Data Aggregation

Connect all your family office’s bank

and investment accounts in one platform

Streamline financial data for your family office: Eliminate manual aggregation,

standardisation and reconciliation with secure, automated feeds.

The Problem with Manual Data Management

Managing your family office’s financial data across banks, custodians, and alternative investments can be overwhelming. You’re stuck with inconsistent formats, manual reconciliations, and missing information — all of which slows you down and increases risk.

Instead of focusing on strategy, your team spends hours wrangling spreadsheets just to get a basic view of total wealth.

With Asora, you can eliminate that friction and get back to what matters most: making confident, informed decisions with complete, accurate, and timely data.

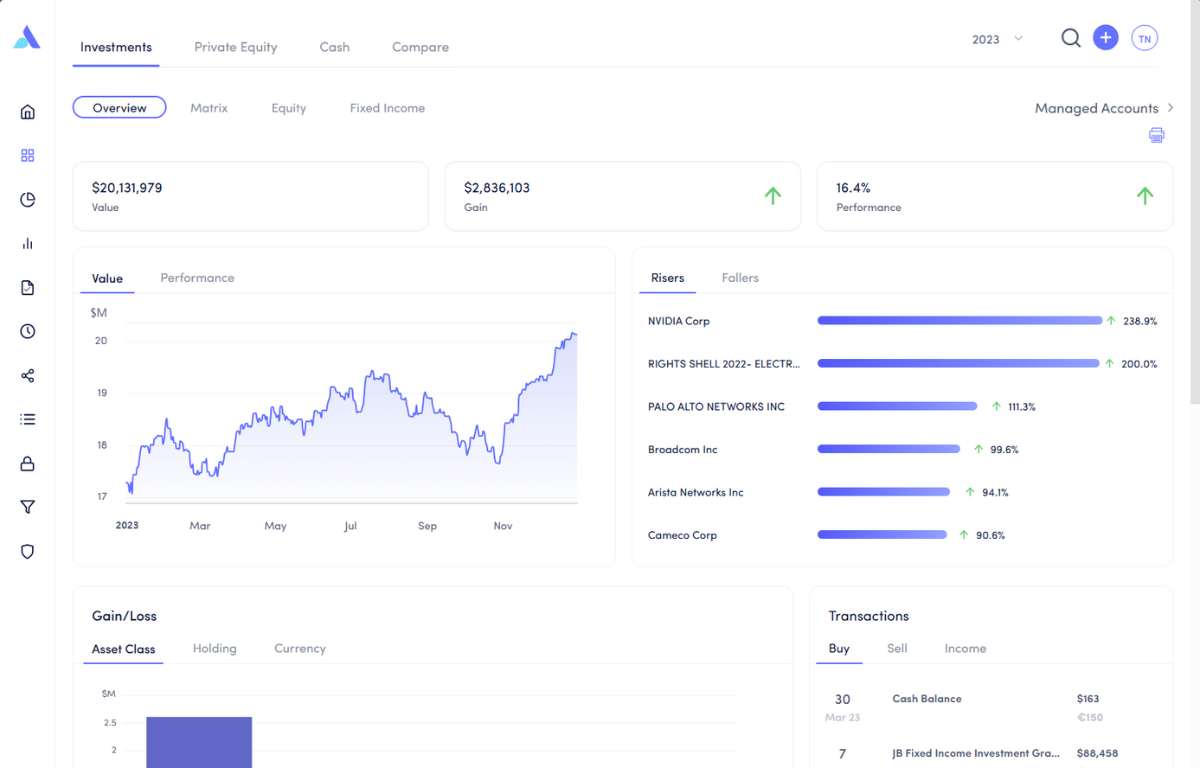

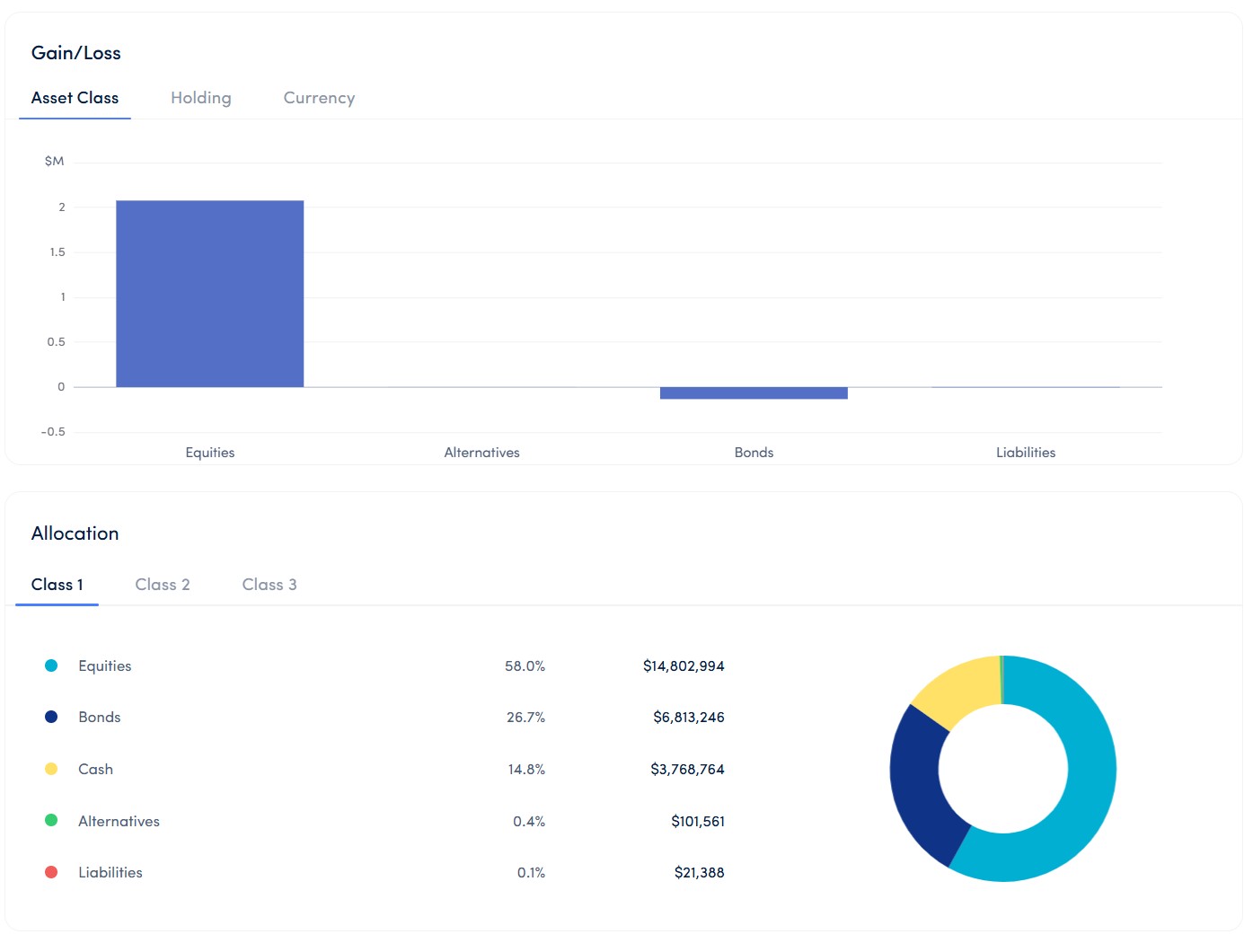

Centralise all your financial data in one place

Your single source of truth

- Your data is automatically aggregated from your banks and custodians, then mapped, cleansed and standardised into a unified format. This is all visualised on the Wealth Map to give you a full picture of your wealth.

- Unlike spreadsheets or legacy tools, Asora ensures your data is consistent at source, so you don’t have to reformat anything.

- You get consistent, accurate data without the manual effort, all in a secure environment ready for reporting, analysis and decision-making.

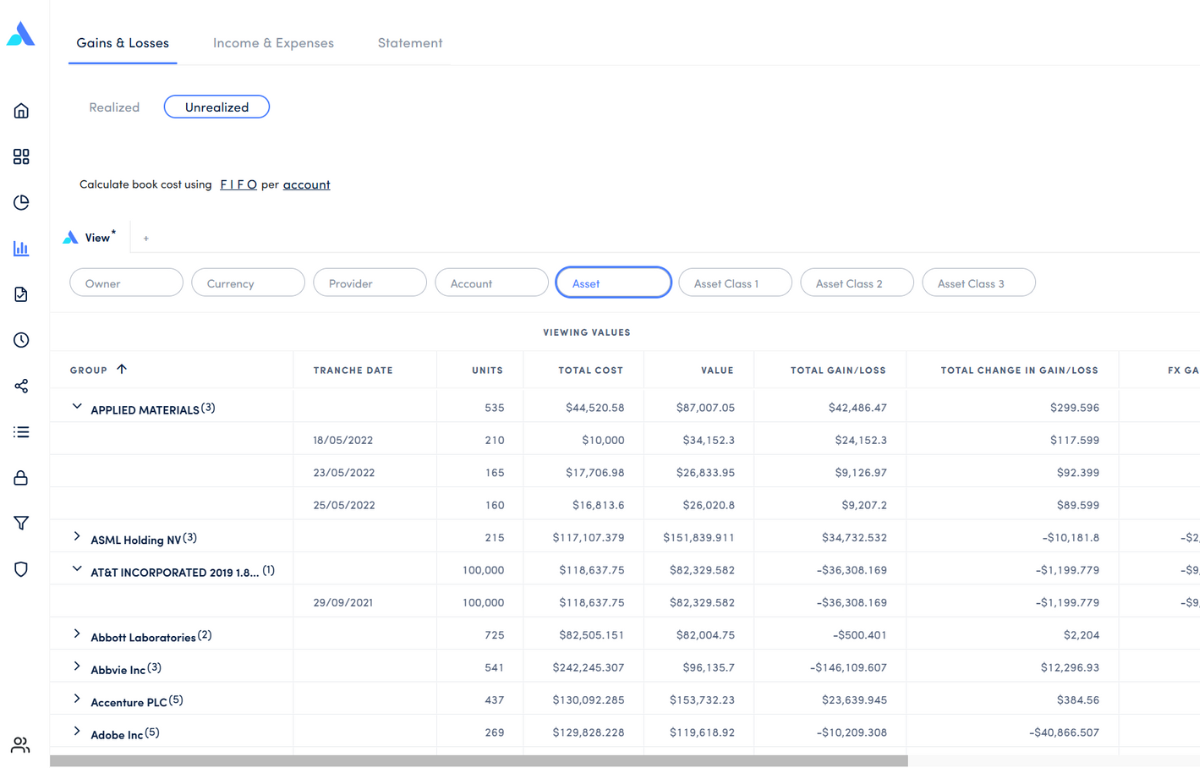

Get clean, reliable data

You get clean, structured data for reporting and portfolio management, which Asora automatically standardises and maps to help you save time and reduce errors.

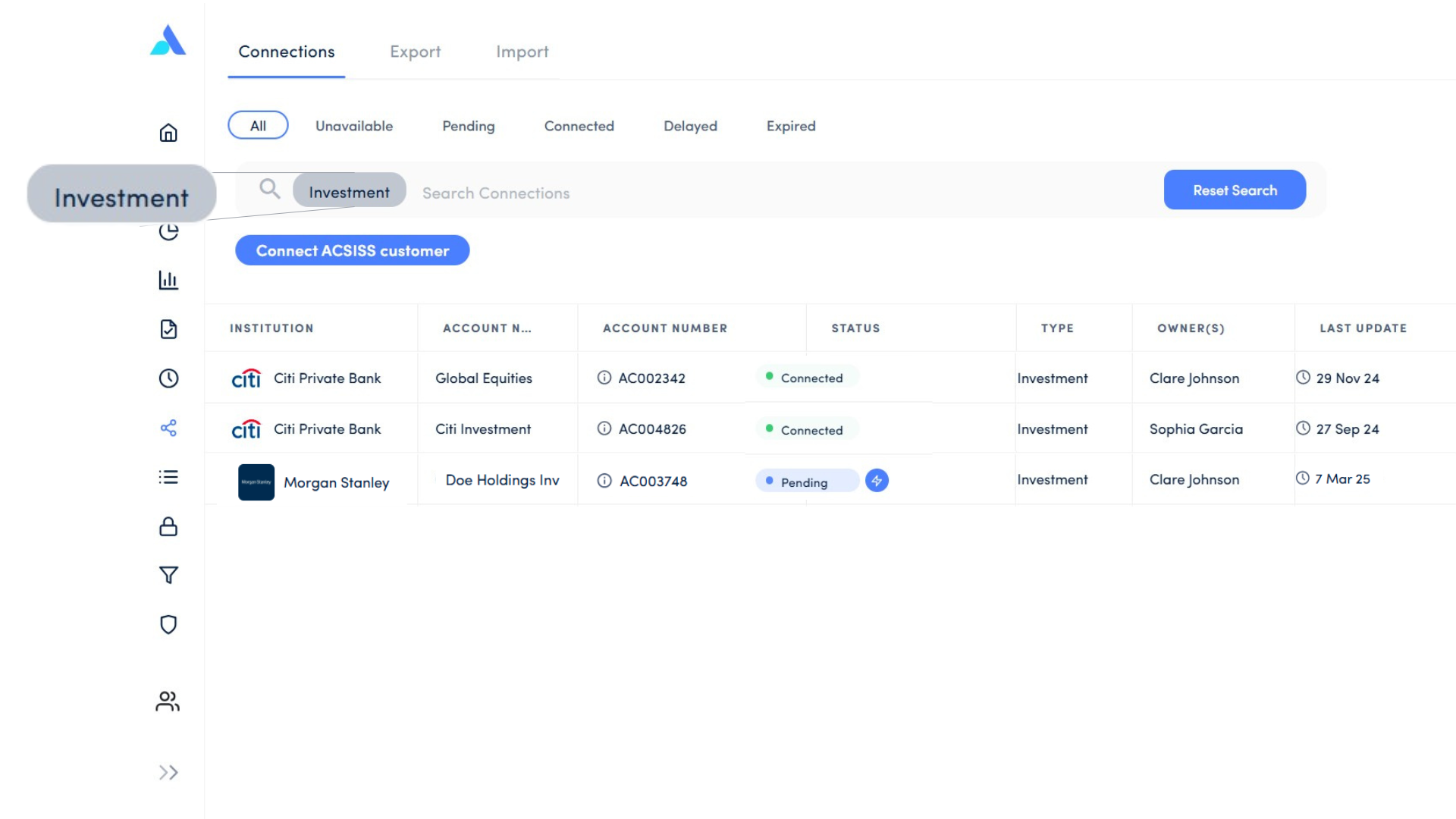

Instantly connect to your bank feeds

Get reliable, up-to-date access to your accounts through seamless connections to any financial institution with available data feeds. Give your team the confidence to make accurate, timely decisions.

Asora connects to thousands of financial institutions with available data feeds.

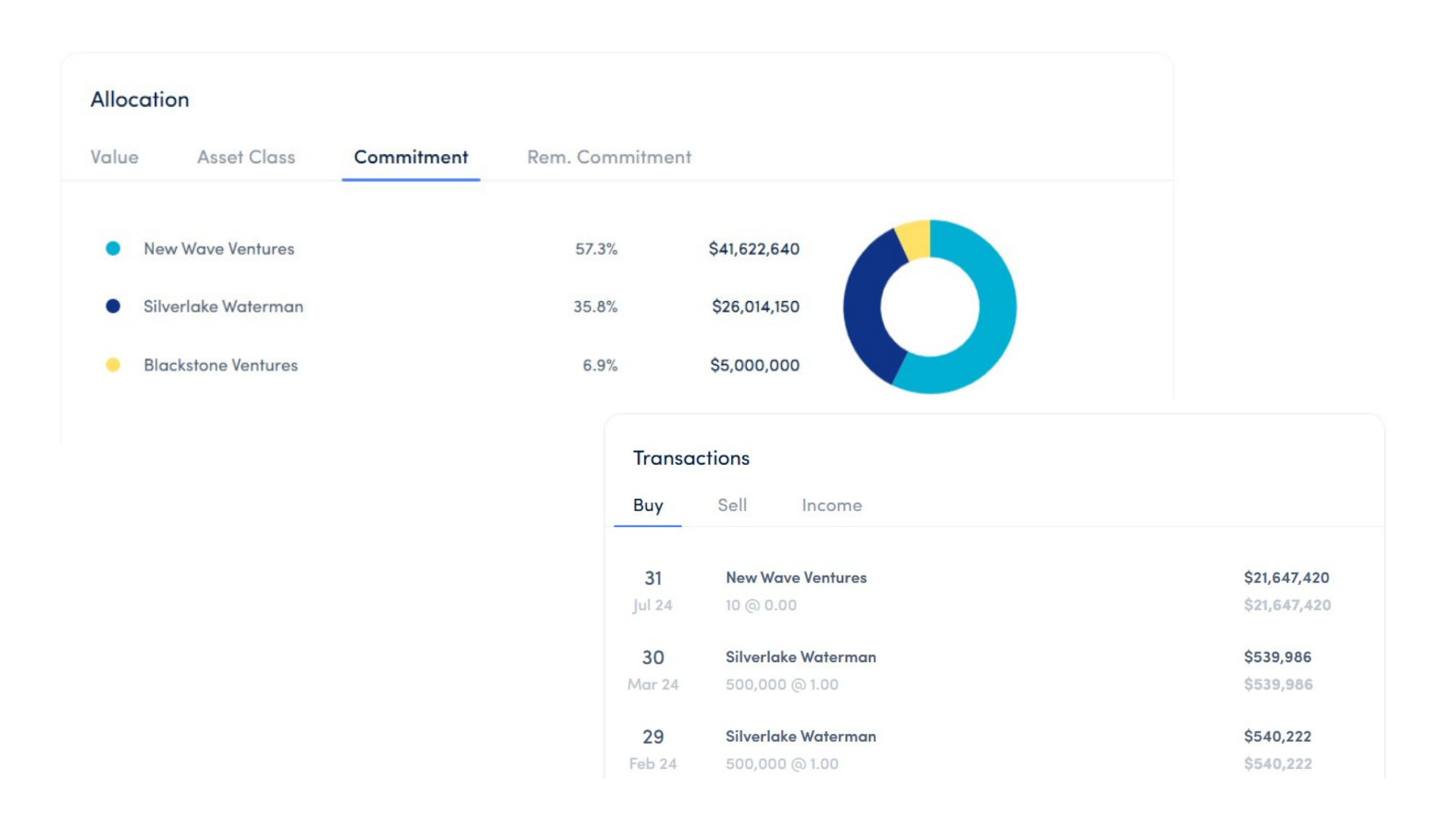

Structure your custodian data effortlessly

Your portfolio data is always timely, complete, and analysis-ready with Asora’s direct custodian feeds — no spreadsheets or manual adjustments needed.

Track alternative investments with ease

With automated document processing powered by Canoe Intelligence, your capital calls, K-1s, and investor statements are converted into clean, structured data, so you can focus on strategic activities, not manual tasks.

SECURITY

A secure home for your

financial data.

Asora offers a multi-faceted data security program to ensure the confidentiality and integrity of your data.

Run your family office securely. Asora meets the latest security best practices and principles.

Data is stored with end-to-end encryption, so only you choose who can view and access it.

Asora conducts regular penetration testing to identify & strengthen weak points.

FAQs: Data aggregation for family offices

What does data aggregation mean for family offices?

Bringing together all your financial data from banks, custodians and other sources into one platform for a complete view of wealth.

How does automated data aggregation work?

Automated aggregation uses APIs, file feeds, or third-party connectors to import data regularly. This removes the need for manual entry and ensures accuracy across accounts, entities, and asset classes.

What are the main challenges I will face without data aggregation?

Without data aggregation, family offices face fragmented data, manual reporting, inconsistent formats, and increased risk of errors; making it hard to get a timely and accurate picture of wealth.

Which bank accounts can I connect to on Asora?

You can connect all your banks with Asora, provided your banks can provide a data feed. We ensure broad coverage and seamless integration for global banking relationships.

What types of financial data can I aggregate on Asora?

You can get all your data from bank accounts, investment portfolios, alternatives like private equity via Canoe Intelligence into the Asora platform.