and compliance features that come with managing major wealth.

AI and automation transform how smart family offices operate, while digital-first approaches and ESG considerations are now need-to-haves rather than nice-to-haves.

This guide breaks down the leading wealth management software platforms for single family office needs. We've highlighted Asora as one of our top choices because it's built from the ground up for family offices who want modern functionality without enterprise headaches.

What Is Wealth Management Software and Why Do SFOs Need It?

Wealth management software for single family offices are comprehensive platforms that track, report on, and manage all aspects of a family's financial life: from traditional investments and alternative assets to complex entity structures and multi-generational planning needs.

Spreadsheets and generic platforms fall short because your family office isn't managing a simple investment portfolio. Instead, you’re:

- Coordinating assets across multiple entities

- Tracking private equity commitments alongside liquid investments

- Managing trust structures

- Providing different levels of access to various family members and advisors

You need governance tools, compliance monitoring, and the ability to generate everything from high-level family reports to detailed entity-level analysis.

Generic wealth management platforms designed for retail investors (or even RIAs) don't understand the operational complexity of managing generational wealth. They can't handle look-through ownership across dozens of entities, and don't provide the security controls needed for family privacy.

The right wealth management software becomes the operational backbone that allows your lean team to manage complexity while keeping family members informed and engaged.

Wealth Management Software vs Investment Management vs Portfolio Management: What's the Difference?

If you're confused by all the different software categories out there, you're not alone. The terminology gets thrown around pretty loosely, but understanding the differences matters when you're trying to find the right wealth management digital platform for your family office:

- Wealth Management Software is the broadest category. It's a comprehensive solution for tracking, reporting, and managing all aspects of a family's financial life. This includes public and private assets, cash, alternatives, entity structures, and even non-financial assets like real estate or collectibles. The focus is on holistic, multi-generational needs, governance, compliance, and providing visibility to different family stakeholders.

- Investment Management Software is more focused on aggregating and tracking investments across public, private, and alternative assets. It's primarily about operational control, oversight, and reporting, but with less emphasis on the broader wealth picture, legacy planning, or non-investment assets.

- Portfolio Management Software is the most specialized category, concentrating on performance analysis, asset allocation, risk metrics, and trading for investment portfolios. These wealth management reporting software solutions are typically used by investment managers, wealth managers, or investment advisors rather than family offices directly.

Single family offices usually need wealth management software for advisors because your world is more complex than just tracking investments or analyzing portfolios. You need a complete, customizable view of your entire financial ecosystem.

However, you’ll see wealth management digital tools like Asora on quite a few different lists. That’s because Asora is designed for SFOs who need advanced aggregation, reporting, and automation across the full wealth spectrum (not just investment or portfolio management in isolation).

Top Features and Trends in Wealth Management Software for 2026

Changes in wealth management software are being driven by technology improvements and evolving family office needs. It’s not about more features, it’s about more solution-oriented products that solve real-world problems that burden single-family offices and ultra-high-net-worth individuals.

Ultimately, the leading platforms combine financial institution-grade capabilities with consumer-level usability:

- Data aggregation and integration: Modern software for wealth management pulls information from an ever-expanding catalog of custodians, banks, and alternative investment sources with advanced automation and fewer manual workarounds.

- Performance and analytics: Improved capabilities now include multi-currency support, comprehensive alternatives tracking, and AI-powered insights that provide actionable intelligence (rather than just overwhelming you with more data).

- Automated reporting and workflows: Wealth management software provides key features to remove the manual grunt work that used to consume family office teams—from routine reconciliation tasks to complex multi-entity reporting.

- Security, compliance, and privacy: Secure platforms are reaching bank-level standards with granular access controls, detailed audit trails, and compliance monitoring that meets the privacy expectations of UHNW families.

- Scalability and user experience: Differentiators include mobile device access, API connectivity, and digital-first interfaces that family members learn to use without extensive training.

- AI, machine learning, and emerging technologies: The biggest trend involves blockchain integration for better transparency and ESG tools for impact measurement and reporting.

9 Wealth Management Software Platforms for SFOs in 2026

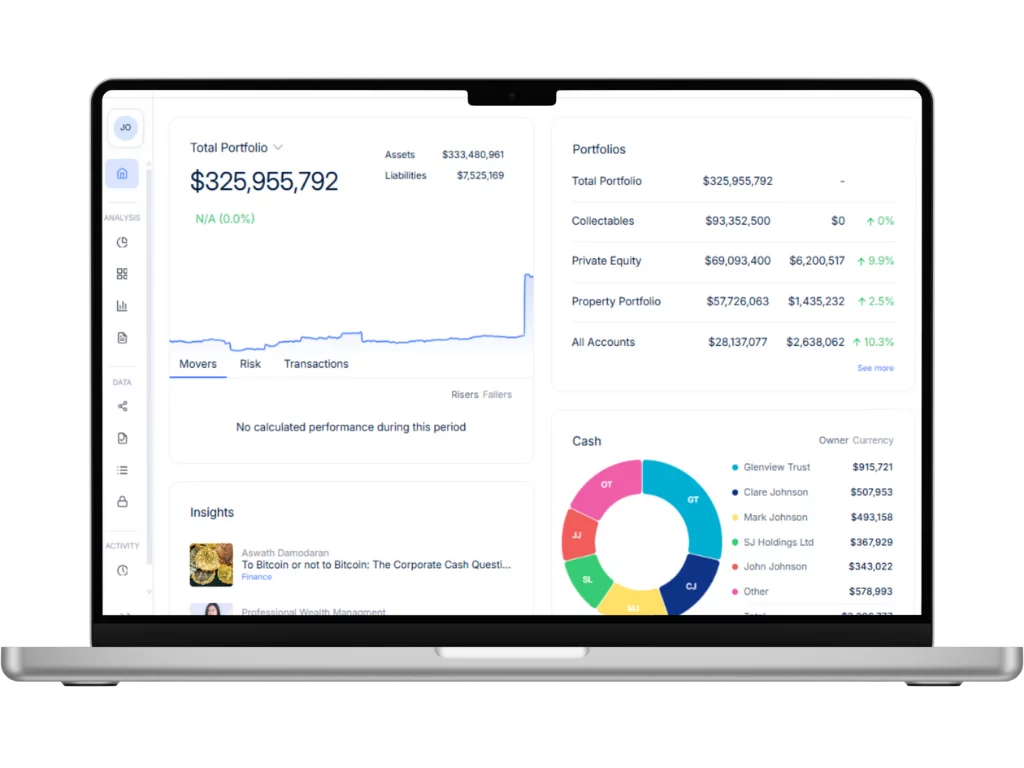

1. Asora (Editor's Choice)

Asora delivers comprehensive functionality without the enterprise complexity that bogs down other platforms. It’s private wealth management software built for single and multi-family offices managing $30M–$1B+ in assets that want to modernize their process (especially those with major alternative investments and complicated entity structures). Asora focuses on automation that simplifies work, interfaces that make sense, and implementation that doesn't drag on for months.

Features:

- Automated data aggregation across banks, custodians, and alternative investments

- Real-time performance monitoring with customizable reports

- Comprehensive alternative asset tracking

- Wealth map with look-through visibility across complex ownership structures

- Workflow support with tasks and deal pipeline tracking

- Secure document management with granular access controls

- Native mobile applications for iOS and Android

- Intuitive interface and ease of use

Pricing: Starting at $900/month, scaling with complexity rather than penalizing portfolio growth.

Request a demo to see for yourself

2. Landytech

Landytech serves family offices operating across multiple jurisdictions. The wealth management software product is designed for European investment operations that need top-level cross-border wealth management features. The digital wealth management software specializes in regulatory complexity and multi-jurisdictional reporting.

Features:

- Multi-jurisdictional wealth consolidation with comprehensive regulatory compliance

- Cross-border reporting and tax optimization tools for international structures

- Multi-currency investment tracking and performance measurement capabilities

- European banking system integrations with strong custody connections

- Risk management tools designed for international portfolios

- Secure document management with European privacy standard compliance

.webp)

3. Masttro

Masttro caters to family offices that need comprehensive wealth management with global reach and advanced reporting. The software fits established family offices that need detailed wealth mapping and secure collaboration tools for complex international structures.

Features:

- Global wealth consolidation with multi-entity performance tracking and reporting

- Advanced wealth mapping visualization tools for complex ownership structures

- Secure document sharing and collaboration capabilities for family and advisor teams

- Multi-currency investment tracking with predictive analytics and benchmarking

- Alternative investment management with document processing and workflow automation

- Customizable reporting and dashboard creation for different stakeholders

.webp)

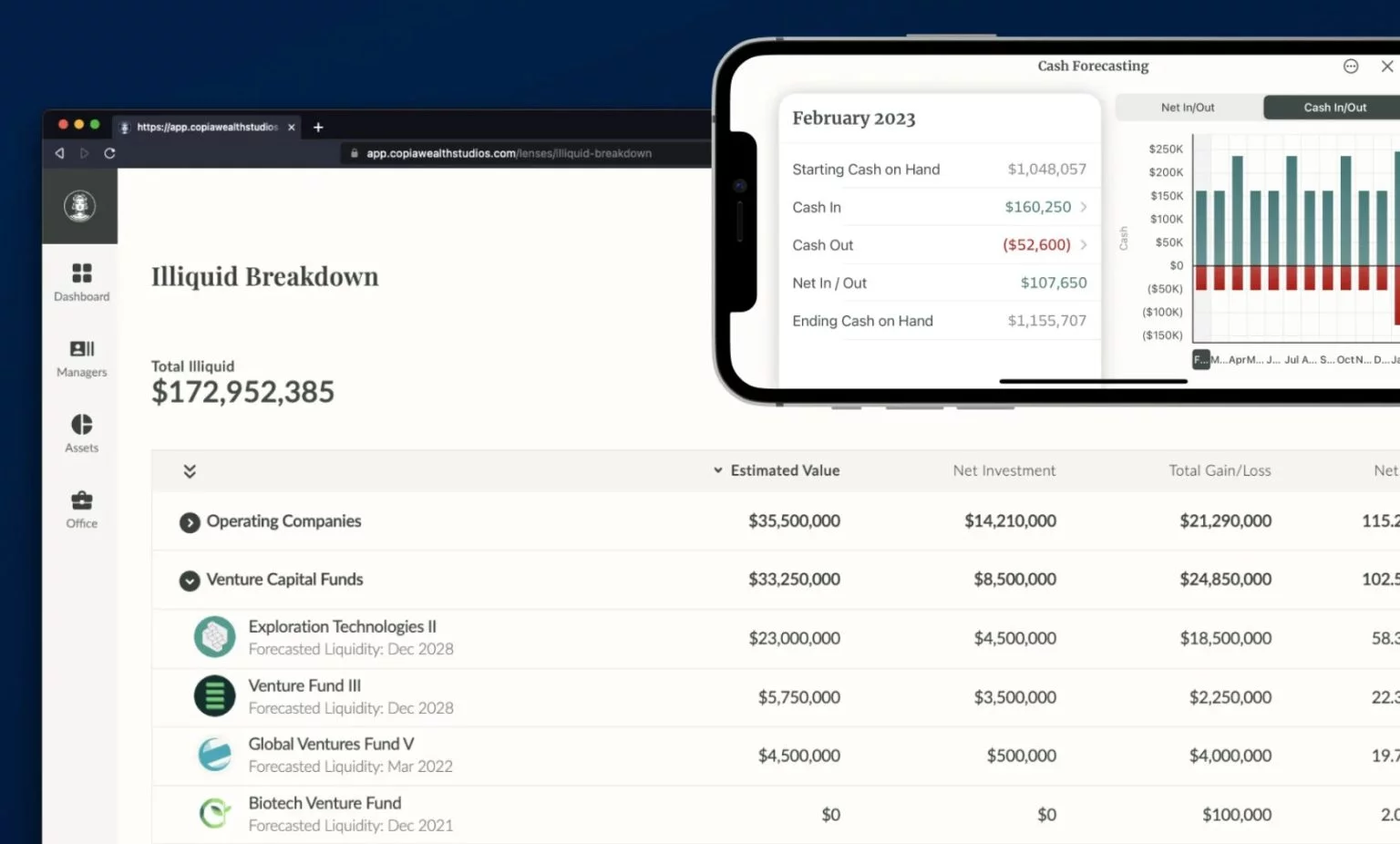

4. Copia Wealth Studios

Copia Wealth Studios makes artificial intelligence (AI) available to family office operations. It focuses on eliminating manual document processing and data entry work that consumes most family office teams. The platform is a great fit for tech-forward families who want to leverage automation for operational efficiency.

Features:

- AI-powered document processing for investment statements and capital call automation

- Multi-custodian investment aggregation with automated reconciliation

- Private investment workflow automation with comprehensive tracking and reporting

- Tiered pricing structure with scalable features

- Secure collaboration tools and customizable dashboards for stakeholders

- Document management with automated processing and intelligent data extraction

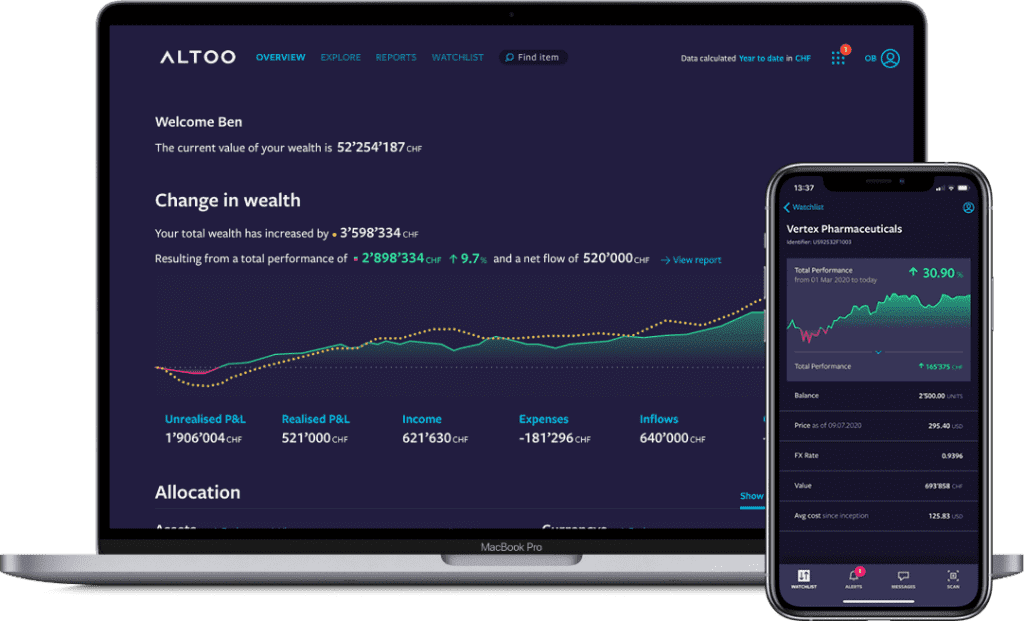

5. Altoo

Altoo serves European family offices and UHNW individuals who need wealth management across multiple jurisdictions and regulatory environments. The platform focuses on international wealth consolidation with strong European compliance and cross-border reporting.

Features:

- European-focused wealth consolidation with international capabilities

- Multi-jurisdictional compliance and tax optimization tools

- Advanced portfolio reporting with European market benchmarking

- Secure document management aligned with EU privacy standards

- Multi-currency investment tracking and performance measurement

- Alternative investment support with valuation management

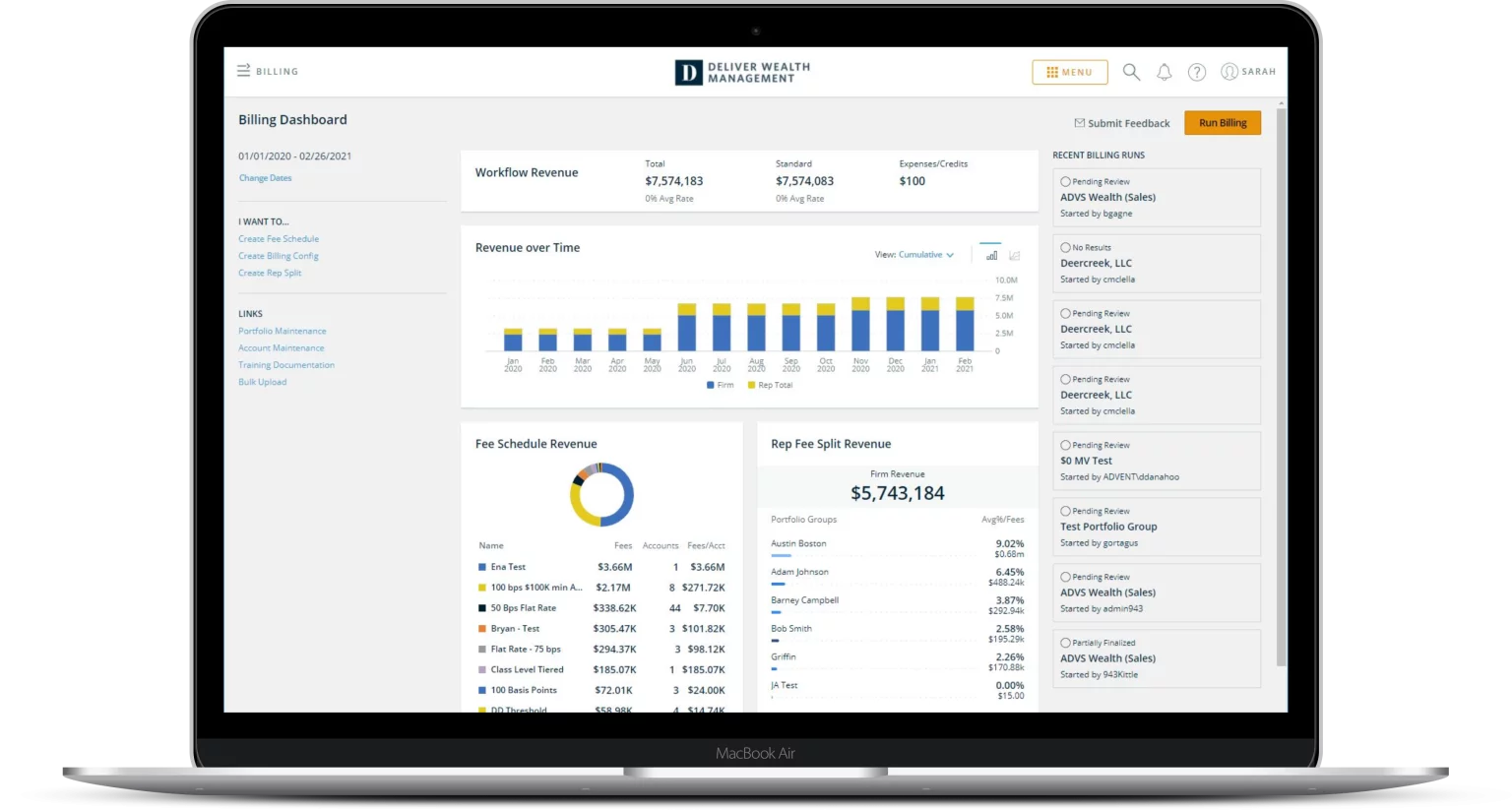

6. Black Diamond (SS&C)

Black Diamond is designed for family offices and wealth management firms that want investment management features combined with operational tools such as billing and CRM integration. The platform blends wealth oversight with practice management capabilities.

Features:

- Integrated portfolio management with automated rebalancing

- Comprehensive performance reporting and analytics

- Built-in billing and fee calculation systems

- Client engagement portals and document sharing

- Custodian integrations with trade order management

- Risk analysis and investment allocation tools

7. QPLIX

QPLIX provides institutional-grade analytics and performance measurement to family offices that need advanced investment analysis. The platform focuses on performance attribution and risk analysis typically offered to institutional investors.

Features:

- Advanced performance attribution across multiple asset classes

- Risk measurement and factor exposure analysis with stress testing

- Multi-asset class reporting with benchmark creation

- Regulatory reporting automation

- Alternative investment analytics and benchmarking

- Custom reporting with visualization tools and API access

8. Private Wealth Systems

Private Wealth Systems specializes in family offices managing complex trust and estate structures alongside their investment portfolios. The platform integrates wealth management with fiduciary responsibilities and multi-generational financial planning.

Features:

- Integrated trust and estate management with investment oversight

- Fiduciary accounting and beneficiary reporting

- Multi-generational wealth tracking and inheritance planning

- Beneficiary portal access with privacy controls

- Compliance monitoring for fiduciary duties

- Document management for trust and estate documentation

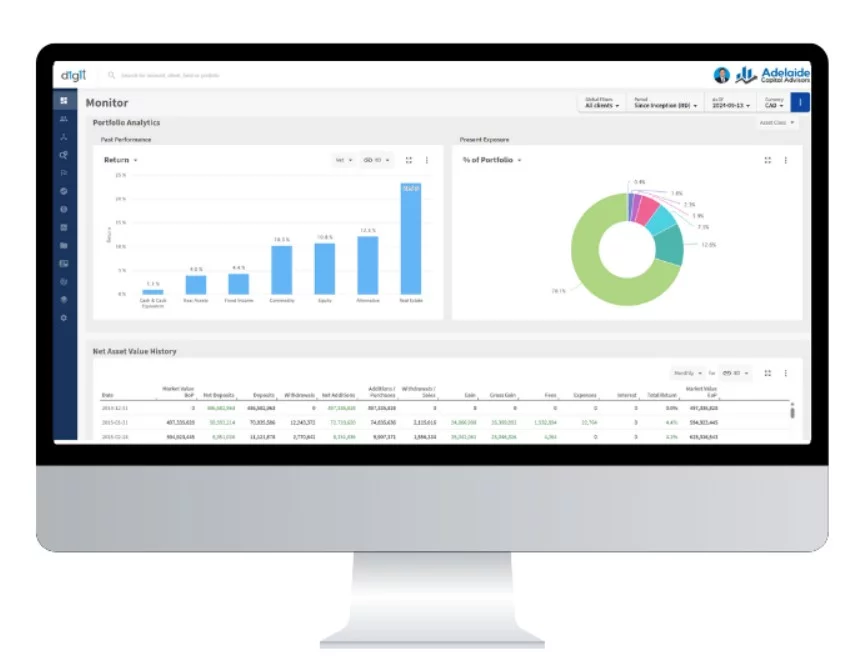

9. d1g1t

d1g1t provides family offices with a cloud-native wealth management platform featuring modern UX and analytics. The platform emphasizes contemporary design and streamlined workflows over traditional enterprise complexity.

Features:

- Modern cloud-based architecture with responsive interfaces

- Interactive dashboards with real-time visualization

- Streamlined alternative investment tracking

- Multi-custodian aggregation with reconciliation

- Customizable workflows for family office operations

- Real-time collaboration with secure document sharing

Conclusion: Powering the Modern SFO with the Right Wealth Management Platform

What worked with simpler wealth structures and fewer regulatory requirements just doesn't scale with today's complex multi-entity operations, alternative investment allocations, and family expectations.

Modern wealth management tools offer automation that eliminates errors, insights that drive better decisions, and security that protects generational wealth.

The top wealth management software lets lean teams manage significant complexity while keeping family members informed and engaged. It's about more than just replacing spreadsheets, it's transforming how your family office operates.

Asora stands out for its purpose-built approach to family office needs that combines comprehensive functionality with usability and implementation speed that modern family offices demand.

Request a personalized demo to see why family offices are choosing Asora for their wealth management solutions.

FAQs about Wealth Management Software for SFOs

What is wealth management software?

Family wealth management software tracks, reports on, and manages all aspects of a family's financial life: investments, alternatives, entity structures, and multi-generational planning needs.

Can these platforms handle private assets?

Yes, leading platforms like Asora, Copia, and others offer comprehensive private asset tracking, including capital call automation, distribution management, and document processing for private equity, real estate, and direct investments.

How secure is my data?

Professional platforms use bank-level encryption, multi-factor authentication, and compliance certifications like ISO 27001. They offer granular access controls and detailed audit trails to protect family wealth data.

What's the average price range in 2026?

Pricing varies significantly, ranging from approximately $900 (like Asora) to enterprise solutions costing mid-five figures annually. Many platforms use AUM-based pricing models, and you won’t find out the prices until you’ve invested time into sales calls and discovery processes.

How should I choose wealth management software in 2026?

When evaluating wealth management platforms, consider the specific needs of your family office or UHNW structure – such as the ability to manage complex entity ownership, support for alternative investments, robust security controls, and seamless integration with your existing custodians and banks. Look for platforms purpose-built for UHNW individuals and family offices, rather than solutions primarily designed for advisors or retail investors.