Automate your family office

Schedule DemoHeading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

TL;DR

Modern family offices need investment management software that goes beyond spreadsheets and generic wealth platforms. The best solutions automate data aggregation, provide real-time reporting, handle private and public assets, and are easy for both families and teams to use – without requiring dedicated IT. Asora is the editor’s pick for its automation, reporting, intuitive design, and fast onboarding, but this guide reviews 15 top platforms so you can find the best fit for your family office’s needs.

Some family offices and UHNWIs think “investment management software” means Bloomberg terminals and complex trading algorithms. Fortunately, it’s a lot more simple (and practical) than that.

Family office investment management software isn’t about executing trades or managing other people’s money. It’s about getting a clear view of where your wealth actually is and how it’s performing. It’s figuring out whether your private equity investments are performing or quietly bleeding cash, or being able to answer “what’s our net worth?” without spending the afternoon in Excel building custom reports.

For family office technology, investment management software means platforms that aggregate, track, and report on public, private, and alternative investments across multiple entities and custodians. And it has the family office data, reporting, and security features that single-family offices actually need. This is different from portfolio management software (which focuses more on construction and analytics) and wealth management platforms (which are often too broad or retail-focused), though there’s definitely overlap—which is why you might see platforms like Asora on multiple “recommended” lists.

The complexity of modern family office investing software demands better tools than spreadsheets. This guide breaks down 15 recommended investment management software platforms for family offices that actually understand what family offices need: oversight, automation, and ease of use.

Why the Right Investment Management Software Matters in 2025

Today’s ultra-high-net-worth families manage more than just stocks and bonds. They’re juggling:

- Private equity commitments

- Direct real estate deals

- Venture capital investments

- Operating companies

And these are spread across dozens of legal entities in multiple currencies.

According to the Family Office Operational Excellence Report 2024, roughly 40% of family offices are still managing this complexity with spreadsheets. That’s families with hundreds of millions in personal assets manually tracking everything in Excel.

Once, automation, compliance monitoring, real-time visibility, and operational efficiency were just nice-to-haves, but now they’re downright essential. When investment opportunities move at digital speed and regulatory requirements keep expanding, operating with manual processes is like bringing a calculator to a data science competition.

It’s more than inefficient—it’s actively putting your wealth strategy at risk.

Simply put: modern family offices need modern tools.

Key Features Family Offices Should Prioritize

Not every family office software investment management platform understands what family offices actually need. Here are the features that separate useful tools from expensive distractions:

- Data aggregation: Your platform should automatically pull from banks, custodians, and investment accounts across multiple currencies without you having to initiate the process.

- Real-time performance reporting: You need IRR and MOIC calculations for private investments alongside traditional metrics for liquid holdings. Dashboards should give you both the big picture and granular details.

- Alternative and private asset tracking: The platform should handle capital calls, distributions, and document management for private equity, real estate, and direct investments.

- Ownership visualisation: Your software needs to understand complex ownership structures, partnership accounting, and look-through reporting.

- Workflow management and audit trails: Family offices have deadlines, compliance requirements, and multiple stakeholders. Your family office investment platform should automate routine tasks and keep detailed records of who did what, when.

- Customizable roles and reporting views: Principals want high-level summaries, while operations teams need transaction details. Your platform should accommodate both without overwhelming either user.

- Security and compliance: Bank-level encryption, multi-factor authentication, and granular access controls should be standard (not premium features).

- Integration capabilities: Your investment platform should integrate smoothly with your existing accounting tools, banking systems, and custodian feeds without any custom development.

- Scalable support and onboarding: Look for providers that offer hands-on implementation and ongoing support. Family office teams are lean. You need partners instead of vendors.

14 Investment Management Software for Family Offices to Choose from in 2025

1. Asora (Editor’s Choice)

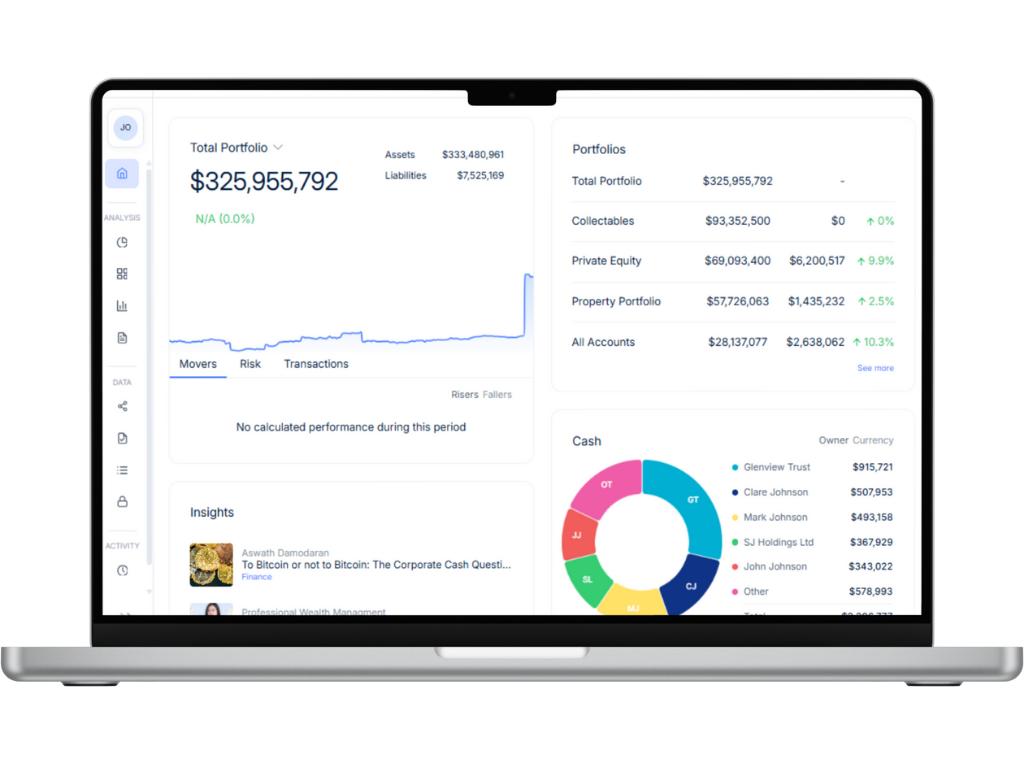

Asora is designed for single and multi-family offices managing $30M-$1B+ in assets that want comprehensive investment oversight without institutional complexity. It’s the perfect fit for family offices modernizing from manual processes while maintaining flexibility.

Features:

- Automated financial data aggregation across banks, custodians, and alternatives

- Real-time performance tracking with IRR, TWR, and MOIC calculations

- Alternative asset management for private equity, real estate, and direct deals

- Ownership visualisation with look-through capabilities

- Secure document vault with workflow support

- Mobile access on iOS and Android

Pricing: Starting at $900/month, scaling with portfolio size. Includes unlimited users, bank integrations, and all Asora features.

2. Altoo

Altoo serves European family offices and UHNW individuals with experienced investment management across multiple jurisdictions. It focuses on comprehensive wealth consolidation with strong regulatory compliance for international structures.

Features:

- Multi-bank and investment platform aggregation

- Comprehensive performance analytics and reporting operations

- Alternative investment tracking with valuation management

- Multi-currency accounting and reporting

- Secure investment document management

- Risk management and allocation monitoring

3. Copia Wealth Studios

Copia Wealth Studios combines investment tracking with artificial intelligence to automate a lot of the manual work that slows down family office operations. The platform works for tech-forward families who want to eliminate repetitive data entry and document processing.

Features:

- Automated document processing using AI for investment statements

- Investment portfolio aggregation across multiple account types

- Private investment tracking with automated capital call processing

- Comprehensive reporting suite with customizable views

- Secure collaboration tools for family and wealth advisor teams

- Multi-entity investment accounting and tax preparation support

4. Masttro

Masttro targets family offices looking for complete investment management features (with emphasis on alternatives and complex reporting). It’s designed for sophisticated investors that need detailed analytics across diverse asset classes.

Features:

- Multi-custodian investment data aggregation

- Advanced alternative investment tracking and analytics

- Customizable reporting and dashboard creation

- Multi-entity accounting with complex ownership structures

- Investment document management and workflow automation

- Integration capabilities with family office investment accounting software

5. Landytech

Landytech brings European expertise to investment management by offering family offices comprehensive oversight tools designed for complex international investment structures and regulatory requirements.

Features:

- Global investment portfolio consolidation across jurisdictions

- Multi-currency investment accounting and performance measurement

- Regulatory compliance monitoring for international investments

- Alternative investment valuation and reporting tools

- Risk management analytics and stress testing capabilities

- Integration with European banking and custody systems

6. Black Diamond (SS&C)

Black Diamond serves RIAs, multi-family offices, and wealth management firms requiring investment management with integrated billing and client reporting. It’s suited for organizations needing both investment oversight and client relationship management.

Features:

- Portfolio management and rebalancing tools

- Comprehensive performance reporting and analytics

- Client portal with investment reporting

- Automated billing and fee calculation

- Custodian integrations and trade order management

- Risk analysis and CRM integration

7. Burgiss

Burgiss (now part of MSCI) is great at private markets intelligence and analytics. It serves family offices that need smart portfolio oversight of their alternative investment portfolios. The platform is a good fit for families with substantial private equity, venture capital, and real estate allocations (requiring institutional-grade analysis).

Features:

- Private markets database with comprehensive benchmarking data

- Investment performance analytics specifically for illiquid assets

- Capital commitment and cash flow forecasting tools

- Manager due diligence and research capabilities

- Risk assessment tools for private market investments

- Portfolio allocation and construction analytics

8. d1g1t

d1g1t offers cloud-based software for investment management. It combines portfolio monitoring and performance measurement within a single system, making it suitable for mid-sized family offices that want institutional-quality capabilities in an accessible format.

Features:

- Real-time investment portfolio monitoring and analytics

- Integrated alternative investment tracking and valuation tools

- Customizable investment reporting with visual dashboards

- Multi-custodian account aggregation and reconciliation

- Risk monitoring and compliance oversight tools

- Secure client portal for family member access

9. Dynamo

Dynamo focuses on the operational side of alternative investments by helping family offices manage the entire lifecycle of private market commitments—from initial due diligence through final distributions.

Features:

- Complete alternative investment operations management

- Due diligence workflow automation and document organization

- Capital call tracking with automated notification systems

- Distribution processing and tax document management

- Investment committee reporting and decision tracking

- Relationship management for wealth managers and co-investors

10. Private Wealth Systems

Private Wealth Systems caters to family offices managing complex trust and estate structures alongside their investment portfolios. The platform integrates investment oversight with fiduciary responsibilities and beneficiary reporting requirements.

Features:

- Trust-aware investment tracking with beneficiary-level reporting

- Fiduciary accounting integration for trust and estate management

- Multi-generational investment performance tracking and analysis

- Beneficiary portal access with appropriate privacy controls

- Estate planning integration with investment allocation modeling

- Compliance monitoring for fiduciary investment responsibilities

11. Osyte

Osyte streamlines operations for family offices that want to eliminate administrative bottlenecks while maintaining oversight of their investment portfolios. The investment software for family offices focuses on workflow efficiency and private data accuracy.

Features:

- Streamlined investment data collection and validation processes

- Performance measurement across liquid and illiquid asset classes

- Investment committee preparation and reporting automation

- Document organization with automated filing and retrieval

- Family member access controls with customized view permissions

- Integration capabilities with existing accounting and tax systems

12. QPLIX

QPLIX delivers institutional-quality investment analytics to family offices that need advanced performance measurement and risk assessment features that are typically only available to large asset managers and pension funds.

Features:

- Advanced performance attribution analysis across asset classes

- Comprehensive risk measurement including factor exposure analysis

- Stress testing and scenario modeling for investment portfolios

- Custom benchmark creation and performance comparison tools

- Regulatory reporting automation for complex investment structures

- API connectivity for integration with external pdata sources

13. Venn by Two Sigma

Venn by Two Sigma brings quantitative hedge fund sophistication to family office investment software. It offers advanced modeling and analytics capabilities powered by institutional-grade digital infrastructure.

Features:

- Quantitative factor analysis and risk decomposition tools

- Advanced portfolio optimization using machine learning algorithms

- Comprehensive stress testing with Monte Carlo simulation capabilities

- Alternative data integration for enhanced investment insights

- Custom research and analytics development platform

- Real-time risk monitoring with automated alert systems

14. Solovis

Solovis (acquired by Nasdaq) transforms how family offices approach private market investing by providing end-to-end operational support from initial sourcing through final exit. Its primary focus is in fund-of-funds management.

Features:

- End-to-end private investment lifecycle management

- Sophisticated cash flow modeling for capital planning purposes

- Investment sourcing and opportunity tracking systems

- Performance benchmarking against private market indices

- Automated data capture and processing capabilities

- Investor reporting automation for family investment vehicles

How to Choose the Right Investment Management Software

Choosing investment management software for your family office isn’t like picking a CRM or accounting system. You’re dealing with complex structures, significant assets, and family dynamics that generic business software simply doesn’t understand.

Ask these questions before you commit:

- Does it handle your specific mix of liquid and illiquid investments without forcing workarounds?

- Can it track multi-entity ownership structures and provide both consolidated and entity-level views?

- Will it integrate with your existing custodians, banks, and accounting systems without requiring expensive custom development?

- How long will implementation actually take, and what kind of ongoing support do you get?

Family office teams are lean. You need partners who understand your operational reality rather than vendors who disappear after the sale.

Enterprise buyers care about user scalability and complex permissions, but family offices need intuitive interfaces that principals can actually use, mobile access for family members, and the ability to generate reports that make sense to non-investment professionals.

The right platform should feel like it was built specifically for families managing wealth instead of rough adaptations from traditional institutional software.

Common Challenges for Family Offices (and How Software Solves Them)

Even experienced family offices struggle with operational challenges that eat up time, create unnecessary risks, and prevent them from focusing on what actually matters: making informed investment decisions and serving the family’s long-term interests:

- Manual data compilation and error-prone processes: Family office teams spend hours downloading statements, reconciling accounts, and building consolidated reports in Excel. Modern platforms automate data aggregation and flag discrepancies immediately (eliminating manual errors and freeing up time for portfolio analysis).

- Private investment tracking issues: Capital calls, K-1s, and distribution notices arrive as PDFs that need to be manually processed. Investment management software (with AI document processing) automatically pulls key data and updates portfolio records.

- Fragmented technology creating blind spots: You lose the big picture when investment data lives in one system, accounting in another, and documents are scattered across email. Integrated platforms provide a single source of truth across all financial activities.

- User adoption barriers with complex systems: If the platform requires extensive training or feels intimidating to non-technical staff, it won’t get used (or won’t get used well). Family-focused software prioritizes intuitive design that works for everyone from principals to operations staff.

Conclusion: Why Investment Management Technology is a Strategic Advantage

Investment management technology helps you maintain control over your family’s financial future. You don’t have the time (or risk tolerance) to gamble with manual data entry and Excel spreadsheets. Modern family offices need real-time visibility, automated compliance, and the ability to make informed decisions quickly.

Asora delivers exactly that: purpose-built software that handles the complexity of family office investing without requiring an IT department to manage it.

Stop managing generational wealth with spreadsheets and start making decisions with current, accurate data.

Request a personalized demo to see how Asora can transform your family office operations.

FAQs about Investment Management Software for Family Offices

What is investment management software for family offices?

Specialized platforms that aggregate, track, and report on investments across multiple entities, custodians, and asset classes. They focus on oversight and operational efficiency for family wealth structures.

How is it different from general wealth management platforms?

The right family office software handles complex multi-entity structures, private investments, and family-specific reporting needs that retail platforms can't manage. It's built for operational teams instead of individual investors.

Can these tools handle private equity, real estate, and direct deals?

Yes, leading platforms track capital calls, distributions, valuations, and document management for illiquid investments alongside traditional assets.

How do I evaluate pricing?

Look beyond monthly fees. Consider implementation costs, training time, and ongoing support. Fixed-fee models often provide better value than AUM-based pricing for family offices.

Is it worth switching if we already use Excel?

Absolutely. Family offices see up to 60% time savings and eliminate costly manual errors within months of switching to dedicated software.