The Best Family Office Software for Single and Multi Family Offices

TL;DR

Wealth Management & Software

The family office industry has undergone major transformation as family wealth becomes increasingly complex and family office professionals demand more advanced software solutions.

According to The Family Office Operational Excellence Report 2025, 42% of participants cited excessive reliance on spreadsheets, while 33% highlighted manual aggregation of financial data as a major operational challenge.

Modern family offices seeking investment management and portfolio analytics require dedicated platforms that can handle multi-asset portfolios, complex partnership structures, and diverse investment data sources. The shift toward intelligent family office suite solutions shows growing demand for automated data feeds, digital on-demand reporting, and comprehensive family office management capabilities.

Whether you’re managing private equity holdings, tracking investment portfolio performance, or need robust family office accounting software, the right platform impacts operational efficiency. This guide examines software solutions that transform how family office professionals manage wealth data, streamline investment management processes, and deliver superior client service.

Which is the best family office software for your team?

In an era marked by rapid technological advancements and evolving financial landscapes, the demand for holistic family office software has never been greater. Whether it’s consolidating diverse assets, analysing their performance and costs or facilitating multi-generational wealth planning, the right software can significantly enhance operational efficiency. Below are some of the top family office software currently on the market.

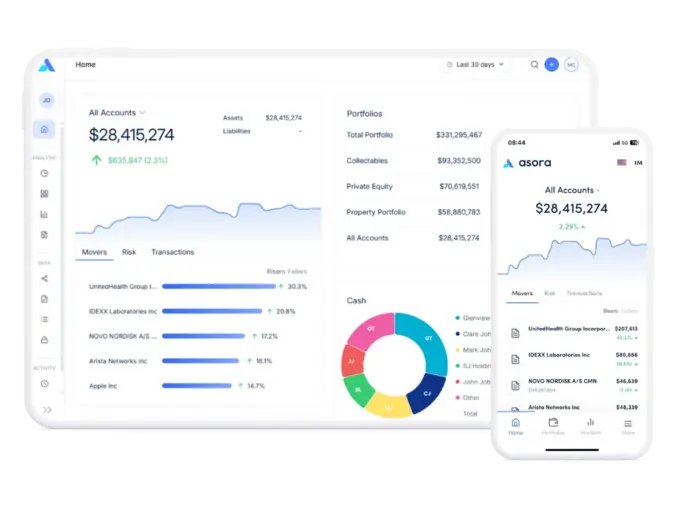

Asora

Price: Tier depending on family office size, starting at €800/month

Client Segment: Ultra-high-net-worth individuals and family offices of all sizes

Asora is a SAAS solution for single and multi-family offices to track and oversee assets, automating data capture and providing digital on-demand reporting on the web and mobile. It provides a single secure location for all the family’s data. The data is protected with always-on encryption and robust security protocols. Time-consuming manual handling of data and report creation are replaced with automated data feeds, comprehensive data cleansing and enrichment and digital on-demand reporting.

Key capabilities: Data Aggregation, Customisable reports, Private asset tracking, Deal pipeline, Task and document management

Altoo

Price: Custodian use/Feature-based (per connected custodian), Manual Services (e.g. non-bankable asset support) by efforts

Client Segment: Ultra-high-net-worth individuals, single-family offices, multi-family offices, trusts and foundations, private bankers, independent asset managers

Founded in 2017, Altoo helps individual wealth owners, family offices, fund managers, and advisors consolidate bankable and non-bankable assets, monitor asset allocation, manage documents and tasks, and manage risks.

Key capabilities: Legal structure overview, Cashflow analyser/future cashflows reporting, Intuitive ‘Explore’ feature to analyse asset/performance

Black Diamond

Price: Flexible, relationship-based

Client Segment: RIAs, single family offices,, multi family offices, trusts, broker-dealers, foundations

The SS&C Black Diamond Wealth Platform is part of SS&C Advent, a division of SS&C Technologies. This cloud-native solution is designed for family offices managing complex portfolios. It helps firms streamline operations and enhance client service through flexible infrastructure and dedicated support.

Key capabilities: Consolidated reporting, data aggregation, accounting, trading/rebalancing

.webp)

Canopy

Price: Flat fee pricing, data-based

Client Segment: High-net-worth individuals, wealth managers, private banks, single family offices, multi family offices

The Singapore-based company offers family offices, wealth managers, private banks, and trustees a customisable data analytics solution offering data aggregation, accounting, impact/ESG reporting, and multi-bank/asset class/currency reporting.

Key capabilities: Customisable dashboards and reports, Document storage with custom tagging, Wealth Map, Can convert non-standardised data into the desired data format

.webp)

Fundcount

Price: Starting at $21,928/year

Client Segment: Single-family offices, multi-family offices, high-net-worth individuals, asset managers, fund admins, hedge funds, private equity firms

Fundcount provide back-office and client reporting software for family offices. This accounting and investment analysis solution’s key tasks include data aggregation, portfolio management, and accounting.

Key capabilities: Partnership and Portfolio accounting, Consolidated reporting, Unified general ledger, Data aggregation

.webp)

Landytech

Price: Based on number of custodians, portfolios, legal entities, and assets.

Client Segment: Single-family offices, multi-family offices, asset managers, trustees

UK-based Landytech’s helps family offices use data aggregation and analytics to make informed investment decisions. The platform, Sesame, also offers portfolio management, cashflow management, and reporting features.

Key capabilities: Automated bookkeeping, Custom reporting, Private asset reporting, Look through ownership structure

.webp)

Masstro

Price: Flat fee pricing

Client Segment: Larger family offices, UHNWIs, wealth managers, private banks

Masttro serves single- and multi-family offices, wealth professionals serving wealth owners, and larger institutions. Offering a holistic view of your wealth, the platform helps with portfolio and task management, secure sharing and storage of documents, and easy integration with other tech platforms.

Key capabilities: Lots of report templates, Use of AI technology to extract fund reports, Wealth Map, Cryptocurrency tracking

.webp)

Orca

Price: Based on four different plans with certain number of users and items

Client Segment: Corporations, holding companies, investment firms, trust companies, CPA firms, private client advisors, law firms, family offices

Founded in Zurich, Switzerland in 2017, ORCA’s software offers data aggregation, reporting, document management features, and more. Orca was specifically built to deal with tax, legal, and compliance obligations for anyone who manages or owns ownership structures.

Key capabilities: Structured charts, Automated way of forwarding documents via email into software, Compliance and governance functions

.webp)

PandaConnect

Price: Flat Fee; AUM/Feature-based

Client Segment: Single-family offices, multi-family offices, RIAs, foundations

Founded in 1997, PandaConnect offers comprehensive services for diverse asset classes, aiding in wealth preservation and growth. With precise data aggregation and transparency, it provides families with institutional-level oversight, spanning multiple banks and currencies.

Key capabilities: Investment accounting and reporting, Auditors assurance reports, Performance measurement (MW, TWR, IRR), Data aggregation

.webp)

QPILX

Price: AUM-based

Client Segment: Single-family offices, multi-family offices, independent wealth managers, banks, corporate treasuries, foundations, institutional investors

QPLIX delivers SaaS solutions for family and investment offices, wealth management, banks, and asset managers. The software maps liquid and illiquid asset classes, and accommodates various client structures, consolidating all investment data into the database. Users can access real-time reports and analytics through the web portal or app.

Key capabilities: Customised reporting, Legal entities management, ESG rating integration, Private equity management

.webp)

Swimbird

Price: Flat fee; feature and data (per data feed integrate)-based

Best for: Banks, asset managers, family offices, investment companies, private equity and venture capital firms

The Swimbird Platform (SWIP) is a portfolio management solution offering users a holistic view of their entire portfolio. SWIP aggregates and visualises portfolio data, including assets and liabilities – all in real time. It can manage all financial instruments (listed and OTC), private equity, and alternative investments.

Key capabilities: Real-time dashboard, Customised reporting, Market and static data master, Data aggregation

.webp)

** All images from company websites and social media platforms.

How to pick the best family office software in 2026

Selecting the right software for your family office is a strategic decision that can significantly impact how efficiently you manage wealth, investments, and operations—both now and in the future. Given the complexity and diversity of family office structures, there’s no one-size-fits-all solution. Each platform offers a distinct set of capabilities, from consolidated reporting and data aggregation to accounting, document management, and alternative investment tracking.

To help you navigate this landscape, we’ve created a guide that outlines what to look for in a service provider and how to assess which solution best aligns with your operational needs, governance requirements, and long-term goals.

Key factors to consider when buying family office software

1. Client Fit

- Is the software purpose-built for family offices or repurposed from institutional or advisor tools?

- Does the vendor primarily serve single-family offices, multi-family offices, UHNWIs, or wealth managers?

2. Features and Capabilities

- Look for platforms that align with your needs—whether it’s real-time dashboards, historical performance tracking, document vaults, or automated reconciliation.

- Consider capabilities like alternative investment tracking, cash flow forecasting, and customisable report templates.

3. Data Aggregation

- Can the platform automatically pull in data from your banks, custodians, fund managers, and accounting systems?

- Does it support feeds for alternatives and illiquid assets, or is it limited to public markets?

4. Reporting and Visualisation

- How flexible and customisable are the reports?

- Can you create different views for family members, investment committees, or trustees?

5. Integration and API Access

- Does it integrate with your accounting platform, CRM, or document management system?

- Are there open APIs to connect with other tools?

6. Security and Compliance

- What measures are in place to safeguard sensitive financial and personal data?

- Is the provider compliant with regulations such as GDPR or industry-specific standards?

7. Ease of Use

- Is the interface intuitive enough for non-technical users?

- Can family members, assistants, or board members log in and navigate it easily?

8. Client Support and Onboarding

- Does the provider offer hands-on onboarding and training?

- Are support teams responsive and knowledgeable about family office-specific challenges?

9. Customisation and Flexibility

- Can the solution adapt to your family’s structure, preferences, and workflows?

- Does it accommodate unique reporting formats or legacy data imports?

10. Pricing and Scalability

- How transparent is the pricing? Is it based on users, entities, or AUM?

- Can the software scale as your family office evolves?

With our independent analysis and insight into the top providers in the space, you can feel confident in selecting a solution that enables smarter decision-making, reduces manual work, and supports your family office across generations.

Why are family offices moving towards purpose-built technology?

As modern family offices become more complex, the reliance on manual workflows and disconnected tools is quickly being replaced by specialised technology solutions. Family office software has emerged as a critical enabler of operational control, responsive decision making, and scalable governance across jurisdictions and generations.

This shift is driven by several key factors:

- The growing volume and complexity of financial activities across asset classes, currencies, and legal entities

- Increasing demand for secure, centralised platforms that support real-time investment insights

- A broader move toward future-proofing family office operations against evolving regulatory, market, and generational needs

The right software no longer just supports portfolio oversight — it acts as an integrated platform that connects stakeholders, safeguards private data, and streamlines everything from performance reporting to document management. As family members, business managers, and wealth advisors seek seamless access to timely and actionable information, software becomes an integral part of making informed financial decisions and sustaining family wealth over the long term.

For single family offices and multi family offices alike, the shift toward digital infrastructure is essential to stay ahead.

Key challenges faced by family offices today

Despite increasing awareness of purpose-built tools, many family offices continue to face operational friction caused by outdated or misaligned systems. A significant number still rely heavily on spreadsheets and manual data handling — a reality confirmed by The Family Office Operational Excellence Report 2025, where 42% of respondents still rely on spreadsheets, and around one-third continue to manually aggregate financial data.

Here are the most pressing challenges:

- Manual financial data entry

Spreadsheets and ad hoc tools require significant staff time and introduce risk through version control issues, inconsistent formats, and lack of audit trails.

- Fragmented or delayed reporting

Without proper reporting software, it becomes difficult to generate consolidated views of wealth, especially across public markets, private equity, venture capital, and real estate holdings.

- Limited visibility into illiquid assets

Most generic platforms fail to adequately track alternative assets or allow look-through analysis for nested ownership structures.

- Exposure to data and compliance risks

Sensitive private data is often stored or shared through unsecured channels, putting family offices at risk of reputational or regulatory fallout.

These challenges impact everything from day-to-day portfolio oversight to long-term investment decision-making. As family offices scale and diversify, the need for a centralised, highly secure, and automation-driven solution becomes unavoidable.

Platforms like Asora are helping modern family offices replace fragmented processes with end-to-end digital control, enabling better decisions, cleaner reporting, and higher operational efficiency.

The essential features of the best family office software

With dozens of vendors on the market, selecting the right family office software begins with understanding the features that matter most. Below is a breakdown of the foundational capabilities that distinguish the best family office software from standard wealth management or accounting tools.

1. Unified Data Aggregation

Centralising data from custodians, banks, asset managers, and alternative investment platforms is essential for building a single source of truth. Effective data aggregation reduces manual work, enhances accuracy, and enables consolidated data views that support investment analytics and reporting.

.webp)

2. Multi-Currency and Multi-Entity Support

Family offices with global portfolios need the ability to manage multiple entities and currencies without duplicating work. Software should automatically handle FX conversions, support legal entity rollups, and enable entity-specific reporting.

3. Custom Reports and Dashboards

Different stakeholders require different views. The ability to build custom reports and dashboards — from detailed financial statements to executive summaries — ensures that family members, business managers, and advisors all get the insights they need in the right format.

4. Timely Performance Reporting

Timely access to performance metrics like IRR, TWR, and benchmark comparisons is no longer a luxury. The best tools include support for tracking both public and private investments, and offer granular analysis across asset classes.

Choosing the Right Family Office Software for Your Needs

Selecting optimal software solutions for family office management requires careful evaluation of your specific investment data requirements, multi-asset portfolios complexity, and long-term family wealth objectives. The platforms reviewed represent the leading options for family office professionals seeking to modernize their investment management operations through intelligent family office suite capabilities.

Key considerations for your decision:

- Investment Data Aggregation Needs: Evaluate how well each platform handles data feeds from your existing custodians, investment managers, and complex structures

- Portfolio Analytics Requirements: Consider the depth of investment portfolio analysis, performance reporting, and digital on-demand reporting capabilities that align with your stakeholders’ expectations

- Scalability and Growth: Choose software solutions that can accommodate expanding family wealth, additional private equity holdings, and evolving family office management requirements

- Integration Capabilities: Ensure selected platforms integrate seamlessly with your existing family office accounting software, document management systems, and workflow processes

Whether you choose Asora for its comprehensive automation and user experience, Masttro for institutional-grade capabilities, or another platform that aligns with your specific needs, investing in robust family

FAQs: The Best Family Office Software

The best family office software should offer data feeds from multiple custodians, comprehensive investment data aggregation, and support for different partnership structures. Key features include multi-asset portfolios tracking, reporting, and integration with existing investment management systems. Look for platforms that can handle private equity holdings, provide analytics, and accommodate the diverse wealth data requirements of modern family office management.

Intelligent family office suite solutions are purpose-built for family offices seeking comprehensive investment management capabilities beyond basic portfolio tracking. These platforms offer advanced investment data aggregation, automated reconciliation, and sophisticated analytics. Unlike generic wealth management tools, they provide family office professionals with reporting, multi-asset portfolios support, and specialized features for managing wealth across generations.

Pricing for solutions varies significantly based on features, assets under management, and complexity. Entry-level platforms may start around $11,000 annually, while comprehensive intelligent family office suite solutions can range from $50,000 to $200,000+ yearly. Costs typically depend on factors like automated feeds quantity, investment data volume, number of entities, and advanced features like equity holdings tracking and partnership structures support.

Investment data aggregation is crucial for effective family office management. Automated data feeds eliminate manual processes, reduce errors, and provide real-time data across all holdings. This capability enables family office professionals to deliver timely analytics, comprehensive investment management oversight, and accurate reporting.

The best family office software solutions offer robust support for equity holdings, real estate, hedge funds, and other alternative investments within multi-asset portfolios. Leading platforms provide specialized investment data aggregation for illiquid assets, automated processing of capital calls and distributions, and sophisticated analytics that include IRR, MOIC, and look-through reporting. This functionality is essential for family offices seeking comprehensive investment management beyond traditional securities.

.webp)