Automate your family office

Schedule DemoTL;DR

Generational wealth planning requires balancing family governance with operational excellence. The most successful intergenerational family wealth planning combines clear family mandates, automated processes, and next-generation wealth planning to strengthen the family's legacy and involve younger generations.

Families protecting generational wealth can follow ten strategies, from mapping entities and enforcing investment discipline to education programs and technology adoption to preserve their legacy across generations.

Introduction

Estate plans and trusts alone don't preserve wealth across generations. Families that succeed in intergenerational wealth planning pair governance with operational discipline as part of their wealth management strategy.

Ultra-high-net-worth families that sustain multi-generational wealth build systems that record ownership clearly for younger generations, ensuring their understanding of multigenerational wealth, reducing confusion with standard reporting, and balancing family harmony with financial discipline.

They face dynamics that span decades, portfolios that must perform through multiple economic cycles, and rising generations who view money differently from their grandparents. Add the complexity of managing entities, investments, and global tax requirements, and the risks multiply.

The strategies below show how families can build family wealth and a long-lasting legacy, while keeping everyone aligned and engaged.

Start with a Family Mandate and Governance That People Actually Follow

Most families overthink it into paralysis or underthink it into chaos. The sweet spot is creating something clear enough that everyone understands it, but flexible enough that it doesn't become a straitjacket.

Clear mandates prevent conflicts from arising. A well-crafted family mandate aligns family values, financial goals, decision-making rights, and dispute resolution paths before problems arise.

How to implement it:

- Draft a concise family mandate that outlines core values, financial objectives, and investment philosophy

- Create a governance charter that defines roles for principals, next-generation family members, and external advisors

- Establish regular review cadences; quarterly check-ins and annual strategy sessions work for most families

- Document decision-making processes for different types of choices (investment approvals, distribution requests, etc.)

- Build in dispute resolution mechanisms before you need them

Families get better results from short, practical rules used daily, as well as from regular family meetings, than from lengthy constitutions that gather dust.

Map Every Entity and Beneficiary with True Look-Through Visibility

Most wealthy families have no idea how complex their ownership structures really are until they try to map them visually. Then they realize they've got entities owning entities, beneficiaries scattered across multiple trusts, and assets that nobody can quite remember how they're titled.

Precise ownership mapping prevents tax surprises, cash flow issues, and reporting headaches. When you know precisely who owns what through which structure, you can make informed decisions about family businesses, wealth restructuring, distributions, and investment allocations.

How to implement it:

- Document every trust, partnership, holding company, and special purpose vehicle

- Build visual ownership maps that trace from ultimate beneficial owners down to individual assets

- Tag assets by entity and beneficiary to understand true exposure and concentration risks

- Update mapping quarterly as structures change and assets move between entities

The families who get this right use visualization tools that make complex structures understandable at a glance. Asora's Wealth Map provides this kind of look-through visibility across multi-entity structures, making it easier for family members and advisors to understand the big picture.

Treat Alternative Investments as a Disciplined Program

Alternative investments often become the wild west of family diversified portfolios: private equity commitments made on relationships, real estate deals that sounded good at cocktail parties, and direct investments that pile up without any systematic approach.

How to implement it:

- Centralize all commitment tracking, capital calls, and distribution management

- Standardize valuation processes and data sources across managers

- Measure performance consistently at both entity and consolidated levels

- Plan for liquidity needs from capital calls 12-24 months in advance

Private asset tracking becomes critical when alternatives represent 30-45% of total family wealth (which is increasingly common among ultra-high-net-worth families).

Build a Liquidity Plan for Taxes, Calls, and Distributions

Nothing destroys generational wealth plans and hard-earned assets faster than being forced to sell financial assets at the wrong time because you didn't plan for liquidity needs. This is especially critical when you're dealing with significant investments that can't be liquidated quickly.

How to implement it:

- Committed capital calls across all private investments

- Estimated tax liabilities by entity and consolidated

- Planned distributions to family members

- Operating expenses and advisor fees

- Debt service requirements across entities

The safety net should maintain 6-12 months of living expenses in liquid instruments, with credit lines available for unexpected calls or opportunities.

Also, implement sweep accounts and automated cash management accounting across entities and diversified investments to maximize efficiency while maintaining required buffers and financial stability.

Forecasting liquidity 12-24 months out ensures capital is available when obligations or opportunities arise.

Standardize Reporting for Principals, the Next Generation, and Advisors

Different family members need different levels of detail, but most families either overwhelm everyone with institutional-grade reports or provide such high-level summaries that nobody can make informed decisions.

Here's a basic reporting structure:

- Principals (Generation 1): Past performance analytics, risk metrics, and strategic financial support

- Next Generation: Portfolio overviews with educational context and involvement opportunities

- Advisory Team: Detailed operational data for implementation and compliance

How to implement it:

- Standardized benchmarks across all asset classes

- Consistent foreign exchange treatment and materiality thresholds

- Clear documentation of data sources and valuation policies

- Mobile-accessible dashboards for quick reference

Performance monitoring systems that provide real-time access to appropriately detailed information help keep everyone engaged without overwhelming them with unnecessary complexity.

Make Financial Education a Standing Priority

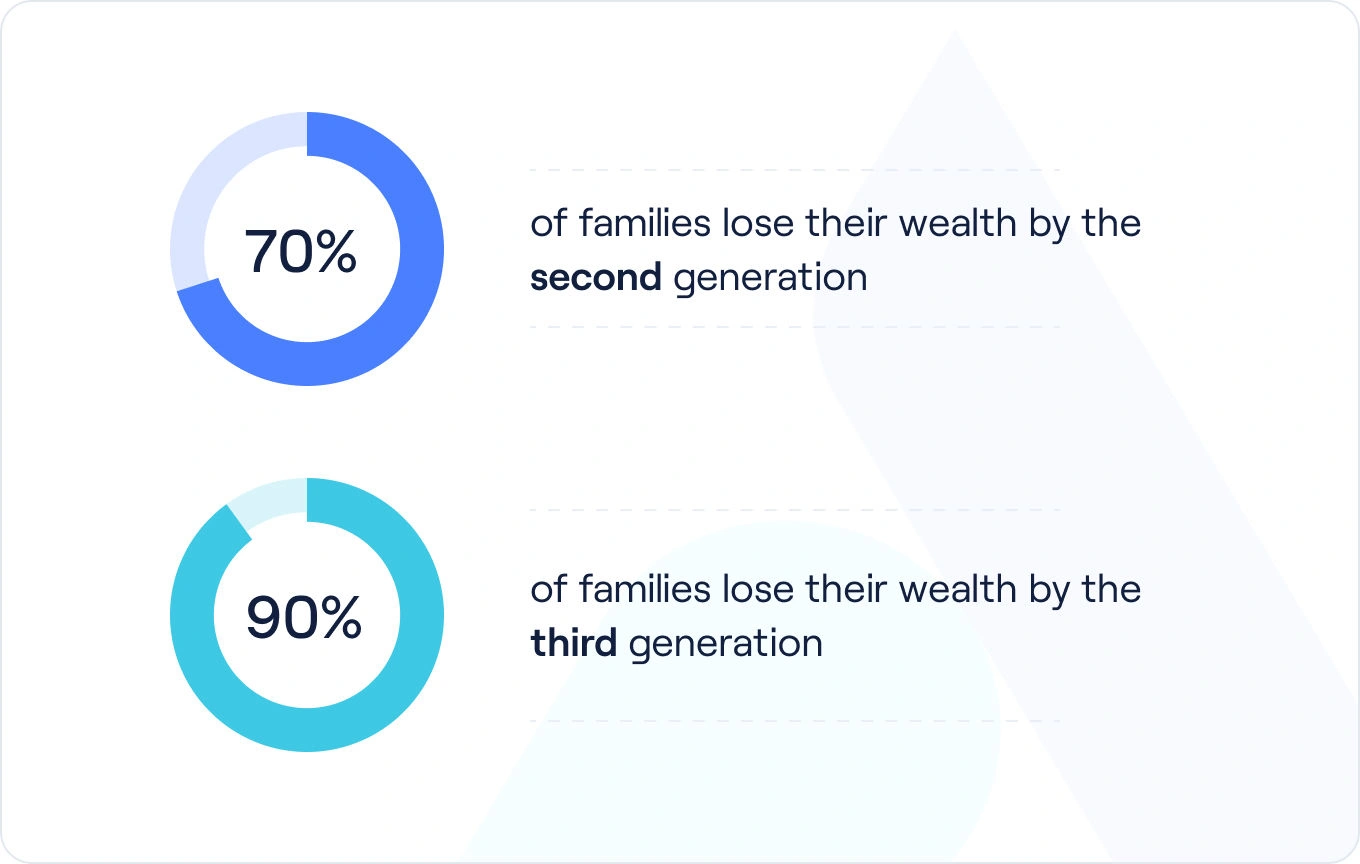

The statistics on generational wealth loss are sobering. According to a Williams Group study, roughly 70% of families lose their wealth by the second generation, and 90% by the third. Poor preparation of future generations is often the culprit behind failed succession planning, especially when it comes to inheriting wealth, highlighting the importance of multigenerational wealth planning that fosters open communication and prioritizes financial education.

Structure a financial literacy program for them (because this is the largest wealth transfer). It might look something like this:

- Q1: Portfolio fundamentals and family investment philosophy

- Q2: Investments deep dive with current examples and tax laws

- Q3: Governance, philanthropy, and family dynamics

- Q4: Global markets and economic trends impact

Have older generations pair education and financial understanding with real decisions (for better financial responsibility). When evaluating a new private equity commitment, include younger generation members in due diligence discussions about financial assets. When reviewing asset allocation, explain the financial wisdom behind rebalancing decisions.

Provide financial support and role-specific dashboards through mobile platforms that let younger family members engage with their own wealth information at their comfort level.

Align Estate Structures with Investment Strategy

Too many families have trust documents written decades ago that don't match their current investment approach or family circumstances. This creates friction that reduces returns and increases administrative burden. Families need a regular structure review process.

How to implement it:

- Compare establishing trust investment powers against the current alternative investment strategy

- Evaluate distribution policies against family liquidity needs, estate taxes, and tax strategy planning

- Review fiduciary arrangements against family governance evolution

- Document all structural decisions with wealth advisor sign-offs for financial future reference

When trust terms enable rather than constrain your investment strategy, the entire family benefits from better returns and reduced operational complexity.

Develop Impact Investing and Philanthropy with Real Accountability

Most wealthy families want their charitable giving to reflect their values and create measurable impact, but they often lack systematic approaches to track outcomes and integrate philanthropic goals with overall financial planning. Families need a structured approach.

How to implement it:

- Define clear objectives and success metrics for philanthropic activities

- Set allocation guidelines that balance impact goals with financial returns

- Track commitments and outcomes alongside traditional portfolio performance

- Report results annually to the family council with specific examples and money lessons learned

The key is treating philanthropy with the same analytical rigor you apply to other investments while maintaining focus on financial goals, family values alignment, and family engagement.

Automate Operational Processes to Reduce Errors and Delays

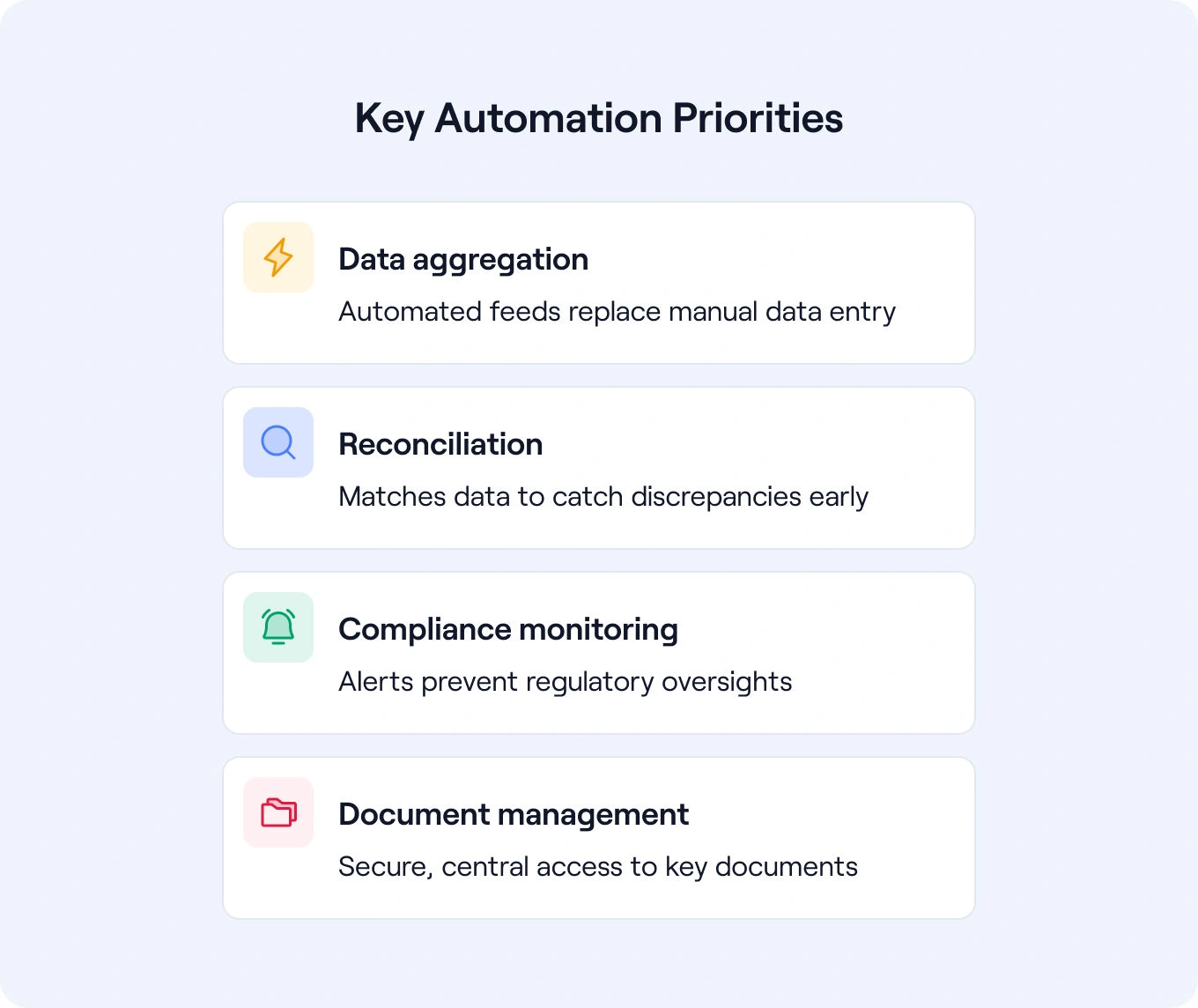

Manual consolidation of financial data across multiple entities, custodians, and asset classes creates opportunities for errors while consuming enormous amounts of time that could be better spent on strategy and family engagement.

Here's what to prioritize:

- Data aggregation: Automated bank and custodian feeds eliminate manual data entry while improving the accuracy and timeliness of reporting.

- Reconciliation: Systematic matching of positions and financial transactions across entities reduces the risk of overlooked discrepancies that can compound over time.

- Compliance monitoring: Automated alerts for regulatory requirements, reporting deadlines, and concentration limits help prevent costly oversights.

- Document management: Centralized document storage with access controls ensures critical information is available when needed while maintaining appropriate privacy and security.

Families who invest in operational automation find they can focus more time on building a solid foundation for strategic decisions and family dynamics rather than administrative tasks.

Implement Enterprise-Grade Security on a Regular Schedule

Family financial information is particularly attractive to bad actors, and the reputational and financial damage from security breaches can be devastating across future generations. Families need to put security and privacy on a formal schedule.

How to implement it:

- Access management: Role-based permissions ensure family members and advisors can access appropriate information without compromising sensitive data.

- Regular security reviews: Quarterly access log reviews and annual security training for family and staff help maintain awareness and identify potential vulnerabilities.

- Incident response planning: Clear procedures for responding to potential security breaches minimize damage and ensure appropriate notification of relevant parties.

- Vendor security assessment: Regular evaluation of service providers' security practices ensures your family's data protection standards are maintained across all relationships.

Real-World Outcomes from Modernizing Family Operations

The difference between theoretical planning and practical implementation becomes clear when you look at families who have successfully modernized their operations.

- Omnia Capital Partners eliminated weeks of manual reporting processes by implementing automated data aggregation and centralized document management. They now have a single source of truth for all client assets and have reduced email-based file sharing by over 50%.

- Capstone Family Office transformed its reporting from a days-long process to under 10 minutes using modern wealth management technology. This improvement enables faster, more informed decision-making while freeing up time for strategic advisory activities and family engagement.

Request a demo to see how modern family office technology can help you build a family's financial legacy and support your multigenerational wealth planning objectives.

Build Systems That Serve Multiple Generations

Successful generational wealth planning requires balancing three elements: clear governance, automated reporting, and technology that integrates across banks and entities. The families who maintain and grow family wealth across generations aren't necessarily smarter or luckier than others. They've built sustainable systems that adapt to shifting market and economic conditions, evolving family dynamics, and new regulatory requirements. These systems preserve the family's legacy, ensure a secure financial future, and maintain effective wealth management without losing sight of core objectives.

For families ready to move beyond traditional approaches to generational wealth planning, schedule a personalized demo to see how purpose-built family office technology can support long-term family wealth planning objectives.

FAQs

What is generational wealth planning, and how is it different from estate planning?

Generational wealth planning is the full system for maintaining and growing wealth across multiple generations—covering governance, operations, education, and family dynamics. Estate planning focuses mainly on tax-efficient transfer at death, while generational planning addresses the whole lifecycle of multi-generational wealth management.

How much structure is enough for a multi-entity UHNW family?

The right amount of structure gives clarity without bureaucracy. Most successful families use formal governance documents, regular family meetings, clear investment policies, and defined roles—while avoiding over-engineered systems that are burdensome to maintain.

How do we prepare future family members without overwhelming them?

Start with age-appropriate involvement and increase responsibility gradually. Prioritise open communication, provide practical financial literacy tied to real situations, offer role-specific access to information, and pair rising members with mentors or advisors.

What tools help track alternatives, beneficiaries, and reporting across entities?

Purpose-built family office platforms offer automated data aggregation, visual ownership mapping, and role-based reporting across entities. Choose technology designed specifically for multi-entity family office operations rather than repurposed institutional systems.

.png)

.png)

.png)

.png)