Automate your family office

Schedule DemoFounded in 2024, Capstone Family Office delivers tailored services to high-net-worth individuals and families across Scotland and the UK. They act as a central point of coordination that brings together each client’s existing network of advisers, including legal, tax, and wealth professionals, to develop a cohesive, long-term strategy.

Before adopting Asora, the office used spreadsheets and generic tools to manage wealth data, including cash accounts, savings, and insurance policies. These manual processes were time-consuming, error-prone, and led to growing concerns about data privacy and security.

Capstone needed a platform that could centralise wealth data, improve visibility, and enhance operational efficiency while addressing the growing risks of unsecured, siloed systems.

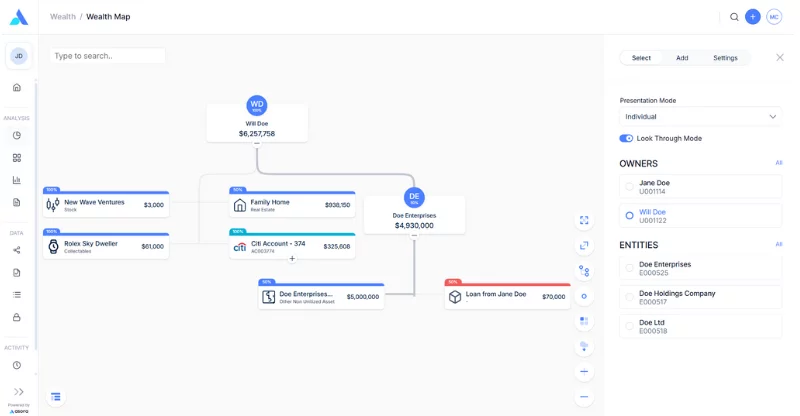

Wealth Map used to track total wealth across individuals, trusts, and companies

Reporting time reduced from days to less than 10 minutes

To tackle the challenges faced, Capstone needed a secure solution that could give them a consolidated view of their client’s entire wealth position.

They needed a platform that was intuitive for both their team and clients, and made wealth data easy to explore.

User experience and ease of navigation for both the team and clients were a must-have. Additionally, the ability to store a vast amount of their data, including various legal and financial documents, was also an important feature.

What Capstone liked about Asora was that it met all their key criteria (wealth consolidation, security, and ease of use), with the simplicity they were looking for.

The onboarding process was smooth and well-structured, with weekly walkthroughs and training sessions that helped the team feel comfortable and confident using the system. The Asora team was always responsive, readily available for last-minute questions or quick calls.

Asora’s Wealth Map plays a central role in both day-to-day monitoring and client meetings. Previously, creating asset overviews meant hours spent consolidating spreadsheets. Now, Capstone can instantly visualise asset allocation and performance, making meetings more dynamic and informed. Family office meetings now run more smoothly, with easier access to accurate information. The ability to see assets held by different individuals, companies and trusts is very valuable.

The time saved has allowed for quicker identification of risks and opportunities, and faster decision-making overall.

One of the most immediate changes was the significant reduction in time spent on reporting. What used to take hours or days is now done in minutes, freeing up valuable time for other analysis and strategic planning. The team and clients now get a clear overview, which was more difficult to see before Asora was implemented.

Donald advises other family offices starting their digital transformation not to wait too long to modernise. As technology becomes increasingly powerful, the longer you rely on manual processes and generic tools, the more time and accuracy you lose and the harder it becomes to scale or respond quickly to changes.

He recommends identifying pain points, be it reporting delays or data fragmentation, and choosing platforms that directly address those challenges.

Asora has become a core part of Capstone’s operations, enabling better visibility, faster and secure reporting, and a more strategic approach to managing client wealth. With plans to onboard more clients, Capstone views Asora as a trusted partner in delivering a modern and scalable family office experience.

.png)

.png)

.png)

.png)

.png)

.png)