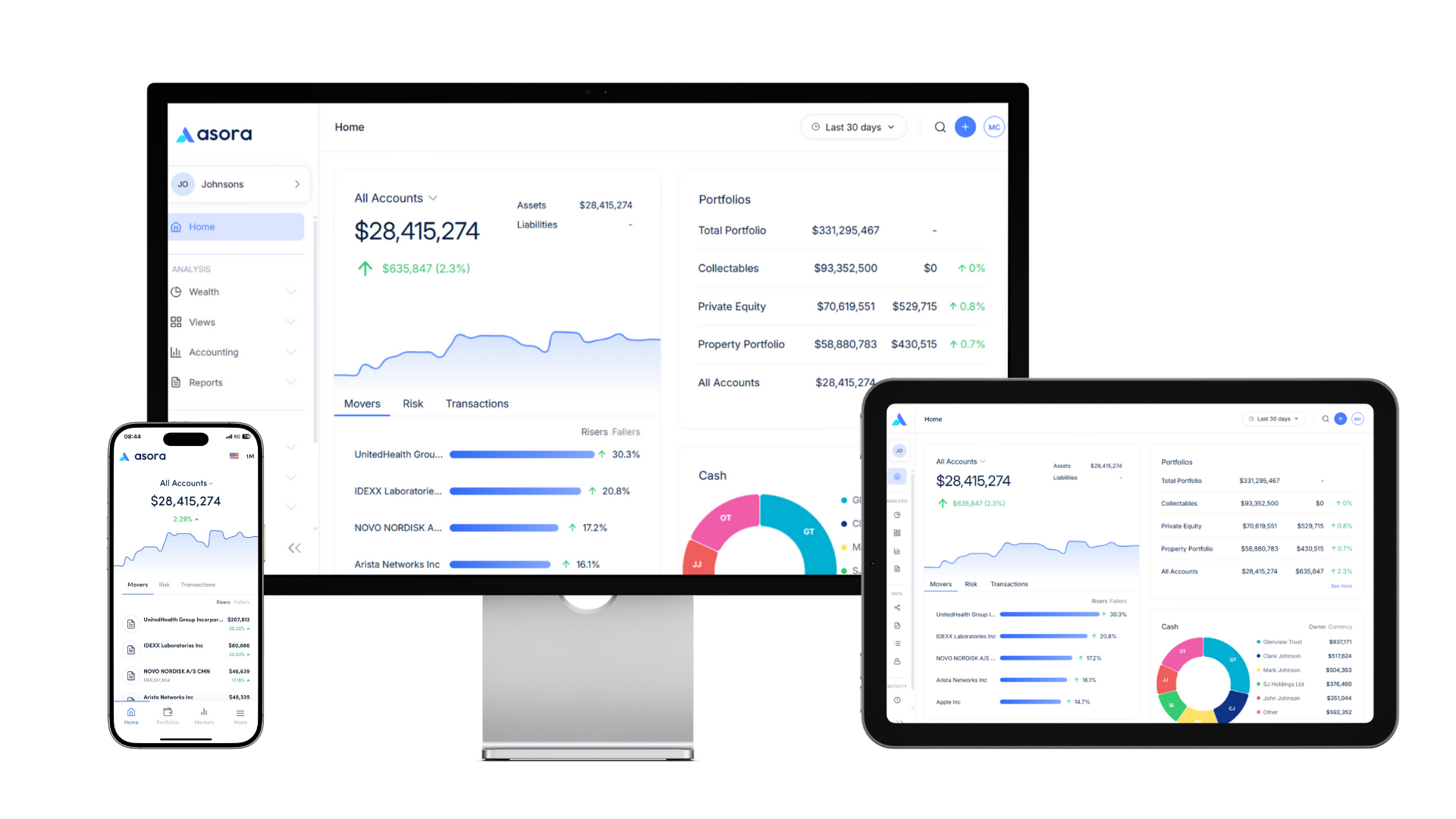

Automate your family office

Schedule DemoHeading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Wealth Preservation and the Role of Family Offices

Wealth preservation is a fundamental concern for high-net-worth individuals and families. It involves not only growing assets, but also safeguarding them for future generations. In this pursuit, family offices have emerged as invaluable tools for managing and protecting substantial wealth. This blog post explores the essential role that family offices play in wealth preservation.

What is a Family Office?

A family office is a private organisation established to manage the financial and personal affairs of affluent families. These offices provide comprehensive services that include investment management, tax planning, estate planning, philanthropic endeavours, and lifestyle management. The primary objective of a family office is to help preserve and grow the family’s wealth over generations.

Family Office Software: A Modern Necessity

In the modern era, technology has transformed how family offices operate and strengthened their ability to preserve wealth. Family office software streamlines financial data, administrative tasks, and portfolio management, while supporting risk assessment, regulatory compliance, and secure communication. It also helps document estate plans and enables smoother wealth transfer across generations.

As a scalable tool, family office software empowers stronger oversight and continuity, supporting long-term wealth preservation and helping families secure a lasting financial legacy.

The Wealth Preservation Triad

- Investment Management

One of the core functions of a family office is managing investments. Wealthy families often have diverse portfolios that include stocks, bonds, real estate, private equity, and other assets. Family offices employ skilled professionals who create customised investment strategies tailored to the family’s financial goals and risk tolerance. These professionals continuously monitor portfolio performance, making adjustments as needed to preserve and grow wealth. - Estate Planning

Proper estate planning is critical for wealth preservation. Family offices work closely with estate planning attorneys to develop strategies that minimise estate taxes and ensure a seamless transfer of assets to the next generation. This can include setting up trusts, gifting strategies, and structures such as family limited partnerships (FLPs) or family limited liability companies (LLCs) to protect assets from creditors and lawsuits. - Tax Planning

Wealthy individuals and families often face complex tax issues. Family offices have tax experts who devise strategies to minimise tax liabilities while complying with changing tax laws. They explore various avenues, such as tax-efficient investment structures, charitable giving, and offshore accounts, to optimise tax outcomes and preserve wealth.

The Benefits of Family Offices in Wealth Preservation

- Customised Solutions

Every family’s financial situation is unique. Family offices provide tailored solutions aligned with the family’s specific goals, values, and circumstances. This level of personalisation is often not available through traditional wealth management services. - Expertise

Family offices employ a team of skilled professionals, including investment analysts, estate planners, tax experts, and legal advisors. This interdisciplinary approach ensures that all aspects of wealth preservation are addressed comprehensively. - Risk Management

Wealth preservation involves not only growing assets but also safeguarding them from risk. Family offices manage risk by diversifying investments to reduce exposure to market volatility and by implementing asset protection strategies to shield wealth from potential threats. - Long-Term Focus

Unlike many traditional financial institutions, family offices take a long-term perspective. They are dedicated to preserving wealth for future generations and prioritise strategies that support the family’s financial well-being for decades to come. - Confidentiality

Family offices prioritise discretion and confidentiality. Wealthy families often value privacy, and family offices are well-equipped to maintain strict confidentiality while managing their financial affairs.

Challenges of Establishing a Family Office

While family offices offer significant benefits, they are not without challenges:

- Cost

Establishing and maintaining a family office can be expensive. Costs include hiring specialised professionals, office space, technology, and administrative expenses. However, many families consider these costs a worthwhile investment in wealth preservation. - Complexity

Running a family office requires a deep understanding of financial markets, tax regulations, and legal matters. Coordinating the various aspects of wealth preservation can be intricate and time-consuming. - Regulatory Compliance

Family offices must adhere to regulatory requirements, which may vary by jurisdiction. Staying compliant with evolving financial regulations can be a significant undertaking.

Wealth Preservation Reinvented: The Family Office Advantage

Wealth preservation is a paramount concern for high-net-worth individuals and families who want long-term financial security for their descendants. Family offices play a pivotal role in this endeavour by offering personalised, expert guidance in investment management, estate planning, and tax optimisation.

While the establishment and ongoing operation of a family office may come with challenges, the benefits of safeguarding and growing wealth across generations often outweigh the costs. In an ever-changing financial landscape, family offices remain indispensable partners in preserving wealth for the future.

About Asora

Asora is a SaaS solution for single and multi-family offices to track and oversee assets, automate data capture, and provide digital on-demand reporting across web and mobile. Time-consuming manual data handling and report creation are replaced with automated data feeds, comprehensive data cleansing and enrichment, and digital on-demand reporting.

To learn more, schedule a demo with us.