Automate your family office

Schedule DemoHeading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

TL;DR

Real estate investments for family offices can offer tangible collateral, potential income, and diversification benefits. Outcomes depend on asset type, leverage, lease terms, liquidity needs, and local market dynamics.. Whether through direct ownership, private funds, or joint ventures, real estate offers family offices portfolio diversification and structures that can support multi-generational stewardship.

Why Real Estate Belongs in Family Offices

Real estate is a common allocation for many family offices, particularly those seeking income, diversification, and long-term capital preservation. Public markets are abstract, but real estate provides tangible assets families can see, touch, and pass down through multiple generations. It may generate rental income and may appreciate over time. Tax outcomes and diversification benefits vary by jurisdiction, structure (direct vs fund vs REIT), and market conditions.

But real estate investing for family offices looks very different from how individual investors buy property. Family offices often structure ownership to align with succession goals, governance, and tax rules in the relevant jurisdiction (estate/inheritance tax, capital gains, income tax, transfer taxes).

Below, we’ll walk through how family offices approach real estate strategy, the investment structures they use, and the technology that makes managing real estate holdings efficient.

Why Family Offices Invest in Real Estate

Real estate checks several boxes that matter to wealthy families thinking about generational wealth planning:

- Potential steady cash flow: Commercial real estate and residential properties can generate income, but direct ownership typically requires active oversight (or outsourced management), and net cash flow can be uneven due to vacancies, capital expenditures, and financing costs.

- Capital appreciation over long horizons is possible: While rental income covers immediate needs, property values typically increase over time, building wealth for future generations. However, over long horizons, some real estate markets have delivered appreciation, but outcomes vary widely by location, asset quality, leverage, and cycle timing.

- Tax efficiency: Real estate can offer tax benefits, subject to local law. Common examples include deductions or allowances for operating costs and depreciation or capital allowances; possible deferral or rollover of gains when reinvesting in qualifying property; and place-based or sector-specific incentives offered by some governments. Availability and impact vary by country, region, and entity type, so confirm rules with a local advisor.

- Inflation hedge: Real estate can offer some inflation resilience, but outcomes depend on context. Rents may keep pace where leases have indexation or scheduled escalators and demand is stable, and replacement costs can support values in supply-constrained markets. Offsetting forces include higher interest rates and cap rates, rising operating and capital costs, and weak local demand. Results vary by property type, lease length, leverage, and market conditions, and may differ from fixed-income assets with predictable coupons.

- Portfolio diversification: Real estate can diversify, but results depend on the vehicle and cycle. Listed REITs often track equities; private assets can look steadier, mainly due to appraisal lags. Any benefit comes from rent and local supply–demand drivers and may fade during rate shocks or broad selloffs.

- Tangible security: During market volatility, families appreciate owning real assets rather than just financial instruments. Property provides psychological comfort alongside financial returns.

- Generational transfer: Real estate can be incorporated into succession plans using structures such as holding companies, partnerships, foundations, or (where permitted) trusts. These can support staged transfers, potential tax or probate efficiencies, and continuity, but “control” depends on the governing documents, fiduciary duties, and local law. Outcomes vary by jurisdiction and entity type; seek local legal and tax advice.

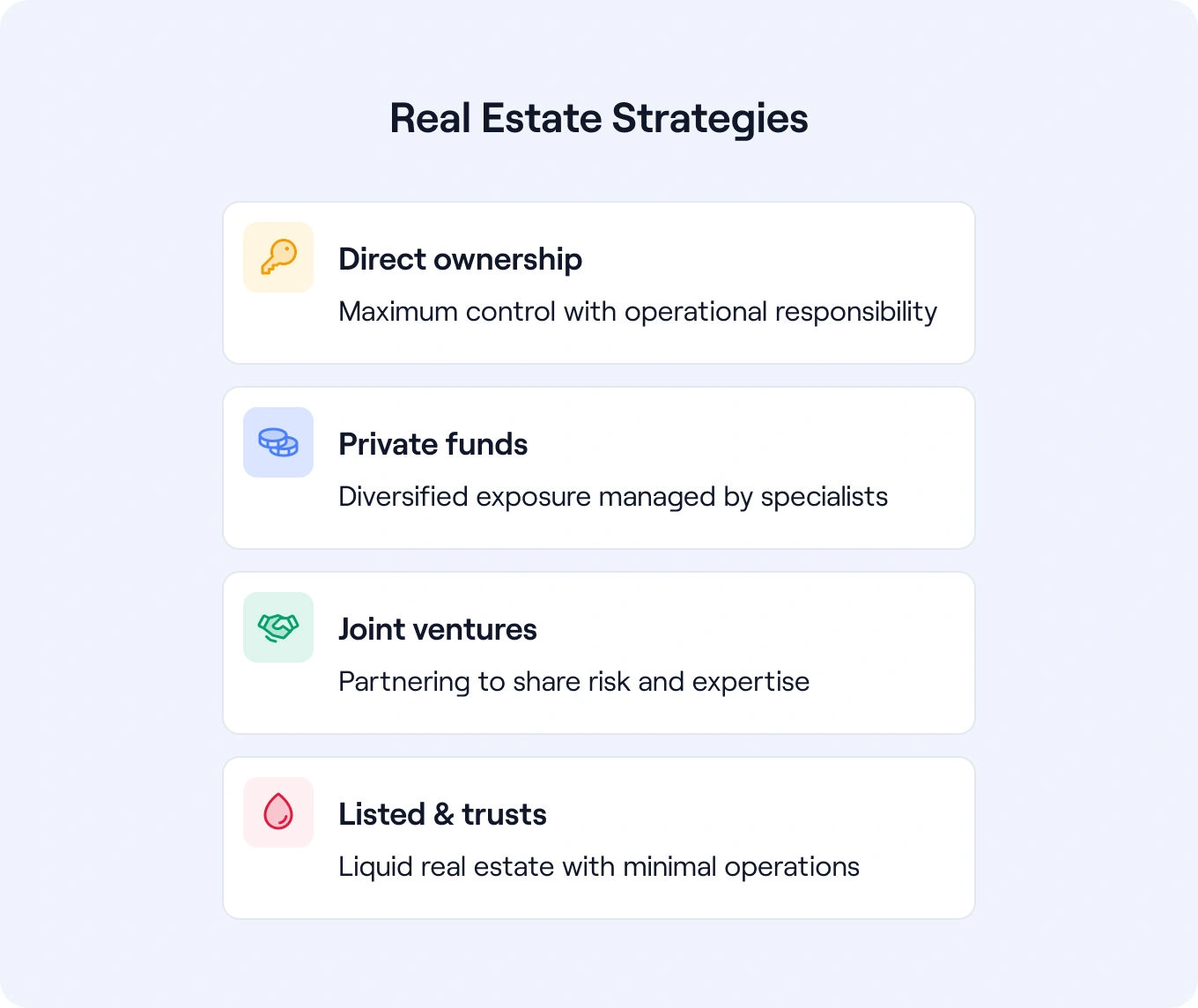

Real Estate Investment Strategies for Family Offices

Most family offices pursue real estate through one or more of these approaches:

1. Direct Ownership

Many families prefer direct exposure to property, office, residential, or other commercial assets, often held through SPVs (LLCs/LPs/companies) and sometimes with leverage, rather than via pooled funds or external intermediaries.

Benefits of direct ownership:

- Complete control over property management and strategic decisions

- Greater control than commingled funds, though day-to-day operations are often delegated to professional property managers

- Flexibility to hold assets indefinitely with patient capital

- Tax outcomes depend on entity type, investor tax status, local rules, and cross-border holdings. Fund structures can be tax-efficient too

- Properties become part of the family legacy and identity

Challenges:

- Requires substantial capital for each acquisition

- Demands expertise in property management, tenant relations, and maintenance

- Less diversification than fund approaches

- Potential concentration risk if holdings are geographically concentrated

Families pursuing direct investments need three clear functions working in sync:

- asset management to set and execute the asset-level strategy and business plan

- portfolio management to govern allocation, risk, and liquidity

- property management to run day-to-day operations and leasing

Who does what and where it sits:

- typically outsource property management to local specialists

- lead asset management in-house (augment with sector or project advisors as needed)

- keep portfolio management in-house under the CIO/CFO (optionally supported by an OCIO for public markets).

2. Real Estate Private Funds

Private funds often pool capital from multiple investors to acquire real estate portfolios. However, family offices also deploy capital through single-investor funds, separately managed accounts (SMAs)/managed accounts, separate accounts, club deals, and co-investments, structures that are not pooled and can be tailored for tighter control, bespoke fees, governance rights, and reporting.

These include core funds focused on stable-income properties, value-add funds that improve underperforming assets, and opportunistic investments that target higher returns through development or repositioning.

Why family offices invest through funds:

- Professional management by firms with proven track records

- Diversification across multiple properties, markets, and property types

- Access to deal flow and expertise beyond family office capabilities

- Reduces operational burden vs direct ownership, but still requires manager oversight, cash management (capital calls/distributions), valuation monitoring, and reporting reconciliation

- Ability to invest across different risk tolerance levels

Private markets offer family offices access to professional sourcing and operations without building a full in-house acquisition and operating platform.

3. Joint Ventures and Co-Investments

Many family offices partner with operating partners, developers, or other family offices on specific deals. These joint ventures combine capital while sharing expertise and risk.

Build in safeguards:

- spell out governance (what counts as a “Major Decision,” approval thresholds, leasing parameters, financing/refi rules)

- economics (promote/waterfall mechanics, hurdle rates, fee types, and caps)

- guarantees (carve-outs, completion or repayment obligation,s and limits)

- exit rights (ROFR/ROFO, buy-sell, drag/tag, forced sal,e and timing)

- capital calls with default remedies (cure periods, dilution formulas, loan-at-interest, or forced transfer).

Joint venture advantages:

- Access to larger deals than the family could pursue alone

- Learning opportunities from experienced partners

- Shared risk on complex developments or opportunistic investments

- Relationship building within the family office community

- Flexibility to structure deals around specific investment objectives

The partnership model works well in real estate for single-family offices seeking selective direct exposure without full operational responsibility. But single family offices vs multiple family offices isn’t the deciding factor. Many MFOs also co-invest. What matters more are internal capability, speed to execute, ticket size, and risk appetite.

4. Listed & Trust Structures (REITs, DSTs, and local equivalents)

While most family offices favour private ownership or specialist funds, some allocate to publicly traded REITs for liquidity or to trust-like vehicles for tax and administrative advantages. DSTs are US-specific (primarily for 1031 exchanges to defer capital gains while avoiding property management). Families may also use private REITs, interval funds, and listed property companies as lower-touch complements to private holdings.

When they make sense:

- REITs (public or private): provide liquid or semi-liquid real estate exposure; useful during portfolio transitions, rebalancing, or when building/maintaining sector tilts.

- DSTs (US only): suitable for 1031 exchanges when deferring gains and offloading operational responsibility.

- Local equivalents: UK REITs and PAIFs; S-REITs (Singapore); A-REITs (Australia); Canadian REITs; and listed property companies in Europe/Asia offer similar exposure with minimal day-to-day management.

Allocation note: sizing varies by mandate, liquidity needs, and conviction. In many portfolios, listed real estate serves as a liquid complement to direct investments and private funds, and is often a smaller allocation than core private holdings.

How Real Estate Fits Different Family Office Portfolios

Real estate investment for multi-family offices and real estate investment for single-family offices follow similar principles but differ in execution:

Execution depends more on internal capability and operating model than on SFO vs MFO labels. Some SFOs outsource heavily; some MFOs run specialist real estate teams. When families have (or assemble) the right bench and patient capital, they may pursue direct ownership, acquiring and holding assets through cycles, integrating them into governance and succession plans, and, at times, making properties part of family identity (e.g., the original headquarters or a training asset for next-gen managers).

Multi-family-offices may use funds, separate accounts, and co-investments to fit different client constraints; some also source direct deals.

Both structures benefit from strong stakeholder reporting (family members, trustees, investment committees), and consistent data/reconciliation and reporting across diverse real estate holdings.

Tax Strategies for Real Estate Investments

This section is informational only and not tax advice. Outcomes vary by jurisdiction and structure; consult qualified advisors.

The tax characteristics of real estate can improve after-tax outcomes, but they’re not guaranteed. Benefits vary by jurisdiction, structure, holding period, and investor profile, and may be offset by fees, leverage limits, depreciation recapture, and compliance complexity. Framing: “potential tax efficiency with trade-offs,” not “automatic tax advantage.”

- Depreciation (where permitted) can reduce taxable income; rules and potential recapture differ by jurisdiction and structure.

- 1031 exchanges: When selling property, families can defer capital gains taxes by reinvesting proceeds in similar real estate within specific timeframes. This allows wealth to compound tax-deferred across multiple generations. Keep in mind, this is US only.

- Stepped-up basis: When property passes to heirs at death, the cost basis is stepped up to the property's current market value, eliminating capital gains taxes accumulated during the deceased's ownership. Keep in mind, this is US only.

- US-only: Opportunity Zone: Outcomes depend on eligibility, compliance, and holding periods.

- Estate tax minimization: With qualified tax and legal advice, families may use structures (e.g., trusts, LLCs/LPs) to facilitate intergenerational transfers of real estate. Any potential valuation discounts are jurisdiction-specific, fact-dependent, and subject to regulator scrutiny; outcomes vary and must be supported by independent appraisals and robust documentation. This is not tax advice.

Tax efficiency distinguishes sophisticated family office real estate strategy from individual investor approaches. Most family offices work with specialized tax advisors to structure ownership for maximum tax benefits while maintaining operational flexibility.

Technology for Managing Real Estate Holdings

As family offices accumulate real estate across different structures, e.g., direct holdings, private funds, joint ventures, tracking performance becomes complex. Family office software can improve consolidation of information across all real estate investments and reduce manual effort, providing unified visibility that manual methods can't match. However, completeness depends on data sources (custodians, administrators, property managers, fund reports) and reconciliation processes.

Key capabilities for real estate management:

- Consolidated tracking: Asora's platform tracks both direct property ownership and fund investments in one place, showing total real estate exposure across the family office portfolio.

- Performance monitoring: You can compare returns across properties, funds, and strategies by recording cash flows as transaction types (income, expenses, capital calls/distributions, valuations). These roll up into portfolio performance (e.g., TWR/IRR/MOIC). Note: Asora does not have a dedicated real estate dashboard; rental cash flows are captured under income rather than a separate “rental income” module. For private funds, IRR/MOIC are computed from capital calls and distributions; for direct holdings, performance reflects total return from income plus valuation changes. Operational KPIs (occupancy, arrears, OPEX per sq ft) are typically tracked in your property management system and referenced alongside Asora’s performance view.

- Document organization: Documents centralize lease agreements, property valuations, partnership agreements, and capital call notices, eliminating the chaos of scattered files.

- Ownership mapping: Visualize complex ownership structures showing which entities own which properties and how they relate to family trusts and estate planning structures.

This consolidated view helps families make strategic decisions: Is our real estate allocation too concentrated geographically? Are our commercial real estate holdings generating stable income as expected? Should we rebalance toward residential real estate?

Build a Reliable Real Estate Strategy

Families considering real estate investments should start by answering several questions:

- What role should real estate play? Are you seeking stable income, capital appreciation, tax benefits, or diversification? Different strategies serve different objectives.

- How much capital can you commit? Direct ownership typically requires sufficient scale to justify oversight. Smaller allocations are often implemented via funds or listed vehicles.

- What's your risk tolerance? Core strategies generally target lower risk and steadier income profiles, but returns and stability depend on market conditions and underwriting. Opportunistic investments aim for higher returns, with the corresponding risk.

- Do you want operational involvement? Direct ownership offers control but demands expertise. Funds provide professional management with less family involvement.

- How does real estate fit into estate planning? Consider how property transfers to future generations and integrate them with broader tax strategies.

The answers guide whether families pursue direct ownership, private funds, or a combination approach.

Schedule a demo with Asora to see how we consolidate direct holdings, fund investments, and complex ownership structures into one secure platform with timely reporting.

FAQs: Real Estate Investments for Family Offices

Q. Why do family offices invest in real estate?

Real estate can provide steady cash flow and may deliver capital appreciation, potential tax efficiency (e.g., depreciation; US-specific tools like 1031 exchanges), and some inflation resilience, but outcomes depend on asset type, leverage, lease terms, and jurisdiction. Diversification benefits also vary over time (correlations can rise in stress). Tangible assets may support multigenerational planning, but come with liquidity, governance, and operational demands. None of these effects are automatic; results hinge on selection, structure, and execution. (Not tax or investment advice.)

Q. What’s the difference between real estate investment for single-family offices (SFOs) and multi-family offices (MFOs)?

Labels don’t decide the approach, capability and operating model do. Some SFOs are lean and outsource heavily; some MFOs run specialist real-estate teams and execute direct deals. In practice, both SFOs and MFOs use a mix of direct ownership, funds, co-investments, and JVs. The real determinants are internal team depth, decision speed, ticket size, governance appetite, liquidity needs, and reporting requirements. Both benefit from consolidated tracking in software; note that in Asora, real-estate cash flows are captured as transaction types that roll into performance.

Q. How does family office software help manage real estate investments?

Family office software like Asora consolidates tracking for direct properties, private fund investments, and joint ventures into a single platform. It provides performance monitoring across all real estate holdings, document management for leases and agreements, cash flow visibility, and ownership structure mapping, replacing fragmented spreadsheets with a unified real estate portfolio management system.

.jpg)