Asora: A Simpler, Smarter Alternative to Masttro for Family Offices

Asora stands out as a modern and user-friendly Masttro alternative that specifically tailors to the needs and use cases of family offices.

Asora is tailored for family offices focusing on automated data aggregation, alternative investments, and private asset tracking. It’s ideal for those who want a modern easy to use tool to track total family wealth and offers a flexible pricing structure, making it accessible for family offices of various sizes.

Masttro, meanwhile, is a wealth management platform aimed at a broader range of wealth management firms It focuses on comprehensive, global wealth aggregation with a large range of custodian integrations and a flat-rate pricing model.

Asora is the perfect Masttro alternative for single & multi-family offices who care about:

- Modern UI

- User-friendly, intuitive interface

- Flexible pricing

TABLE OF CONTENTS

Why is Asora the best Masttro alternative?

CORE FUNCTIONALITY

Asora centers its solution on data aggregation specifically tailored for family office portfolios, containing private equity, venture capital, real estate, hedge funds, private property and collectibles. The platform enables family offices to centralise a broad range of data sources and have access to information on demand through a collaborative easy to use interface.

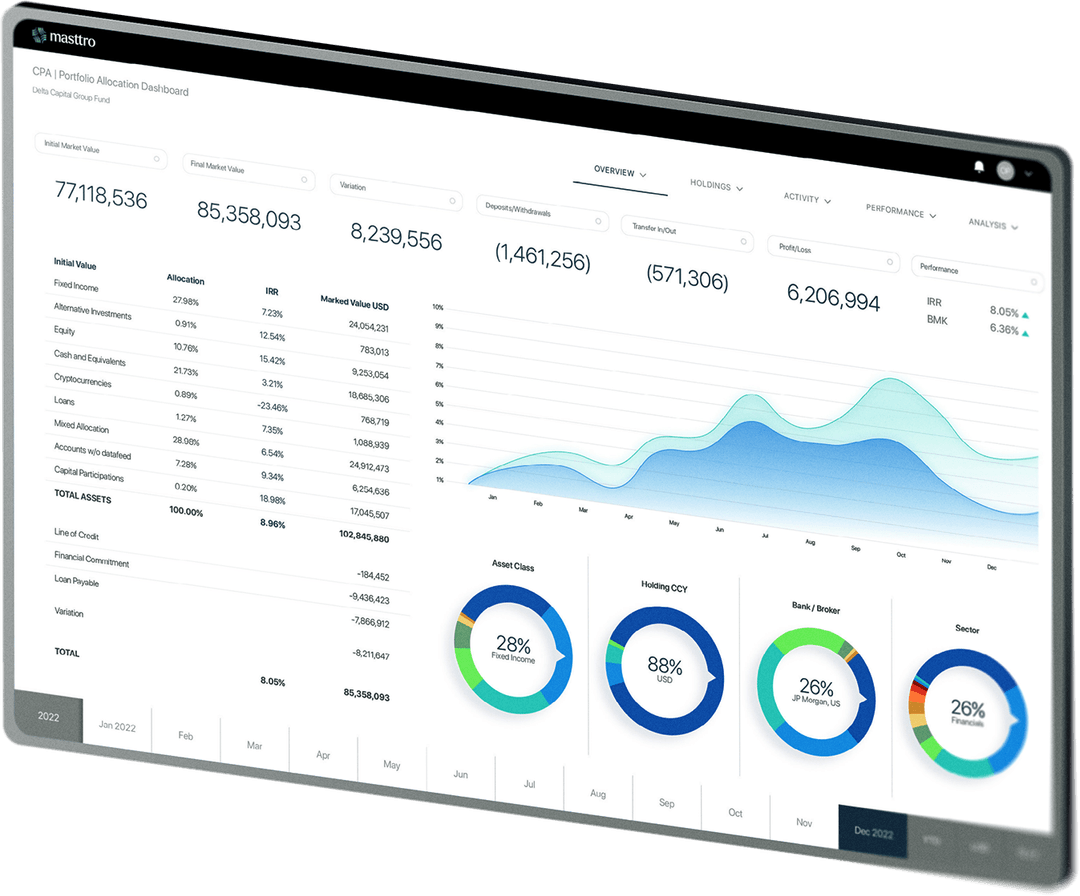

Masttro is a wealth management platform for tracking total net worth and providing a centralised view of all wealth data. It offers customisable dashboards to simplify portfolio management and a way to securely share data.

Unlike Masttro, which offers a broader approach to wealth management, Asora was designed specifically for family offices with complex, diverse portfolios that include significant private investments. Asora’s flexibility enables each family office to see exactly the data they need in a format that best suits their decision-making process.

USER EXPERIENCE

Asora is built with a modern, intuitive interface that aims to make wealth tracking easily accessible for every family office team member. The software is designed so that principals can easily access information on web or mobile making it accessible for users without extensive financial or technical backgrounds. It focuses also on supporting workflows especially on private assets such as tracking pipeline and assigning tasks.

Masttro offers an interactive, customisable client experience but relies on a more traditional dashboard design that may feel less intuitive to some users.

While Masttro also offers a user-friendly experience, Asora’s interface is highly optimised for family offices specifically, prioritising ease of use and accessibility for private market-focused needs.

DATA CONNECTIONS

Asora, the top alternative to Masttro for family offices, offers integrations with leading banks and custodians and provides a Data Connect guarantee – as long as your bank makes a data feed available, Asora will connect them to the platform.

Masttro integrates with custodians globally, providing extensive data aggregation and supporting a range of asset classes. This depth of integration is valuable for offices managing global, diversified portfolios.

Both platforms handle extensive integration capabilities. While Masttro’s extensive pre-built integrations reflect its established presence, Asora’s modern structure is designed to handle complex mappings and its Data Connect guarantee means that if a family office’s bank provides a datafeed they will be able to access it on the platform.

PRICING

Asora provides competitive pricing overall and through it’s a tiered-fee subscription model, pricing scales based on the size of the family office making it also accessible for smaller family offices.

Check our our pricing

Masttro employs a flat-rate pricing model that does not scale with assets under management (AUM), providing transparent pricing.

Asora’s pricing is structured to fit the size of a range of family offices, offering a more flexible cost model. For smaller family offices or those looking to grow, this tiered subscription model can be more accessible.

“The security features and data protection were relevant in driving our decision-making process, and we are thoroughly impressed with the overall experience.”

Paul Bakker, Omnia Capital Partners

Asora: A Powerful Masttro Alternative

While Masttro offers a strong, secure platform for general wealth management, Asora’s specialised tools, configurable options, and focus on private assets make it a superior choice for family offices. By tailoring its features to the unique challenges family offices face, Asora provides a more precise, adaptable, and efficient solution for managing private wealth and complex requirements.

FAQs: Asora – the best alternative to Masttro

What is the best alternative to Masttro for family offices?

Asora is a leading Masttro alternative for family offices that want modern, easy-to-use software. It offers fast onboarding, timely data, and powerful reporting—without the complexity.

Does Asora offer the same features as Masttro?

Asora includes the key features family offices rely on—investment tracking, performance reporting, data aggregation, and document management—without the overhead of legacy platforms.

What’s Asora family office software’s pricing like?

Asora is a more cost-effective solution for family offices seeking ROI without long implementation cycles. Check our pricing here.

Does Asora support timely family office reporting?

Absolutely. Asora provides timely dashboards and automated reporting, helping your family office make faster, data-driven decisions—no more waiting on spreadsheets.

Is Asora secure family office software?

Yes. Asora is built with enterprise-grade security, including data encryption, ISO 27001 compliance, and GDPR adherence to keep your sensitive financial data fully protected. Read all about our security measures here.

Who should use Asora family office software?

Asora is ideal for single-family offices, UHNW individuals, and lean multi-family offices looking for a scalable, intuitive, and modern wealth platform. As one of the leading Masttro alternatives, it’s built to simplify complex reporting and deliver value fast.