Automate your family office

Schedule DemoAfter the passing of the family patriarch, the Tan family set up theirfamily office but faced various challenges with multi-jurisdictional assets and bank accounts. After a few years of going through the probate process invarious countries, the second generation decided that they required a clear and centralized data management information system to move forward with their legacy planning and portfolio management.

Asora, focused on family offices, understood their goals and helped them to move all the various data from multiple data sources into a single source of truth. This allowed the family members to have on-demand access to key information across the stakeholders, portfolios and assets across the globe.

Omnia Capital Partners is an investment-led multi family office based in Sydney, that was set up in 2019. Like most family offices, they dealt with multiple custodians, asset classes, currencies, and tax jurisdictions. The Australian market lacked a solution that could easily merge custodial information with anything that was non-custodial or directly held by their clients.

Reporting for clients required significant manual work, collecting and manipulating data from various sources in order to create a static PDF report. The report took about three weeks to prepare, with the risk that the information was outdated. Omnia CP were looking for a solution that would help them consolidate all their clients’ wealth and offer a single source of truth with reporting on demand.

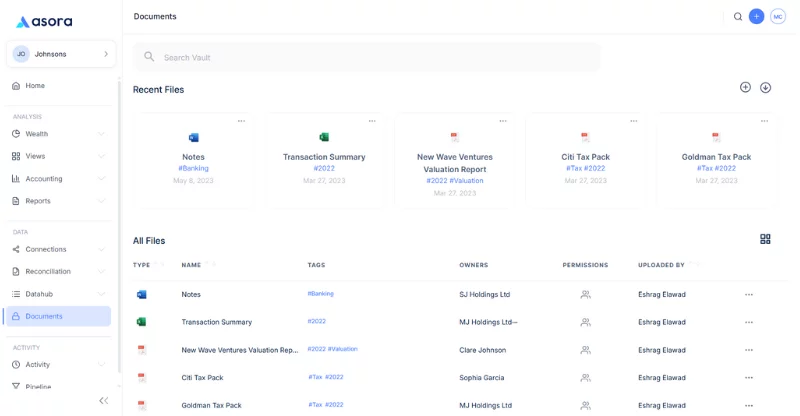

Reduced files being sent through email by over 50%

Single source of truth for client wealth

Omnia CP initially used their custodian to do total wealth reporting but found that it was overly restrictive for non-custodial assets. There were challenges in managing non-AUD assets and pricing private assets. It also didn’t have a way to capture documents or unstructured data such as notes against an asset.

The firm looked at both new and established products. Often the new products were still in the beta stage; while established products would over-encumber them with unwanted features and functionality.

Having looked at a broad suite of solutions, Omnia CP decided to go with Asora as it offered the features they needed to help enhance their clients’ experience but with an easy to use, modern interface.

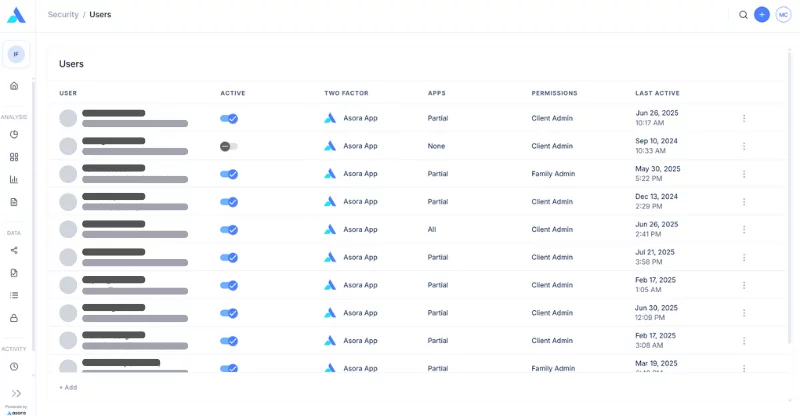

Asora’s security is one of its biggest strengths – the platform is ISO27001 certified and GDPR compliant. As well as their wealth data, Aora provides a single secure location for all the family’s documents through an encrypted vault. This avoids the emailing of sensitive information, reducing the risk of phishing, email hacking and other cyber threats.

Asora also helped them automate data aggregation and data cleansing, enabling them to provide clients with accurate real-time data.

Asora is easy to implement, with a modular rollout – they have been able to roll out the secure document management feature first, followed by others. From an implementation and advisor usability perspective, Asora provided Omnia CP with comprehensive support.

They’ve reduced files being sent through email by over 50%, with a target to get that close to zero.

Omnia CP believes family offices need a strategy for the secure sharing of data with owners.

The next generation is more tech-savvy and is looking for solutions that remove the burden of paperwork and administration – they seek engagement through web and mobile rather than PDFs.

Moving to new software can be intimidating, as family offices anticipate time and resource constraints. They found that having a phased rollout of the platform made it easier for the customers to adopt the platform and smoother for them to operate.

Omnia CP like that they are working with a company where the product is continuing to grow and develop and where they have a say in the product roadmap.

They are excited about what future innovation in the product will bring and their ability to engage the next generation with a modern digital experience.

.png)

.png)

.png)

.png)

.png)