TL;DR

Private equity portfolio software helps single family offices track commitments, capital calls, distributions, and valuations without rebuilding spreadsheets. The right platform handles PE alongside total wealth (including banks, entities, documents, and reporting), so principals and advisors work from a single, live record. This guide compares 9 solutions that support private capital workflows, entity look-through, and on-demand reporting for modern family offices, showcasing innovation while emphasizing the importance of data management, which provides a single source of truth.

Why This Guide Matters

Private equity investments generate more data than most family offices can track manually. Commitments turn into capital calls, distributions arrive without warning, and quarterly valuations sit in PDFs across email threads.

When your office manages PE alongside marketable securities, real estate, and operating entities, spreadsheets quickly become outdated. Portfolio management software consolidates that chaos into a single system, where capital flows, performance metrics, and ownership structures remain current without requiring daily reconciliation.

Below, we’ll review 9 solutions built to handle private capital workflows for single family offices, showcasing innovation.

What Counts as Private Equity Portfolio Management (for SFOs)

Private equity portfolio management for family offices encompasses five operational layers, driven by technology.

- Cashflow lifecycle

- Commitments: Maintain current unfunded amounts by fund/vehicle; capture commitment dates, terms, and pacing assumptions.

- Capital Calls: Log calls on receipt with due dates, FX (if applicable), fees, and the exact allocation across entities.

- Distributions: Record cash and in-kind distributions, carried interest, fees, and return of capital; tie each movement back to the relevant deal, vintage, and entity.

- Valuation and performance

- Valuation cadence: Apply quarterly (or policy-defined) fair value marks with methodology notes and approval history.

- Metrics: Track IRR (deal and portfolio), TWR (periodic), MOIC/TVPI/DPI, as well as benchmark or vintage-year cohorts where relevant.

- Data hygiene: Separate book values from fair values; preserve lot/tranche detail to maintain accurate gains/losses, taxes, and waterfalls.

- Ownership and entities.

- Structure mapping: Show how trusts, SPVs, holding companies, and operating businesses roll up to the family members and the office’s legal entities.

Look-through: Attribute exposures, cashflows, and performance to ultimate beneficial owners while retaining intermediate-entity records for tax and governance.

- Structure mapping: Show how trusts, SPVs, holding companies, and operating businesses roll up to the family members and the office’s legal entities.

- Documents in context

- Source of truth: Store LPAs, side letters, subscription docs, capital call notices, distribution statements, and valuations alongside the asset or entity record they support.

- Retrievability: Use consistent tagging (e.g., fund, deal, vintage, entity, counterparty) so that documents can be resolved directly from the position or transaction being reviewed.

- Reporting

- Audience-specific outputs: Produce principal-level summaries (clear exposure, recent movements, performance vs. goals) and advisor/ops drill-downs (cashflows, lots, fees, notes).

- Live layouts: Build reports based on the live data model, allowing quarterly packs to update without rebuilding. This feature also enables filters by entity, geography, sector, vintage, and manager.

How We Picked (Buyer Criteria)

We evaluated private equity portfolio monitoring tools on seven factors that matter to single family offices, including metrics for assessing investment performance :

- Reconciliation and exceptions: Automated flagging of mismatches between custodian feeds and internal records.

- Private assets depth: Support for commitments, capital calls, performance monitoring, distributions, valuations, IRR, TWR, and MOIC.

- Entity look-through: Multi-entity transparency without hard-coded tabs or manual cascade logic.

- Documents in context: Evidence bound to each capital event or valuation update.

- Reporting speed: Executive and internal stakeholder packs generated in minutes from live data, with PDF export when needed.

- Security: Role-based permissions, encryption at rest and in transit, two-factor authentication.

- SFO fit: Fast onboarding, modern UX, mobile access, right-sized pricing for lean teams.

And, ultimately, portfolio monitoring tools for private equity need to make managing your wealth easier (not more complicated), supporting informed decision-making.

The 9 Private Equity Portfolio Management Software (2025)

1. Asora (Editor’s choice)

Asora is a family office software that tracks private equity alongside liquid accounts, real estate, and operating entities on a single platform. It handles commitments, capital calls, distributions, and quarterly valuations while linking documents to each record.

Who Uses It: Single family offices with $100M–$1B in assets, typically managing 5–50 entities and a mix of private and public investments, as well as any firm looking to optimize their portfolio management.

Key Features:

- Data Aggregation with custodian feeds and manual asset entry

- Private Assets tracking for private equity and venture capital firms (VC), real estate, and direct investments

- Performance Monitoring with IRR, TWR, and MOIC calculations

- Accounting for tranche-level cost basis and gains/losses

- Documents vault with secure upload links and custom tags

- Workflows for task assignment and pipeline tracking

- Wealth Map for entity look-through

- iOS and Android mobile apps for on-the-go access

Pricing: Tier-based, starting at $900/month, with optional add-ons for additional custodian accounts and alternative data ingestion.

2. Private Wealth Systems

Private Wealth Systems offers portfolio management software designed for family offices and wealth managers. The private equity software solution handles private assets, public securities, and alternative investments with consolidated reporting.

Who Uses It: Single and multi-family offices with complex trust and estate structures alongside investments.

Key Features:

- Multi-asset investment accounting ledger

- Consolidated reporting across asset classes and currencies

- Performance data reconciliation and validation

- Customizable reporting dashboards

- Fiduciary accounting and beneficiary reporting

- Multi-generational wealth tracking

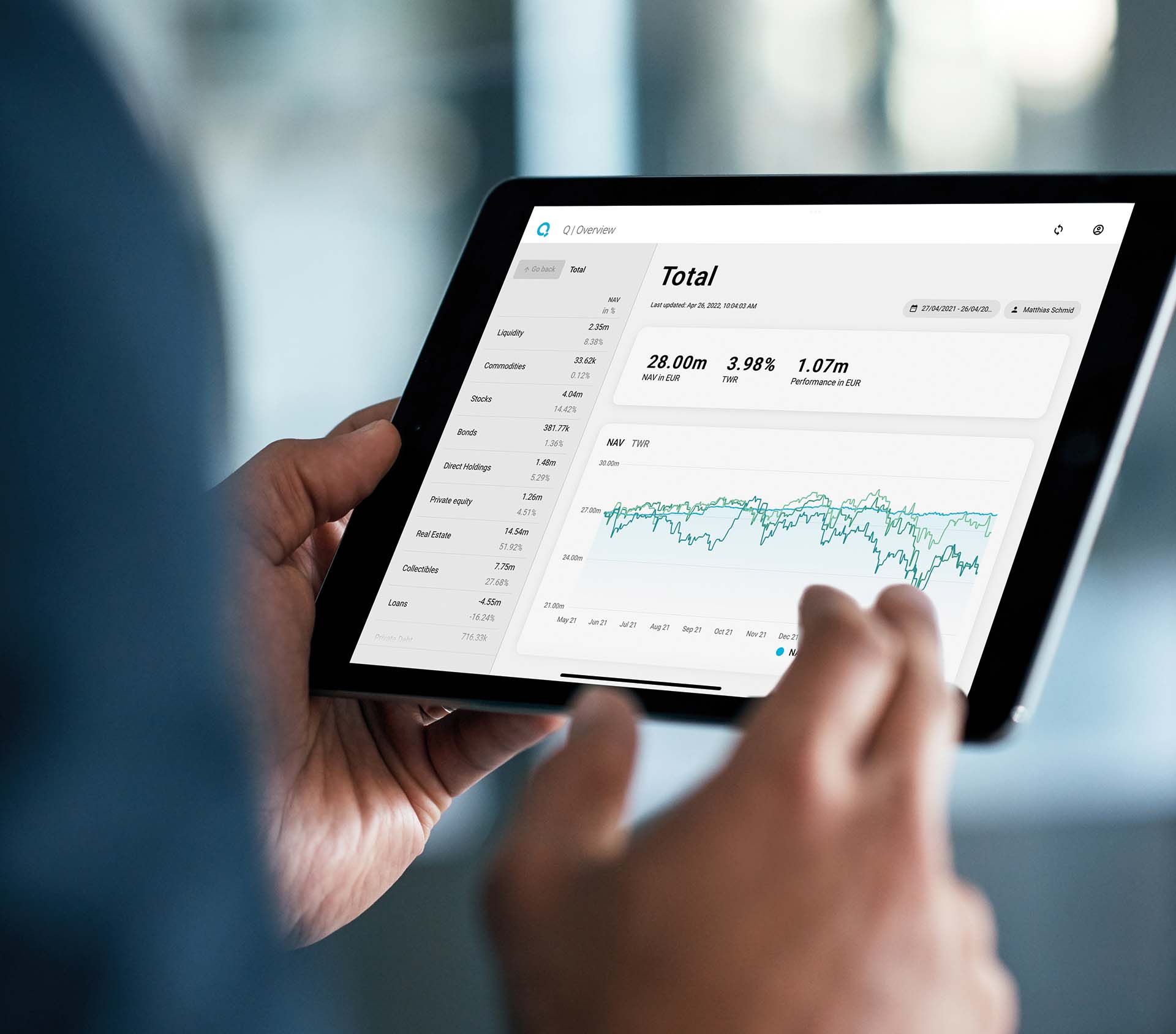

3. QPLIX

QPLIX is a wealth management platform focused on data aggregation and portfolio analysis. It supports private banking relationships and multi-currency portfolios.

Who Uses It: European family offices and private banks managing cross-border wealth with complex currency needs.

Key Features:

- Multi-currency portfolio tracking (160+ currencies)

- Trading & rebalancing capabilities

- Consolidated reporting across liquid and illiquid assets

- Real-time portfolio analytics

- Web portal and mobile app access

- ESG rating integration

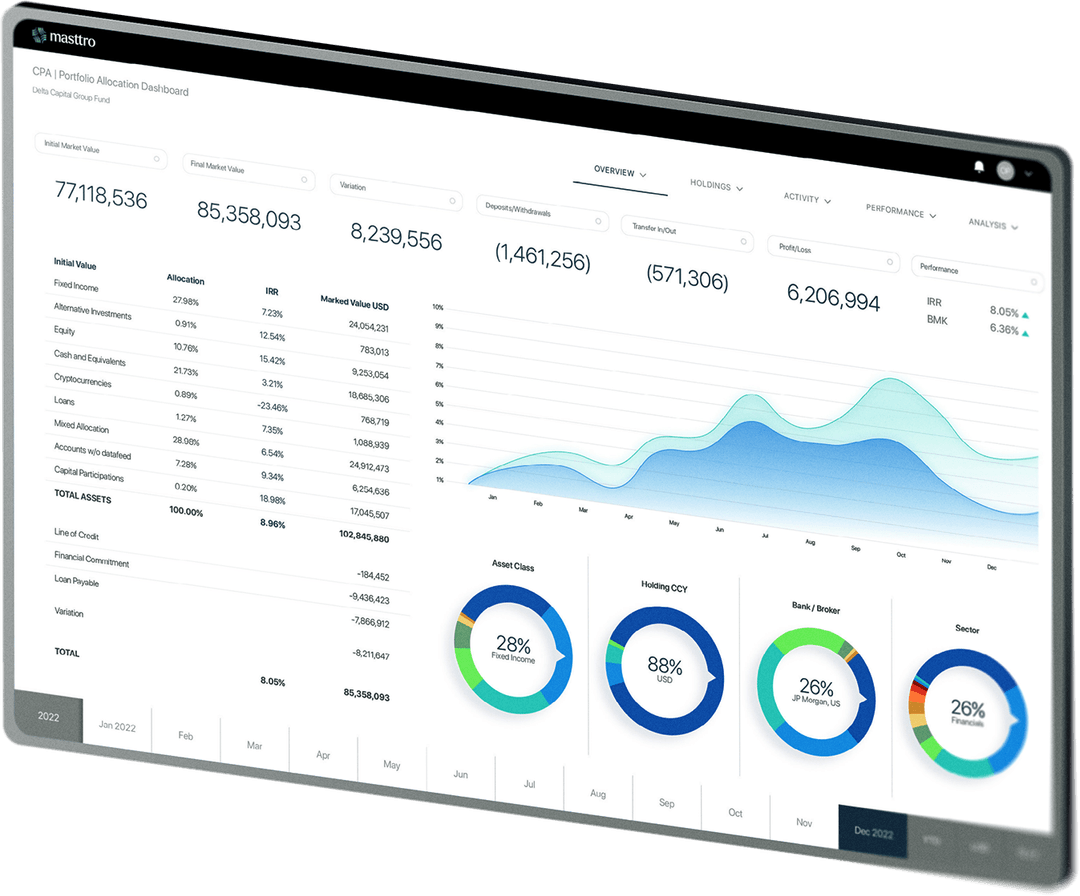

4. Masttro

Masttro provides comprehensive wealth management software for family offices, offering data aggregation, AI-powered automation, and customized reporting across all asset classes.

Who Uses It: Single and multi-family offices, wealth managers, operating partners, and professional service firms managing complex portfolios with alternative investments.

Key Features:

- Direct custodian feeds for automated data aggregation

- AI-powered document ingestion for capital calls, distributions, and statements

- Custom dashboards and portfolio visualization

- Multi-currency support for aggregation and reporting

- Document vault with automated alternative investment data processing

- Task management and workflow tools

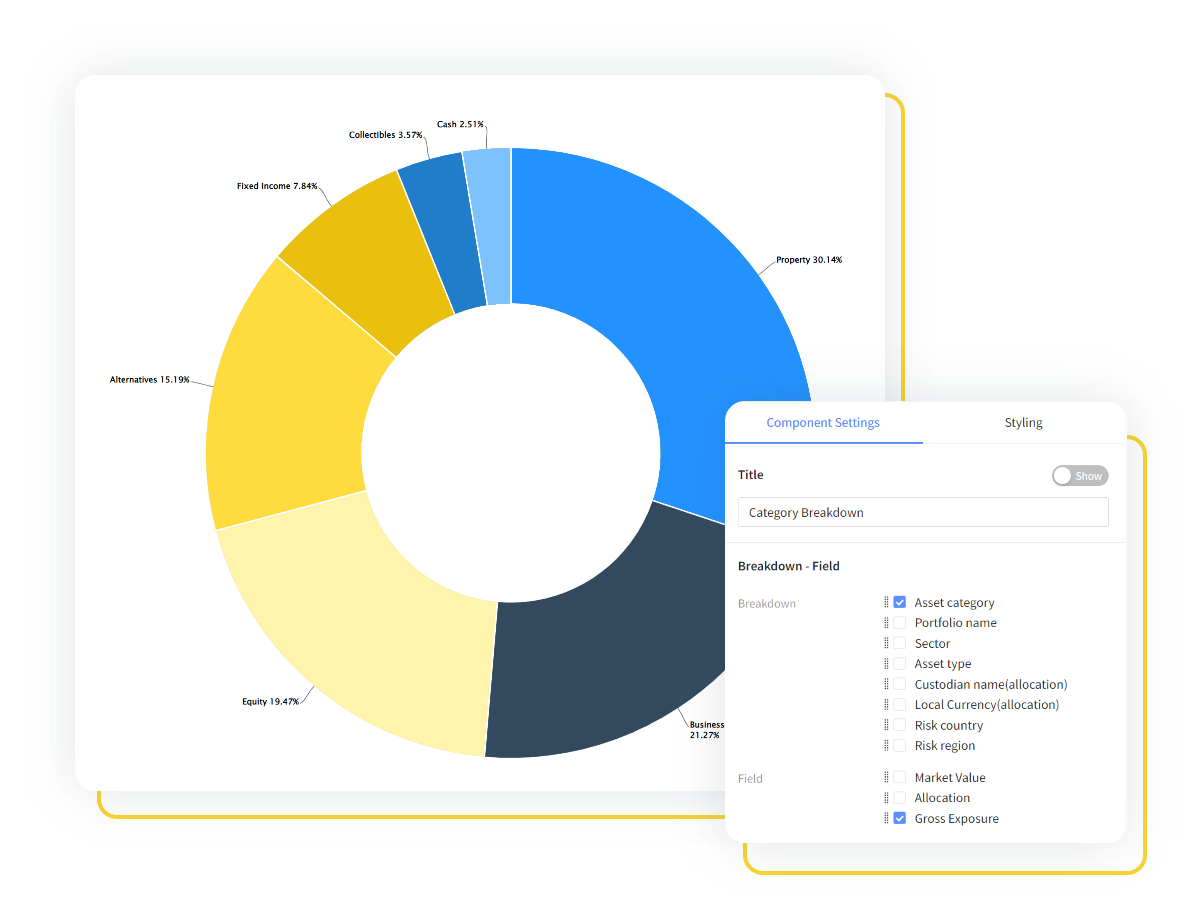

5. Landytech

Landytech offers investment management software for asset managers, family offices, and private banks. The platform handles alternative investments alongside traditional portfolios with a European regulatory focus.

Who Uses It: Family offices, asset managers, and private banks with significant alternative investment allocations and regulatory compliance needs.

Key Features:

- Portfolio performance measurement and risk exposure, and analytics

- Regulatory reporting for European jurisdictions

- Multi-currency capabilities

- AI-driven document ingestion capabilities

- Integrated compliance monitoring

6. Black Diamond (SS&C)

Black Diamond by SS&C Technologies serves RIAs, broker-dealers, and family offices with comprehensive portfolio management and reporting solutions. It integrates with custodians and handles a diverse range of asset classes, offering trading capabilities.

Who Uses It: Wealth management firms, RIAs, and family offices with extensive custodian relationships and trading needs.

Key Features:

- Strong custodian integrations

- Portfolio rebalancing tools

- Performance reporting and analytics

- Client portal for investor access

- Integrated trading capabilities

- Billing and fee management

7. Asset Vantage

Asset Vantage provides investment management software for family offices, fund administrators, and asset managers. The platform handles complex entity structures and alternative investments, featuring robust accounting capabilities.

Who Uses It: Single and multi-family offices managing complex entity structures, funds, and direct investments requiring detailed accounting.

Key Features:

- Entity and fund accounting

- Alternative investment support

- Consolidated reporting across structures

- Workflow management tools

- Multi-currency capabilities

- Fund administration functionality

8. Copia Wealth Studios

Copia Wealth Studios offers cloud-based portfolio management for family offices and wealth advisors. The platform combines portfolio tracking with collaboration tools for advisor-client communication.

Who Uses It: Smaller to mid-sized family offices seeking cloud-based solutions with strong advisor collaboration and client communication features.

Key Features:

- Cloud-based portfolio tracking

- Collaboration tools for advisors and clients

- Performance reporting and analytics

- AI-assisted document ingestion and organisation

- Client communication features

- Workflow tools for managing repetitive tasks

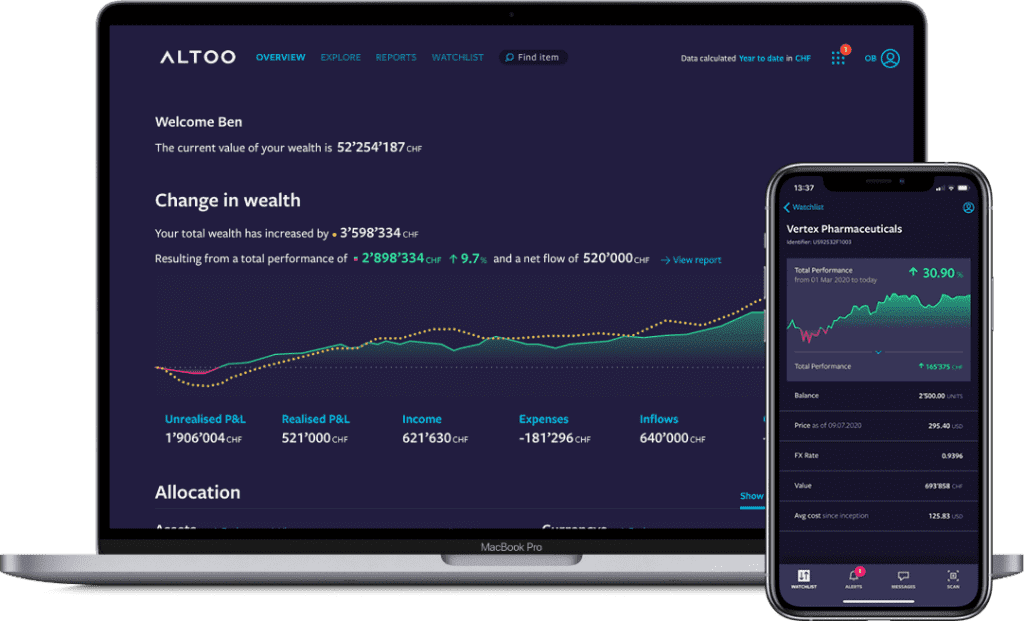

9. Altoo

Altoo is a Swiss wealth management platform designed for ultra-high-net-worth individuals and family offices. It aggregates wealth data with a strong focus on privacy and security.

Who Uses It: UHNW individuals and European family offices prioritizing data privacy and security.

Key Features:

- Secure wealth aggregation across multiple banks

- Multi-bank connectivity

- Portfolio overview dashboard

- Document vault with encryption

- Multi-currency support

*All images from company websites, social media, or created for illustration.

Pick PE Software That Works for a Modern SFO

Private equity data lives across PDFs, portals, and spreadsheets. Single family offices need one system that handles commitments, capital calls, distributions, and valuations while generating clean reports in minutes.

Prioritize platforms that offer automated data capture, entity look-through, documents in context, and executive packs without rebuilds. Choose software that manages PE alongside total wealth and investment strategies so principals and advisors work from a single live record.

Request an Asora demo to validate the end-to-end speed, accuracy, and usability of our solution for your office.

FAQs

Which private equity portfolio management software is best for SFOs?

Asora works well for single family offices managing PE alongside total wealth because it tracks commitments, capital calls, distributions, and valuations while also enhancing investor relations through linking documents to each record. The platform handles entity look-through, private credit, and generates reports in minutes without requiring the rebuilding of layouts. Other strong options include Masttro for larger offices and Private Wealth Systems for mid-market needs.

What must-have features should PE portfolio software include?

Private equity portfolio monitoring software should accurately and efficiently handle unfunded commitments, capital calls, distributions, and quarterly valuations throughout the entire fund lifecycle . Look for IRR and TWR calculations, MOIC tracking, vintage year tags, and tools for fund performance reporting to benchmark performance across various investments. Document management tied to capital events matters, as does entity look-through across trusts and SPVs. Reconciliation tools that flag exceptions automatically save time during quarter-end close.

Does it support entity look-through for trusts, SPVs, and holdcos?

Most platforms designed for family offices support entity structures, but implementation varies. Asora’s Wealth Map shows ownership connections without hard-coded tabs. Verify that the platform can show ultimate beneficial ownership across multiple layers without manual cascade logic before committing.

How fast are executive reports?

Report generation speed depends on whether the platform retrieves data from live sources or requires batch processing. Asora typically generates executive packs in minutes from current records. Some platforms may require overnight processing for complex portfolios. Ask during demos how long it takes to produce a board-ready report from the moment you log in.

How are data aggregation, reconciliation, and security handled?

Look for platforms that automate data aggregation through custodian feeds and automatically flag reconciliation exceptions, eliminating the need for manual review. Security should include encryption at rest and in transit, two-factor authentication, and role-based permissions, while also enhancing data management by leveraging business intelligence to improve security measures. Asora is ISO 27001 certified and GDPR compliant. Verify that any platform you consider meets your office’s compliance requirements before implementation.