Automate your family office

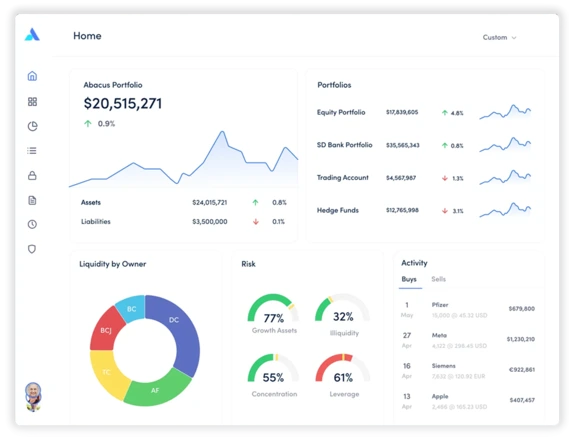

Schedule DemoK.E. Skye was looking for a simple and efficient way to track their portfolios across different asset classes in a consolidated manner. They also wanted to reduce the time spent organising performance data and monitoring their portfolios. They needed a single platform to serve as the central source of truth for all of their investment performance data.

Prior to implementing Asora, the office used to consolidate its quarterly reports into a single Excel spreadsheet. They had to manually calculate each desired metric to view the data every time. This process was time-consuming, and it required a considerable amount of effort to redo the reporting every quarter.

Up to 60% time saved on data collection and analysis

Single source of truth for all investment performance data

K.E. Skye was primarily looking for a platform that could display the performance data of multiple asset classes, with a specific focus on private assets, in a consolidated view. Additionally, they wanted the platform to function as a database for data-sourcing purposes. Lastly, the overall design of the product and its reporting pages were also considered while looking for a platform by K.E. Skye.

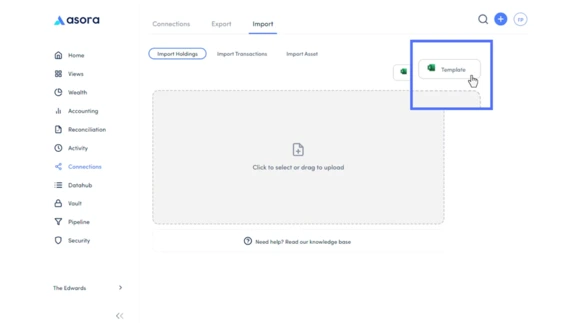

After an analysis of a number of competing products in the family office software space K.E. Skye opted for Asora because of the breadth of functionality and the user-friendly interface. Asora’s modern UX design and database function made it easy for them to collate and store their information. The transfer of private asset data was made easy with Excel templates. The portfolio information went through a few iterations. Once all the information was uploaded, the platform was easy for K.E. Skye’s team to understand.

Additionally, when K.E. Skye researched different products, they discovered that many were priced based on a percentage of AUM. The pricing structure of Asora is not based on AUM, which aligned with their requirements better.

After implementing Asora, the office now spends significantly less time than before on organising and consolidating reports, as well as performing calculations (such as IRR, MOIC, and DWTR). The platform has become a crucial part of its back office, and it has helped them save around 50-60% of their time in gathering and reconciling quarterly performance data. As a result, K.E. Skye can now allocate more time to monitoring asset allocation and analysing new investments.

Moving to dedicated software brings a lot of opportunity to increased analysis and oversight. During the implementation process, when adding information, it’s important to understand the functionality and analytics available and how the data you enter processes calculations and generates analysis. Looking back at the initial stages, the office realised that they should have taken more time to understand how the platform works before proceeding with the implementation.

Before deploying software, K.E. Skye recommends that other family offices should have a clear understanding of its functionality to avoid any additional work. It is advisable to analyse real-life processes and identify the steps where the technology can enhance efficiency. Prioritising those areas from the outset is crucial during the implementation phase.

K.E. Skye has experienced significant improvements in its asset management processes since adopting Asora. The software has helped them reduce the time spent calculating and compiling performance reports by more than half. Asora is now an essential tool in their back office, enabling them to focus on more crucial tasks. The benefits that K.E. Skye has gained from using dedicated software solutions demonstrate the potential advantages that family offices can have when they graduate from spreadsheets and automate their manual processes.

.png)

.png)

.png)

.png)

.png)

.png)